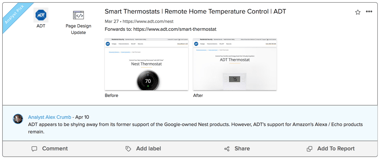

We Predicted Our Competitor's Product Launch Before They Even Hit ‘Publish’

And turned it into a competitive advantage before their team even reposted the teaser.

Yesterday, Klue’s CEO posted a teaser on LinkedIn:

"...tomorrow, we're dropping something that's going to change how teams understand why they win and lose deals. Excited for this one."

Now, this is the kind of post that can spin a lot of companies into panic mode.

People scramble. Slack threads pop. Screenshots fly. The “we should probably update the battlecard” moment begins.

Not with Crayon. With Crayon you can be automatically plugged in to all the moves your competitors are making, as well as figure out how to respond.

Let me walk you through the ...

Before You Build: The Realities of DIY Competitive Intelligence

With LLMs now widely accessible, many CI and product marketing leaders are asking: “Should we build our own AI-powered competitive intelligence tool?” It’s a fair question. If AI can summarize ...

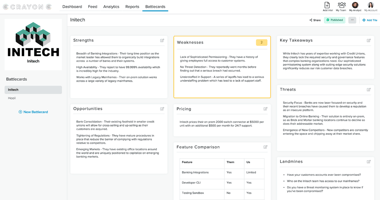

Introducing Refine: Give Your AI an Edit Button

Crayon's Spark Agent changed how competitive teams work. Instead of manually tracking updates and constantly updating battlecards, teams now have the power of AI to analyze competitive intelligence ...

From Win to Repeatable Play: How PMMs Can Scale What Works with Win Stories

Competitive wins aren’t just cause for celebration, they’re your most powerful, overlooked asset. Inside every competitive deal you win is a mini playbook: the objection that got turned around, the ...

Customer Corner: How The Standard Relies on Crayon AI to Automate Battlecard Creation and Delivery

For years, The Standard’s sales organization relied on static competitive assets such as flyers, PDFs, and manually updated battlecards that struggled to keep pace with a fast-moving benefits market. ...

We Predicted Our Competitor's Product Launch Before They Even Hit ‘Publish’

And turned it into a competitive advantage before their team even reposted the teaser. Yesterday, Klue’s CEO posted a teaser on LinkedIn: "...tomorrow, we're dropping something that's going to change ...

Customer Corner: How Vasion Uses Crayon to Deliver Faster, More Accurate Competitive Intelligence

What if your sales and marketing teams didn’t have to hunt for competitive intelligence — what if it was served to them automatically, exactly when they needed it? That’s the transformation underway ...

Google Drive Integration is Now Here for Crayon Users

Competitive intel doesn’t only live in platforms — it lives in scattered files: win/loss interviews, pricing comparisons, analyst PDFs, and internal teardowns. With Crayon’s new Google Drive ...

Effective Strategies for a Successful Sales Kickoff

Q4 planning is officially underway which means the race to prepare for Sales Kickoff (SKO) is on. For PMMs, competitive intelligence leaders, and sales enablement pros, this is your moment to make ...

Training your Reps for Competitive Deals: Lessons from Our SKO Webinar

Sales kickoff season is right around the corner and that means pressure — pressure to deliver a session that isn’t just informative, but unforgettable. At our recent SKO webinar, Isaiah Crossman, ...

How Compete Pros Are Using AI and Building Agents for Better Competitive Intel

Artificial intelligence is reshaping how compete teams operate, but for many it’s not about chasing hype. It’s about solving real problems, automating manual workflows, and getting better intel into ...

Connecting Competitive Intel to Enterprise AI with API and MCP

Reps Are Asking AI. Are They Getting the Right Answers? Crayon Can Help The world of competitive enablement is evolving fast, driven by the influx of AI tools entering the workplace. Sales reps and ...

5 Takeaways from Crayon’s State of Competitive Intelligence Webinar Event

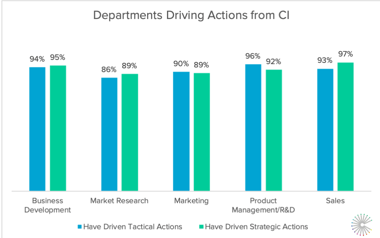

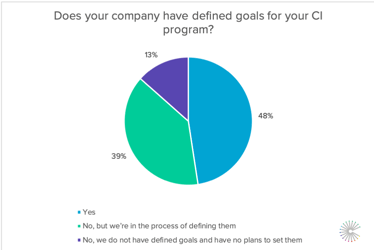

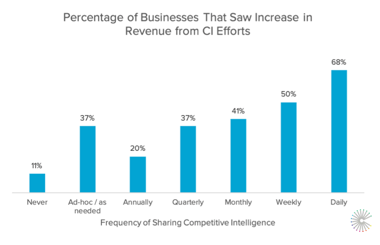

Crayon customers Aaron Wood, Director of Technical Marketing at Box and Brianna Cabral, Product Marketing Manager at Arena by PTC came together to discuss the top findings from the State of ...

Crayon Launches First Competitive Intelligence MCP Server

Now your AI tools can truly compete. Go ahead. Type it in: “How do we beat Competitor X?” Whether it’s ChatGPT, Glean, Copilot, or Claude — chances are, you’ll get something like: “According to their ...

Custom Insights Is Here — Bringing Your Intel Into The Full CI Picture

A few years ago, most competitive intelligence was built from public data — competitor websites, product pages, reviews, analyst reports — plus the occasional piece of field intel from sellers. It ...

AI Can’t Replace This: The Human Side of Product Marketing

There’s no denying it — AI is transforming product marketing. From automating content creation to competitive research and analysis, the latest tools are accelerating workflows and freeing up hours ...

5 Tips to Better Enable Your Sales Team (Backed by New 2025 Data)

In today’s competitive sales environment, reps need real-time, battle-tested competitive insights delivered in the tools they already use. Yet, the majority of sales teams remain woefully ...

You Don’t Need More Battlecards. You Need Crayon’s GTM Slack & Teams Insights.

If you're in product marketing, sales enablement, or competitive intelligence, chances are you’ve heard a lot about automated battlecards lately. Everyone’s racing to build them faster, cleaner, and ...

AI Tools For Your Go-To-Market Team [Webinar Recap]

In our Behind the Curtain webinar series, we’re pulling back the layers on how GTM teams are using AI tools. Here at Crayon, AI isn’t just a buzzword, but a daily part of how our own teams operate. ...

From Experiment to Essential: How AI is Transforming Competitive Intelligence

In this year’s State of Competitive Intelligence Report, one theme came through loud and clear: AI is changing the way CI teams work. Across hundreds of responses from B2B competitive professionals, ...

Customer Corner: How Bloomerang Relies on Sparks for Better Competitive Enablement

In this Customer Corner interview, we sat down with Lisa Gonzalez, Senior Competitive Intelligence Manager at Bloomerang, a giving platform that helps nonprofits manage supporter relationships and ...

State of CI: Sales Teams Are Losing Millions Because of This One Disconnect

You’ve got a killer product. A revenue team hungry to win. And a competitive intelligence program in place. So why are you still losing deals you should be winning? In Crayon’s just-released 2025 ...

New from Sparks: AI-Powered Analysis, Delivered Straight to Your Sales Tools.

Your competitive content just got a whole lot smarter. We’re rolling out a powerful new capability for Crayon Sparks: the ability to automatically publish curated analysis directly into Battlecards ...

Mastering Prompt Engineering for Competitive Intelligence

Unlock the potential of AI in competitive intelligence by mastering prompt engineering techniques that drive smarter, faster insights. The Crucial Role of Prompt Engineering in CI One of the standout ...

Modern Battlecards: The Blueprint for Sales Enablement That Works

Sales enablement is evolving — fast. The rise of AI, the shift toward real-time competitive selling, and the increasing complexity of go-to-market motions have changed the role battlecards play ...

A Smarter Way to Compete: How AI Is Reinventing Competitive Intelligence

In a world where two thirds of sales opportunities are competitive—and those opportunities close at 5x the rate of non-competitive ones—competitive intelligence (CI) is a necessity. Yet most ...

AI for Product Marketers:16 Tools to Supercharge Your Go-To-Market Strategy

As AI transforms product marketing, sales enablement and competitive intelligence (among everything else), there's new tools and technologies popping up constantly. It's difficult to keep up with ...

Women in CI: Defining the Future of Competitive Intelligence

Competitive Intelligence helps businesses navigate evolving markets and stay ahead of the competition. At the heart of this work are incredibly talented professionals—many of them women—who are ...

3 Key Takeaways from Our GTM in the AI Era Webinar

There’s no question that generative AI is rewriting the rules of go-to-market strategy. But while the technology is evolving at breakneck speed, most GTM teams are still figuring out how to harness ...

Customer Corner: How Archer Empowers Sales with Crayon Answers as Their Personal CI Assistant

For most of today’s competitive intelligence teams, AI isn’t just a tool—it’s a game-changer. Whether product marketers are fine-tuning messaging with ChatGPT or instantly synthesizing insights from ...

Outdated Battlecards are a Thing of the Past: Automate Your Compete Program With Sparks Content

Every PMM knows the drill: A sales rep pings you before a call—“How do we compete against [Competitor]?” or “Do we have a battlecard on them?” You drop what you're doing, dig through your compete ...

Crayon Introduces AI-Powered Competitor Website Analysis

Your competitors’ websites are central hubs of information — and intelligence. They reveal critical details about shifts in positioning, pricing, and go-to-market strategies. But keeping track of ...

The Dos and Don’ts of Running a Competitive Intelligence Session at Sales Kickoff

Editors Note: This post was originally published on November 21st, 2022 as part of our Customer Corner series featuring Holly Jackson and has been updated — below is advice for CI practitioners ...

2024 in Review: From AI Breakthroughs to the Launch of the AI Toolkit

We will look back on 2024 as the year that artificial intelligence revolutionized competitive enablement. We have finally hit the critical paradigm shift. The changes weren’t just about advancing ...

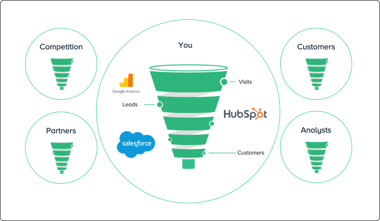

How a Competitive Strategy Boosts Your Marketing Impact

Marketing today isn’t just about creativity—it’s about strategy, pipeline, and outperforming competitors. But here’s the reality: relying on traditional marketing tools may no longer cut it. With ...

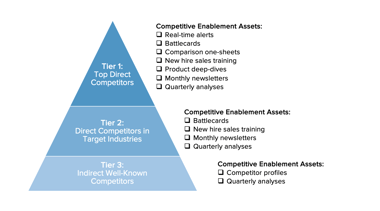

Why Competitive Enablement Is the Ultimate Key to Closing More Deals

In today’s hyper-competitive sales landscape, every deal counts. Two-thirds of sales opportunities are competitive, and here’s the kicker: these deals close 5x faster and at significantly higher ...

One Month Later: Sparks Has Had a Transformative Impact on Crayon Customers ✨

Since its launch a month ago, Crayon Sparks has had an outsized impact on how Crayon customers compete, enabling them to transform data overload into effortless, actionable enablement. Sparks By the ...

5 Ways to Build a Stronger Product Marketing + Sales Relationship

In B2B organizations, Product Marketing and Sales teams are critical drivers of growth, yet aligning these two functions can often be a challenge. This is why we teamed up with Yi Lin Pei, PMM ...

Build a World-Class Competitive Enablement Program: A CXO’s Guide

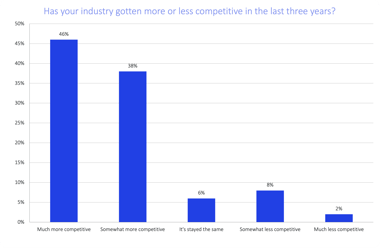

In today’s business landscape, hyper-competition is the norm. A staggering 94% of companies report that their markets have become more competitive over the past year, a trend that has compounded over ...

Crayon Announces Sparks, the First AI-Analysis Tool that Transforms Data Overload into Actionable Enablement

Call Clips for Gong Also Unveiled to Deliver Real-Time Competitive Insights from Call Recordings In the literal sense, a spark ignites or triggers something — whether that be an electrical discharge, ...

The 5 Flaws of Old-School Compete Programs (and How to Fix Them)

As summer winds down and the out of office replies become less frequent, companies are in full on planning mode for 2025. While there are many inputs that go into annual planning and setting revenue ...

Webinar Recap: Elevate Your Competitive Enablement Strategy

In a world where business competition is fiercer than ever, having a strategic edge is no longer optional—it's essential. Our recent webinar, "Elevate Your Competitive Enablement Strategy with Crayon ...

Introducing Crayon Answers: The Industry's First Gen AI Compete Assistant for your Revenue Team

In today's fiercely competitive sales landscape, two-thirds of open deals are head-to-head with competitors. Yet, traditional competitive enablement is falling short. Battlecards, while essential, ...

Customer Corner: How Cognism's Compete Program Influenced $6 Million in Revenue

Enabling a sales team of hundreds of reps with real-time competitive intel is no easy feat. When Cognism partnered with Crayon — replacing their previous CI platform — the two person team of Kathy ...

The State of Competitive Intelligence in 2024: AI Meets CI

Looking back, what two words would you use to define the past 18 months or so? If you say Taylor Swift, well, you’re not wrong. But we’d have to go with artificial intelligence (AI). As of January ...

Customer Corner: How HiBob Surpassed User Engagement Goals in Crayon BEFORE LAUNCH

Bringing on competitive intelligence software is transformational for your compete program — when done right. The “when done right” caveat boils down to setting your teams up for success. Chances ...

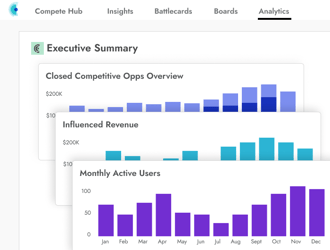

Introducing Executive Summary: Prove the ROI of Your CI Program

In today's competitive landscape, doing more with less is no longer a luxury, it's a necessity. And for compete leaders, that means it is more vital than ever to prove the impact of your work. Forget ...

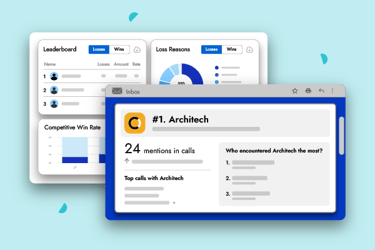

Introducing Seller Engagement: A New Way to Analyze Battlecard Usage and Win Rates

Creating competitive enablement assets like battlecards can feel like a futile effort if they aren’t being used by your sales team. Is anyone reading this intel? Are these battlecards making an ...

Customer Corner: How ConnectWise Increased Global Battlecard Adoption by Centralizing CI

The leading characteristic of any successful competitive intelligence program is consistent, enthusiastic adoption. But before your sales reps can dive into the competitive assets you create for ...

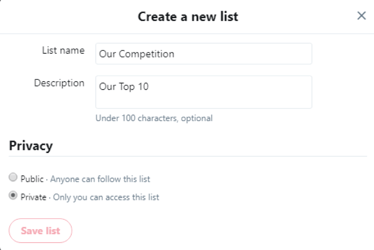

Customer Corner: How Later Created a Must-Read Competitive Newsletter with a Little Help from the Kardashians

If you’re a CI leader, you’re creating competitive assets left and right to help enable your colleagues and support your company’s overall goals. One of these assets is most likely an internal ...

How Product Marketing Can Better Align with Sales: Advice from Bob Boyle, a Seller Who Accidentally Became a PMM

If you visit Bob Boyle’s LinkedIn profile, you’ll see that he became a product marketing manager (PMM) in January 2023. But if you have a conversation with him, you’ll quickly realize that he started ...

3 Tips On Presenting CI Results to Senior Leadership from Our Webinar with Rachel Pangburn

Rachel Pangburn and Garrett Denney—who lead competitive intelligence at RF-SMART and Crayon, respectively—are well-versed in the act of presenting CI program results to senior leaders. They’re so ...

Industry Benchmarks: Median Number of Competitors Tracked + Battlecards Created

Last month, we began collecting responses for our 2024 State of Competitive Intelligence survey. So far, of the 106 people who have completed the survey, 62% have said they struggle to gather ...

How to Run a Competitive Intelligence Platform as a Team of One

In 2024, it’s quite possible that your CI team has gotten smaller, or the amount of time you can dedicate to the program has decreased. Organizations are trying to do more with less, but while ...

Battlecard Views per Competitive Deal: A New Measure of Seller Confidence

If you’re responsible for competitive enablement, you should survey your sales reps on a quarterly basis and ask them how confident they feel selling against your top competitors. Their responses ...

New Data: 7 Industries Where AI Dominates the Conversation

Last week, I used data from Crayon’s competitor tracking software to show you that your competitors are talking about AI 5x more than they did in 2022. The data in that blog post is industry ...

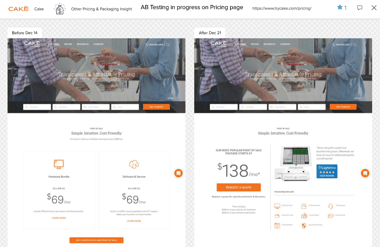

11 Examples of Companies Hinting at Product Announcements with Content Marketing

When a competitor announces a major product release or an acquisition, the natural reaction is to wish you’d known about it sooner—because the sooner you know, the more time you have to prepare ...

The Simple Habit That Makes It Easier to Predict Your Competitors' Product Releases

In a perfect world, you can see the future. You know what your competitors are going to do months before they actually do it. I wish I could tell you that I have a portal to this alternate universe. ...

3 Ways CI Leaders Can Use AI Chatbots to Their Advantage

A few days ago, we started collecting responses for our 2024 State of Competitive Intelligence survey. As I’m writing this, the sample size is still very small (42 responses), but the early results ...

New Data: Your Competitors Are Talking About AI 5x More Than They Did In 2022

For the data presented in this blog post to make sense, you need some background on Crayon. Crayon is a competitive intelligence platform. Our customers use our technology to monitor their ...

How to Use Champions to Improve Adoption of Competitive Intelligence

Champions (a.k.a. advocates or evangelists) are coworkers who encourage their peers to consume the content you produce. They are essential to the success of your competitive intelligence program. So ...

Indirect Competitors 101: What They Are + How to Keep an Eye On Them

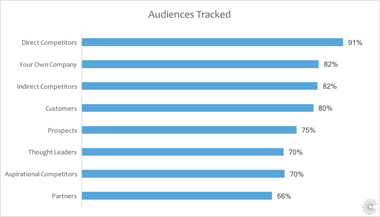

Your company has two kinds of competitors: direct and indirect. You know the former. Those are the competitors that your sales team goes head-to-head with every single day. Meanwhile, an indirect ...

Customer Corner: How AB Tasty Used Market and Competitive Intelligence to Improve Employee Onboarding

Creating a culture of CI can feel like training for a marathon. It requires serious dedication and repetition (So. Much. Running). And for most, running 26.2 miles doesn’t happen on the first day. ...

Struggling to Prioritize Your Competitors? Use the Competitor Coefficient + the Threat Thermometer.

Being a CI team of 1 in a saturated market is a tough job. Ideally, you'd like to keep tabs on every competitor, but you don't have nearly enough bandwidth to do that. You need to prioritize. You ...

Compete Program Maturity Model: How to Advance From Level 2 to Level 4

For nearly a decade, Crayon has been helping people like you build excellent compete programs—programs that increase win rates and influence executive decision-making. We decided to take everything ...

Compete Program Maturity Model: How to Advance From Level 5 to Level 6

For nearly a decade, Crayon has been helping people like you build excellent compete programs—programs that increase win rates and influence executive decision-making. We decided to take everything ...

Compete Program Maturity Model: How to Advance From Level 4 to Level 5

For nearly a decade, Crayon has been helping people like you build excellent compete programs—programs that increase win rates and influence executive decision-making. We decided to take everything ...

Compete Program Maturity Model: How to Advance From Level 0 to Level 2

For nearly a decade, Crayon has been helping people like you build excellent compete programs—programs that increase win rates and influence executive decision-making. We decided to take everything ...

Crayon and Clozd Announce a New Integration that Gives Customers the Insights They Need to Win More Deals

Here at Crayon we surveyed the market for the 2023 State of Competitive Intelligence report to get a deeper understanding of how teams rank the importance of different types of intelligence. More ...

3 Tips From Our Battlecard Webinar with Sam Niro

Earlier today, I had the pleasure of talking to Sam Niro, Competitive Intelligence Manager @ Talkdesk, about how she creates and rolls out new battlecards. Here's the recording of our conversation: ...

Guest Post: Complete Your Compete Program

This is a Crayon guest post from one of our partners, Fletcher. Visit the Crayon Partner Directory to learn more! So, you've started your Compete program... What more should you do? As a CI ...

Introducing Compete Hub: Automated, Real-Time Announcements and Community for Your Sales Team

A lot can happen in a week. One of your competitors updates their pricing. Another competitor releases a new AI feature. A third competitor publishes a comparison page on their website. We know that ...

How Crayon Onboarding Empowered MiQ to Achieve 70% Battlecard Adoption

From the very first time Rachel Foskett, VP of Global Product Marketing at MiQ, met with Crayon, she had high expectations for her onboarding experience — and she knew that to run a thriving CI ...

2 Tips + 2 Takeaways From Our Win/Loss Webinar with Nick Siddoway and Brad Rosen

For the third installment of our new Win/Loss Wednesdays series, we had the pleasure of chatting with Brad Rosen, President at Sales Assembly, and Nick Siddoway, President & CRO at TruVoice from ...

Start Small and Don’t Surprise People: Tips From Our Win/Loss Webinar with Scott Frost

For the second installment of our new Win/Loss Wednesdays series, we had the pleasure of chatting with Scott Frost, who’s led competitive intelligence at Stripe, Adobe, and New Relic. By the end of ...

Value + Variety: How CI Leaders Can Capture Mindshare and Drive Adoption

When I was a kid, car commercials puzzled me. I remember asking my dad: Why do they make these? No one is gonna get off the couch and buy a Camry after watching a Toyota commercial. Which is true — ...

Guest Post: We Need Win/Loss Insights Even More During an Economic Downturn

This is a Crayon guest post from one of our partners, Goldpan. Visit the Crayon Partner Directory to learn more! Win/loss analysis isn’t a nice-to-have. Understanding your buyers and prospects is ...

Some Competitors Don’t Deserve Your Time: Why Gong and Crayon Are Better Together

There’s a trope in teen movies where the protagonist’s mom prepares an extraordinary breakfast — eggs, bacon, bagels, fresh fruit, coffee, orange juice — only for said protagonist (annoying, ...

Crayon AI: Capture and Summarize Critical Competitive Insights In Minutes

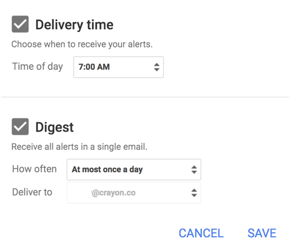

Few activities are more tedious than sifting through Google Alerts in search of important competitive insights. Not only is it tedious, it’s detrimental to your CI program — because the time you ...

3 Takeaways From Our Win/Loss Webinar With Egencia’s Jayde Phillips

For the first installment of our new Win/Loss Wednesdays series, we had the pleasure of chatting with Jayde Phillips, who manages market and competitive intelligence at Egencia, an American Express ...

How Salsify and Dropbox Reap the Benefits of Crayon + Slack

Slack is the communication backbone of tens of thousands of companies around the world because while it’s true that knowledge is power, we all know that the true power comes only once that knowledge ...

The Future is Here: Testing out ChatGPT with Win/Loss Analysis

This is a Crayon guest post from one of our partners, PSP Enterprises. Visit the Crayon Partner Directory to learn more! “Let’s talk about how I can use GPT to help me with competitive intelligence.” ...

Improve Battlecard Adoption by Creating an Awards Ceremony for Your Sales Team

Competitive intelligence leaders are often so focused on improving the content of their battlecards that they overlook a simple yet vital responsibility: reminding their sales teams that the ...

The CI Leaders at Akamai and Deltek Want You to Do These 3 Things

A few weeks ago, I had the pleasure of speaking with Mimi An and August Jackson — who run competitive intelligence (CI) at Akamai and Deltek, respectively — about the top insights from Crayon’s 2023 ...

The Worst Thing a Seller Can Do In a Competitive Situation (+ More Takeaways From Our Latest Webinar)

A few days ago, I had the pleasure of hosting a webinar that featured Crayon’s VP of Strategy, Chris Pope, and Aircall’s Director of Sales, Tommy Jester. We talked about the mistakes that sellers ...

How Alteryx Increased Battlecard Adoption 40% in Just 60 Days

According to the 2023 State of Competitive Intelligence report, 58% of those who measure their battlecards think they’re well-adopted. Among the ranks of that majority is Spencer Hong, Senior ...

Guest Post: Understanding Competitive vs Competitor Intelligence

This is a Crayon guest post from one of our partners, Atlantic Intelligence. Visit the Crayon Partner Directory to learn more! What separates competitive from competitor intelligence? Simply put, ...

Customer Corner: How Intellum Used Crayon to Renew an At-Risk Customer

After successfully enabling the sales organization with competitive insights at Intellum, Kaitlyn Smith — Product Marketing Manager and competitive intelligence practitioner extraordinaire — set her ...

Hey, Product Marketer: Your Battlecards Shouldn’t Be Perfect

In high school, my economics teacher loved to remind us that “there’s no such thing as a free lunch.” It’s an old-timey way of saying “everything comes at a cost.” Oftentimes, the cost of something ...

Customer Corner: How SafeGuard Cyber Increased Win Rates with Battlecard Adoption

In our fifth installment of the Crayon Customer Corner, we sat down with Dan Dearing — Senior Director of Product Marketing at SafeGuard Cyber. As a competitive intelligence team of one who maintains ...

NEW DATA: Field Intel Is Vital to Your Competitive Program. Here Are 5 Tips to Help You Capture It.

Here at Crayon, we recently published the 2023 State of Competitive Intelligence, a benchmark report based on a survey of CI leaders and stakeholders. We gave CI leaders a list of 11 sources of ...

NEW DATA: The Secret to Earning Your CI Stakeholders’ Trust

Here at Crayon, we recently published the 2023 State of Competitive Intelligence, a benchmark report based on a survey of CI leaders and stakeholders. “Stakeholders” refers to people who need CI to ...

Guest Post: How B2B Companies Use Competitive Intelligence to Improve Retention

This is a Crayon guest post from one of our partners, Satrix Solutions. Visit the Crayon Partner Directory to learn more! You’ve probably heard the saying, “A rising tide lifts all boats.” It’s ...

Find Your Perfect Competitive Intelligence Partner:Crayon Launches CI Partner Directory

Competitive Intelligence professionals and product marketing leaders know the struggle of being resource-constrained. Product marketing in particular often owns competitive intelligence (and all that ...

Introducing Draft Control: The Secret to Building Better CI Deliverables

Creating effective competitive intelligence deliverables is like trying to build a sandcastle on the beach: Just when you think you've got it right, a new wave comes crashing in and changes ...

The State of Competitive Intelligence In 2023

When Crayon published the first edition of the State of Competitive Intelligence on January 16, 2018, “Despacito” was still comfortably in the Top 40. You had just heard the term “Bitcoin ...

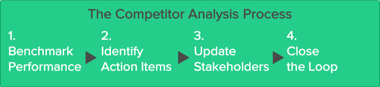

8 Key Steps to Help You Spot Competitor Analysis Trends in 2023

While they might be a thorn in your side, your competitors aren’t special. They, like every other business on the planet, are coming into 2023 with all kinds of newfangled ideas. The optimists are ...

It Takes a Village: How to Elevate Your CI Program Through Multi-Threading

As a Customer Success Manager here at Crayon, I have seen over 100 CI programs in action. Nearly all of them have the same success criteria: “Enabling the sales team to win competitive deals and ...

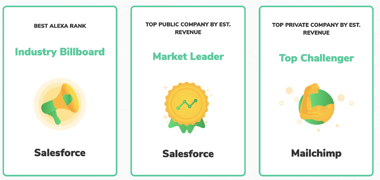

It’s a Three-Peat: Crayon Is Once Again Named the PMA Pulse Leader for Competitive Intelligence

In the world of sports, a team that wins three or more championships in the span of only a few years is considered a dynasty. Today, Crayon is celebrating a dynasty of our own in the competitive ...

Crayon and Primary Intelligence Develop a Market First Integration: Sellers Now Automatically Have the Win-Loss Insights they Need to More Close Deals

When your win/loss data is disconnected from your competitive intelligence tool, trying to understand your differentiators is like trying to appreciate the Mona Lisa from a mere 6 inches away — you ...

3 Strategies Customer Success Managers Need to Keep Customers From Switching to Competitors

Your sales team just won a competitive deal. It was a taxing evaluation: multiple demos, a trial period, extensive pricing conversations—the works. Until the account executive on your sales team got ...

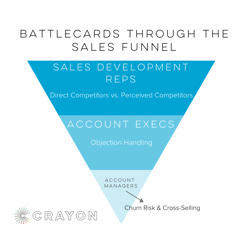

The 4 Types of Role-Based Battlecards You Need to Build

Battlecards are one of the most popular sales enablement materials businesses create today, with two-thirds of competitive intelligence teams saying that they regularly maintain competitive ...

Podcast Episode: A Practical Guide to Competitive Intelligence

Tis’ the season for a brand new episode of Into the Fray: The Competitive Intelligence Podcast! In our latest installment, podcast guest host Will Thompson (Crayon’s Director of Growth Marketing), ...

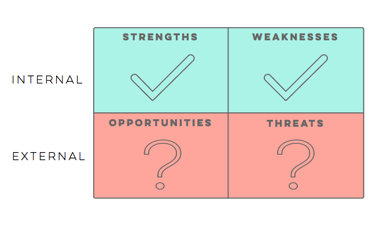

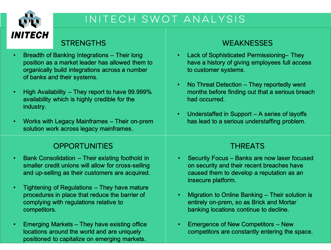

What's a SWOT Analysis?

Tesla, Rivian, and Toyota all make electric vehicles, but the way they perceive their respective roles in the EV market (and the way prospective purchasers perceive each brand) couldn’t be more ...

Podcast Episode: Using Competitive Intelligence for Product-Led Growth

As we glide into a new month, you know what that means — a new episode of Into the Fray: The Competitive Intelligence Podcast has arrived! In our latest installment, guest host Will Thompson sat down ...

Your Sellers’ Needs Are Always Changing. Hit the Bullseye Every Time with Competitive Performance Insights.

The best competitive intelligence programs are proactive, meaning they identify threats as soon as they begin to emerge and enable their sales teams accordingly. That sounds pretty straightforward—so ...

Your Competitor’s Next Big Move Is Coming. Get Ready with the Accelerator Course.

A product launch. An acquisition. A groundbreaking go-to-market partnership. Sooner or later, your competitor will do something big—something that directly threatens your market share. You have two ...

10 Best Practices for a Successful Win/Loss Program

This is a Crayon guest post from one of our partners, PSP Enterprises. Visit the Crayon Partner Directory to learn more! The hypercompetitive New York Yankees owner George Steinbrenner said it best: ...

NEW DATA: The Industries with the Most Mature Competitive Programs

There are several obstacles to building a successful competitive intelligence program—one of the biggest being the lack of consensus on what a successful CI program actually looks like. That’s why ...

Never Get Blindsided by a Competitor Again. Crayon Introduces CI Without Limits.

It’s a typical Monday morning as you go through emails and catch up. Suddenly an urgent email arrives from the CEO: “Did you see this?” Cue instant anxiety….palms sweaty, knees weak, arms are ...

Build and Implement Your Sales Enablement Strategy (in 7 Simple Steps)

It doesn’t matter if you’re building a strategy from scratch or overhauling tired practices established by marketers of yore: Sales enablement shouldn’t be an afterthought. In fact, if you aim to ...

What Is Sales Enablement? Your Burning Questions Answered

Alec Baldwin wouldn’t be the patron saint of closing deals if, in perhaps the most cliche sales reference in cinematic history, he’d said “always be… enabling.” Sellers are hired to sell. It’s the ...

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

A competitive matrix is a visual resource that enables you and your colleagues to better understand your company’s position within the market—that is, to better understand how your company stacks up ...

5 Tips for Building Your Competitive Intelligence Dream Team from CI Leaders at Dropbox and Stripe

Assembling a team takes more than just finding candidates with the right keywords on their resumes — company culture, soft skills, and communication styles are key to putting together the right ...

Your Competitor Is Up to Something—But What? Use Analysis of Competing Hypotheses (ACH) to Crack the Case

Imagine you lead the intelligence function at a CRM software company. One day, you notice that your closest competitor has recently published a couple blog posts about contracts and document ...

Podcast Episode: How to Train Your Whole Company on Competitive Intelligence Techniques

As we inch closer to the end of another month, you know what that means — a brand new episode of Into the Fray: The Competitive Intelligence Podcast has arrived! In our latest installment, podcast ...

Podcast Episode: Building a Competitive Intelligence Program That's Collaborative and Connected to What Your Users Really Need

Just in time to kickoff Q4 — a brand new episode of Into the Fray: The Competitive Intelligence Podcast has arrived! In our latest installment, podcast host, Erik Mansur (our VP of Product ...

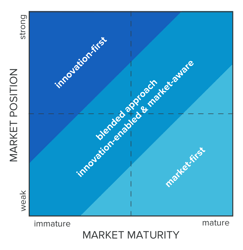

Building A Top-Tier Market Intelligence Strategy

After watching the new Amazon-meets-Middle-Earth show last week (it’s good!) I decided to watch the extended cuts of the Lord of the Rings movies. 10+ hours of whimsy and brimstone, what a delightful ...

Crayon Customer Corner: How Splash Used Crayon to Implement a Culture of Competitive Intelligence

In our fourth installment of the Crayon Customer Corner, we sat down with Zach Napolitano — Director of Product Marketing at Splash. As a first time CI practitioner, Zach took his role as a student ...

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

According to Harvard Business School, of the approximately 30,000 new products launched each year, about 95% fail. Of course, the product failure rate varies from one industry to another—for example, ...

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales battlecards (also known as competitive battlecards, or simply as battlecards) give your sellers the facts, tactics, and materials they need to win competitive deals. Before we go any further, a ...

The Competitive Program Grader: A Free Tool for Anyone Who Wants to Master Competitive Intelligence

Imagine waking up and finding yourself in the driver’s seat of a car, parked on the side of a road that you don’t recognize. You’re alone, and your phone is nowhere to be found. A stranger walks up ...

Everything You Need to Know About Competitive Analysis (Template Included!)

When it comes to competitive analysis, scope is everything. If you’re just starting out, you might go broad and deep on a dozen market stalwarts (like oil painters and SEC tailgaters, building a base ...

Podcast Episode: Using Competitive Intelligence to Influence Your Content Marketing Strategy

Just in time to kick off the month — a brand new episode of Into the Fray: The Competitive Intelligence Podcast has arrived! In our latest installment, podcast host, Erik Mansur (our VP of Product ...

How do you Conduct a Competitive Audit?

Few things are more intimidating than the prospect of an audit. You know, those mildly invasive processes in which someone from an SEO consultancy or the IRS or some other authoritative three letter ...

Scaling Your Competitive Intelligence Team? Start Here

What does the compete department at your company look like? Is competitive intelligence the responsibility of one person? Two people? A whole team? Odds are, your CI program is just a fraction of one ...

Competitor Tracking 101: Identifying the Competition and Your Biggest Questions Answered

The Olympic podium. Bookish teens jockeying for valedictorian. The couples on the cusp of a $50K payday on British reality TV phenomenon Love Island. There is nothing more fundamentally human than ...

You’re Not a Factory, Gift Cards Suck, and Other Takeaways from Our Latest CI Live Event

A couple weeks ago, when we sat down with Andy McCotter-Bicknell and Fouad Benyoub—leaders of competitive intelligence programs at ClickUp and Everbridge, respectively—we were expecting to talk about ...

Podcast Episode: Taking a Tiered Approach to Your Competitive Landscape

Another month is here and you know what that means — a brand new episode of Into the Fray: The Competitive Intelligence Podcast! In our latest installment, podcast host, Erik Mansur (our VP of ...

How to Use Slack + Crayon to Unlock Real-Time Intel, Delight Your Colleagues, and Win More Deals

The last time I made an appearance on this blog, I showed you how to optimize your competitive intelligence program for both search mode and awareness mode. I showed you, in other words, how to ...

How to Write a Better Battlecard: Follow the ABCs

If you’re working with a sales team actively involved in competitive deals, you’re probably familiar with battlecards. Battlecards are a fundamental resource to help your sales team win more deals ...

I Used Google Alerts to Collect Intel for a Month. Here Are 5 Things I Missed.

When I was in 4th grade, my elementary school did an invention convention. Each student had to identify a problem in their everyday life and come up with a solution. My 9-year-old brain—which was ...

How to Win More Competitive Deals (and Lose With Dignity)

Competitive deals are emotional. How could they not be? You’re in sales because you like to win and make money. Competitors get in the way of both. I don’t care how senior you are—when a competitor ...

The Key to Handling Competitive Objections and Landmines: “Why?”

An account executive on your sales team, Jen, is chatting with a prospect. The conversation is going well. The prospect doesn’t seem to be evaluating any other vendors. And then they say this: “Talk ...

Podcast Episode: Creating a Win/Loss Program That’s Repeatable and Actionable

June is here and with it comes a brand new episode of Into the Fray: The Competitive Intelligence Podcast! In our latest installment, podcast host, Erik Mansur (our VP of Product Marketing), sat down ...

Your Seat at the Table Awaits: Introducing the Architect Certification Course

A lot of smart, creative people have taken the lead on competitive intelligence and found themselves trapped in a vicious cycle: It’s not an infinite cycle, of course—it does, eventually, come to an ...

New Data: Battlecard Benchmarks and Best Practices Based On 1,200+ Survey Responses

Sadly, the impact of good product marketing is often obscured. A flawless product launch, an inspiring positioning statement, a face-melting slide deck—you and I both know that each of these things ...

Whether You Want to Play Pop Music or Pro Hockey, Crayon Has Your Back

For most of April, an indie pop band called shallow pools was touring the East Coast of the United States, making stops at legendary venues like Irving Plaza and Toad’s Place. For now, the band is ...

How to Write an Outstanding Competitive Positioning Statement In 4 Steps (Example Included!)

Even the greatest product will be overlooked if it lacks a captivating message that resonates with its target customer in a way that no competitor can match. Doing this isn’t easy. It requires ...

Happy Pride: The Freedom to be Yourself is an Amazing Thing

The freedom to be yourself is an amazing thing. It’s powerful and fundamental. It’s something everyone deserves. Life is short and everyone should be proud to be himself, herself or themselves. Given ...

6 Tips for Driving Competitive Intelligence Adoption from the Experts at Gainsight, Affinity, and Apprize360

There’s a lot of things I should do. I should stretch in the morning. I should go to the dentist every six months. I should stay off Twitter for the rest of my life. But just because I should do ...

Competitive Intelligence in the Financial Services Industry

In recent years, the financial services industry has undergone massive and near-constant change. First, the COVID-19 pandemic altered our spending habits completely. In response, businesses that had ...

Trying to Make the Case for Competitive Intelligence Software? Here Are 3 Tips

A few weeks ago, we showed you how to make the case for an official competitive intelligence program. We showed you, in other words, how to convince an executive decision-maker (EDM) that CI is a ...

Crayon Customer Corner: How Mend Uses Crayon Integrations to Empower their Sales and Marketing Teams

In our third installment of the Crayon Customer Corner, we chatted with Geoffrey Gibson — Vice President of Sales at Mend and a three-time (!!) Crayon user. After successfully leveraging Crayon at ...

Connecting Employees to the “Why Care” and “Where to Go” with Competitive Intelligence Integrations

We all know your stakeholders can benefit from competitive intelligence, but let’s talk about the real problem: They have so many places to look for information that, rather than looking, they’ll ...

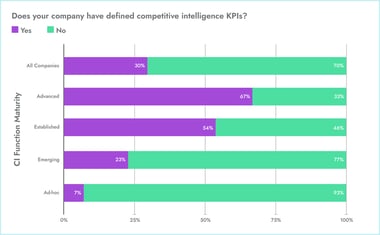

The Competitive Intelligence KPIs You Need To Be Tracking

So, you’ve gone through all the work of implementing competitive intelligence. You’re off to the races — tracking, analyzing, and activating valuable intel left and right… now what? Implementing a ...

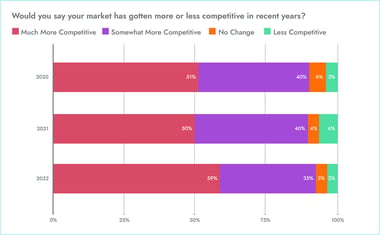

It’s True, Your Market is Getting More Competitive

If it seems like your industry is getting more competitive, it probably is. Why is that you ask? There are a few factors at play here. A big one is that it has never been easier to start a company. ...

To Create a Competitive Culture, You Need Role Models and Software

To create a competitive culture is to convince your colleagues that competitive intelligence is essential—to shift the perception of CI from nice-to-have to need-to-have. What does that mean? It ...

Exceed Your Inbound Revenue Target With Crayon

You just lost a customer. Let’s call her Sarah. No, she didn’t churn. In fact, she’s never seen your product, let alone used it. Sarah just signed a contract with your competitor—without so much as a ...

Podcast Episode: The Past, Present, and Future of Competitive Intelligence

May has arrived. Do you know what that means? We have a brand new episode on Into the Fray: The Competitive Intelligence Podcast! In our latest installment, podcast host, Erik Mansur (our VP of ...

Gong + Crayon: Helping Your Sellers Win With Personalized Competitive Insights

It’s 8:32am. An account executive on your sales team opens up their laptop to get their day started. Yesterday was crazy. Back-to-back-to-back-to-back calls. Lots of follow-up for them to tackle ...

What's in Your Competitive Intelligence Tech Stack?

9,932 As of 2022, there are 9,932 martech solutions according to Scott Brinker’s latest marketing technology landscape. From email marketing to social media monitoring to ABM and everything in ...

Sponsor, Scope, Solutions: How to Create an Ironclad Business Case for Your CI Program

Things could be going better. You’re working hard to deliver on the competitive intelligence requests that come through your inbox, but as far as you can tell, very few people are consuming the ...

Loss Leader Pricing: What It Is and How It Works (Examples!)

We touched on it in our guide to penetration pricing, and today we go deep on one of the most polarizing pricing strategies out there: loss leader. In this post, we’ll define loss leader pricing, ...

Hopes, Hypotheses, Humility: The 3 H’s of a Successful Win Loss Project

Canada is south of Detroit. There’s nothing you can do with this information, but it’s pretty cool, right? Sometimes, learning for the sake of learning is perfectly appropriate. But when it comes to ...

Reinventing Your Career at Crayon

Over the last two and half years, people have experienced tremendous change. It’s shown up in everything from our daily routines and rituals to our ability to travel and see friends and family. It’s ...

Crayon Analysts: Your Built-In Competitive Intel Sidekick

Trust me. We get it. Your competitors are always on the move–from constant website updates to new product features and maybe even new funding rounds. That’s why companies find Crayon’s Competitive ...

Product Marketing Spotlight Series: Hannah Sackett

Crayon's Product Marketing Spotlight is a video interview series where we chat with product marketers to get a glimpse into their careers and gain unique insight into product marketing strategy. In ...

3 Ways Product Marketers Can Win (More!) with Crayon’s Competitive Win Loss Tools

It's Monday morning. You haven’t even taken the first sip of your coffee. You touch your right index finger to the magical biometric scanner thing on your MacBook. Your company-approved desktop ...

Crayon Customer Corner: 5 Questions with the Product Marketing Team of Bonterra

In our second installment of the Crayon Customer Corner, we sat down with the Product Marketing Team at Bonterra (formerly Social Solutions). The team recently purchased Crayon and discussed how the ...

Navigating Motherhood (and a Whole Lot More) With Crayon By My Side

I have two kids – Reagan, 18 months and Jimmy, 4 months. If you are doing the math, which is not hard, you will notice they are incredibly close…some might say too close… I certainly didn’t ...

Out of the Dark, Into the Noise: The Case for a Tiered Approach to Competitor Tracking

I don’t think I’ve ever walked up a basement staircase. If I’m feeling courageous, my ascension might look something like a casual jog. Most of the time, though, I’m climbing that thing as fast as I ...

Compete: The Next Must-Have Department

Sometimes it pays to be the new kid on the block. Every few years it seems as if there is a hot new role that catches like wildfire in organizations of all sizes. Can you remember the days before ...

Podcast Episode: Building CI Credibility at Your Company

New month, new quarter, new… podcast episode. We’re kicking off April with a fresh episode on Into the Fray: The Competitive Intelligence Podcast! In case you missed our last blog, the podcast is ...

Competitive Intelligence: A Data-Backed Overview (Video)

Competitive intelligence (CI) is the process of capturing, analyzing, and activating information related to your competitive landscape. Done right, CI empowers everyone at your organization to make ...

March Madness Final Four: Leveraging Battlecards to Predict Winners

March Madness is coming to an end. This high-stakes NCAA tournament has been filled with fierce rivalries and plenty of upsets. Take Saint Peter’s, for example–the first No. 15 seed in tournament ...

How to Effectively Analyze Competitive Intelligence: 5 Questions with Affinity’s Carolyn Klinger

In our first installment of the Crayon Customer Corner, we sat down with Carolyn Klinger, Director of Market and Competitive Intelligence at Affinity. Carolyn recently purchased Crayon for the second ...

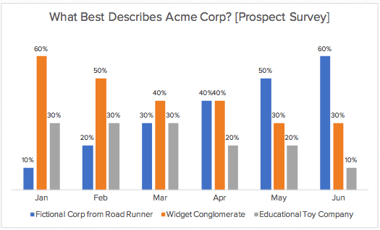

Supply Chain Solutions: Who Has the Largest Share of Voice?

There’s no denying that 2021 was a troubling year for the supply chain (2022 hasn’t been much better). Catastrophic events such as the COVID-19 pandemic and the Suez Canal blockage disrupted supply ...

Seven Tried-and-True Pieces of Advice For Product Marketers

Product marketing is easily one of the most cross-functional (and busy) roles in an organization. Product marketers have to juggle the messaging and positioning of products, lead product launches and ...

Penetration Pricing: What It Is, What It Isn't, and How It's Executed In the Real World

Your product team has spent the last 18 months cookin’ up something shiny. Prospects are going to love it. There’s just one problem: You’re entering a saturated market. There’s the old guard. The ...

Product Marketing Spotlight Series: Alison Hayter

Crayon's Product Marketing Spotlight is a video interview series where we chat with product marketers to get a glimpse into their careers and gain unique insight into product marketing strategy. In ...

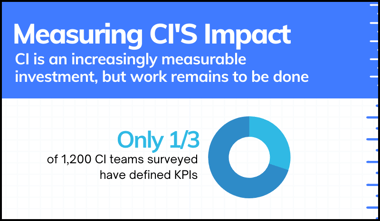

Are You Measuring Your CI Efforts? New Data Reveals It’s Time to Start [Infographic]

It’s that time again: the monthly marketing staff meeting where the growth team, content team, web team—you get the idea—will showcase their latest metrics. How are our efforts in these respective ...

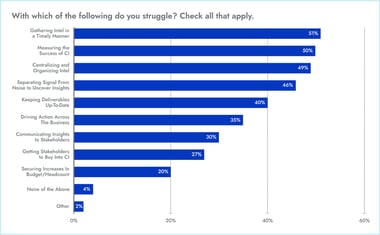

Here’s What CI Practitioners Are Struggling With—And What Experts Recommend [New Data]

Read the 2022 State of Competitive Intelligence Report and you’ll find tons of encouraging insights: 33% of CI teams are making time for win/loss analysis on a monthly basis. 66% of growing CI teams ...

Product Marketing Spotlight Series: Ankita Asthana

Crayon's Product Marketing Spotlight is a video interview series where we chat with product marketers to get a glimpse into their careers and gain unique insight into product marketing strategy. In ...

5 Battlecard Best Practices From the Experts at Gong, Salsify, and Hootsuite

Battlecards. They can be your organization’s secret weapon or just another outdated file buried in the shared drive. But while every PMM worth their salt knows they should be creating, updating, and ...

Introducing Into the Fray: The Competitive Intelligence Podcast

Competition is fiercer than ever before. According to our 2022 State of CI Report, 59% of CI practitioners say their markets have gotten much more competitive while 98% of stakeholders say CI is ...

Competitor Messaging Analysis: A Step-by-Step Guide for Product Marketers

In a world where the most talked about 60 seconds of the Super Bowl involved a $7M black screen emblazoned with nothing more than a bouncing, polychrome QR code, the road between market leader and ...

5 Ways to Elevate Your CI Function In 2022 [New Data]

98% of the stakeholders we surveyed for the 2022 State of Competitive Intelligence Report said that CI is at least somewhat important to their success. That’s up from 86% in 2020—a handsome increase ...

The State of Competitive Intelligence In 2022: 3 Remarkable Trends

Five years. When David Bowie sang those two words, over and over again, in the final moments of Ziggy Stardust’s opening track, his point was that five years is not a lot of time. And, sure, in the ...

A Battle for the Ages: Rams vs. Bengals Competitive Advantages

This Sunday, the “David vs. Goliath” matchup we’ve been waiting for will hit TVs all across America. No, we’re not talking about the head-to-head battles on Big Brother. We’re talking about the Super ...

Jobs to Be Done: What Product Marketers Can Learn From Product Managers

Picture this: It’s Tuesday afternoon and yet another request just got added to your to-do list in Airtable. You take a look and immediately think to yourself, “There’s no way I can get to this. In ...

Five Key Takeaways from Leading Analyst Firms on the Competitive Intelligence Industry

When your market is competitive, being an insights-driven business becomes imperative. Companies that have a pulse on their competitors stay on top. Competitive intelligence (CI) software makes the ...

Prestige Pricing: What It Is, Why It Works, and How It's Executed In the Real World

Q: How much is a product worth? A: Whatever people will pay for it. In some cases, that’s nothing (not great!). In others, it means charging a premium because, well, you can. Today, we’re focusing on ...

Product Marketing Spotlight Series: Farhan Manjiyani

Crayon's Product Marketing Spotlight is a video interview series where we chat with product marketers to get a glimpse into their careers and gain unique insight into product marketing strategy. In ...

Influenced Revenue: How CI Practitioners Can Prove—and Amplify—Their Impact On Sales

Over the past decade, marketing organizations at enterprise companies have grown from being perceived as cost centers built around soft metrics to being highly respected drivers of measurable ...

Who Uses Competitive Intelligence? A Quick Tour of the 4 Major Stakeholder Audiences

Competitive intelligence is only as good as what it yields: better preparedness, happier customers, stronger revenue growth, and so on. In order to yield these results, you need to activate the intel ...

Competitive Differentiation: How to Stand Out and Win

The space race. SATs. Where the best barbecue hails from. Nothing is more American than competition. Forgive me—that’s not true. Nothing is more American than the desire to win. And what holds true ...

Product Marketing Manager Salary Overview: How Do You Stack Up?

Product marketing managers (PMMs) hold one of the most pivotal and collaborative roles at companies – they sit at the intersection of marketing, product, sales, and customer success. PMMs are the ...

I Just Bought Crayon For the Second Time—Here's Why

I have been working in the B2B SaaS world for over five years now. As a competitive intelligence (CI) professional, I help companies define and build their CI programs so that they can be one step ...

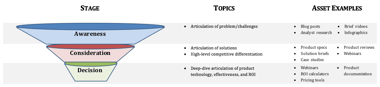

4 Insights That CI Pros Can Deliver to Their Content Teams

Blogs. E-books. White papers. Reports. The list goes on and on. Behind every great piece of content is a team that strategized, planned, and executed an idea with one goal in mind – to share their ...

Product Marketing Spotlight Series: Elizabeth Brophy

Crayon's Product Marketing Spotlight is an interview series where we chat with product marketers to get a glimpse into their careers and gain unique insight into product marketing strategy. In this ...

Positioning vs. Messaging: Distinguishing These Go-to-Market Staples

We’ve all found ourselves lured by the siren song of some irresistible silver bullet. The adtech tool that automates away hours of mundane account optimization. The martech tool that automates away ...

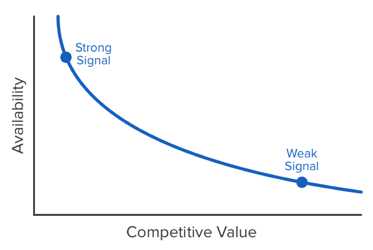

5 Next-Level Tactics for Gathering Competitive Intelligence

As a practitioner of competitive intelligence, you have to make trade-offs. You can’t gather intel and activate intel at the same time; every minute spent on the former is a minute not spent on the ...

Product Marketing Spotlight Series: Sophia Chang

Crayon's Product Marketing Spotlight is an interview series where we chat with product marketers to get a glimpse into their careers and gain unique insight into product marketing strategy. In this ...

3 Keys to a Captivating Product Story (with Examples)

Regardless of industry or available resources, brand is the north star for product teams the world over. Stop what you’re doing and thumb through your LinkedIn feed; every third post is extolling the ...

Rival Companies: Exploring 8 Businesses with Fierce Competition

Time and time again, companies’ yearning desire to be the best gives way to fierce rivalries. For some rival companies, the feud is public-facing – think comparative advertisements and competitor ...

6 Competitive Advantage Examples From the Real World

Venmo. Walmart. Warby Parker. Xfinity. Supreme. Apple. Obviously, each of these companies is a massive success story. But as it turns out, the drivers of their success—although not without ...

8 Product Marketing Interview Questions That Hiring Managers Should Ask (and Candidates Should Prepare For)

Product marketing interviews are tricky—it’s inevitable, given the interdisciplinary nature of the role. If you’re a hiring manager, it can be overwhelming trying to narrow down the list of potential ...

5 Steps to Get Valuable Insight From Competitor Website Analysis

When it comes to user experience (UX) design, competitive analysis should be an integral part of your strategy, to stay ahead of trends and make your website stand out against the rest within your ...

How to Find Competitor Pricing Information

Picture this: You’re a sales rep at an email marketing software company. One day, you hop on a discovery call with a prospect. As you’re chatting with them about their goals, they say this: “Easy ...

Competitive Comparisons Are Not Battlecards—But They’re Close

I’m sitting at my desk as I write this intro—a desk that I assembled over the course of a snowy Saturday afternoon last winter. Had the box in which the parts were shipped not included an instruction ...

Product Marketing Spotlight Series: Jaime Singson

Crayon's Product Marketing Spotlight is an interview series where we chat with product marketers to get a glimpse into their careers and gain unique insight into product marketing strategy. In this ...

Sales Enablement Materials: 12 Types of Content That Empower Sellers

Making cold calls. Running demos. Persuading decision-makers. The life of a seller isn’t an easy one. But that doesn’t mean you—whether you’re a product marketer, sales manager, revenue leader, or ...

Compete Like You Mean It: Taking Crayon’s Brand—and Competitive Intelligence—to New Heights

For the second time this year, allow us to kick off a blog post with our favorite declaration: It’s a great day for the Crayon community! Back in May, the cause for celebration was our $22M Series B. ...

6 Exceptional Brand Messaging Examples We Can All Learn From

All successful companies have brand messaging that is clever, strategic, and relevant to their target audiences. Think Nike: “Just do it.” Or, Walmart: “Save money. Live better.” Smart, persuasive, ...

Restaurant POS Software Leader Has Removed “Restaurant” From Its Vocabulary In 2021

In recent years, point of sale (POS) systems have become a key differentiator for restaurants across the globe. These systems allow restaurateurs to meet many practical needs such as growing profits, ...

7 Metrics to Measure the Success of Your Sales Enablement Efforts

Whether you’re a marketer or a sales manager, there are innumerable ways you can empower sellers to do their jobs more effectively. You can provide content that helps them personalize emails. You can ...

Product Marketing Spotlight Series: Mitchell Comstock

Crayon's Product Marketing Spotlight is an interview series where we chat with product marketers to get a glimpse into their careers and gain unique insight into product marketing strategy. In this ...

Cybersecurity Content Marketing: 2 Data-Backed Tactics For a More Differentiated Strategy

There’s more than one way to measure the success of your content marketing strategy. Traffic. Lead volume. Revenue. The list of KPIs is long, and it spans the entirety of your funnel. No matter what ...

8 Sources of Competitive Intelligence to Keep Tabs On Industry Rivals

While your company may have a strong grasp of what’s happening internally, understanding what’s happening externally in your marketplace is critical for sound decision-making. This is where ...

5 Reasons Competitive Intelligence Is a Critical Component of Pre-Call Planning

Unless you’re subscribed to the Crayon blog, you’re most likely reading this because you Googled “pre-call planning.” If that’s the case, you probably noticed that there are a lot of blog posts on ...

Product Marketing Spotlight Series: Elvis Lieban

Crayon's Product Marketing Spotlight is an interview series where we chat with product marketers to get a glimpse into their careers and gain unique insight into product marketing strategy. In this ...

B2B Competitive Analysis: Your Definitive Step-by-Step Guide (+ Free Template)

B2B competitive analysis is the process of critically assessing your company (or business unit) in relation to one or more competitors. Broadly speaking, the objective is to identify opportunities ...

16 of Our Favorite B2B + B2C Product Advertising Examples

As your market saturates, connecting with your target audience becomes increasingly difficult. With each new competitor that pops up, you have to work that much harder to say something ...

8 Pain Point Examples From the Real World (+ Tips for Better Understanding Your Prospects)

If you want to win in a competitive market, you need to position and promote your solution in a way that makes prospects think, That’s exactly what I’m looking for. Put differently, you need to do a ...

This Summer, Education Brands Blogged About COVID—But They Didn’t Tweet About It

Back-to-school season is always an exciting time of year. Classmates come together to trade tales of summertime adventure (and, eventually, employment). Teachers brainstorm new ways to engage and ...

Brand Pillars: How to Use Your Company’s Core Values as Strategic Differentiators

We talk a lot about branding and messaging on the Crayon blog. Specifically, we’re interested in how companies can leverage messaging to position themselves as unique, best-in-class players in their ...

Features vs. Benefits: How to Leverage Them Both and Create Messaging That Your Competitors Envy

No matter how experienced you are as a product marketer, one aspect of the role that’s often a challenge is properly conveying the difference between features and benefits. You yourself may see the ...

Women in Sales at Crayon

As Crayon fiercely commits to our diversity, equity, and inclusion initiatives, it has furthered our discussion around women in sales. Women represent only 39% of the workforce in sales despite women ...

3 Ways to Use Market Research for Product Development

Right off the bat, let’s make sure we’re on the same page in terms of definitions. In its simplest form, a market consists of buyers and sellers. Technically, we could also include suppliers, ...

A Marketer’s Guide to Conducting Social Media Competitive Analysis (Free Template Included)

There are tons of moving parts when it comes to keeping up with your competitors’ digital footprints. Tracking your rivals’ social media movements, in particular, is critical due to its widespread ...

Competitive Pricing: Breaking Down 5 Time-Tested Strategies

At all business levels—and especially at the enterprise level—product pricing can be a challenging yet vital activity. How much should your company’s products cost? Should you go with tiered ...

How to Create Win/Loss Analysis Templates In Microsoft Excel (Free Downloads)

More than two-thirds of competitive intelligence professionals say their in-house team is responsible for win/loss analysis. Translation: A lot of folks—perhaps yourself included—are tasked with ...

Your Guide to Creating Customer Case Studies (+ Some Show-Stopping Examples)

Teams are constantly looking for ways to stand out in crowded markets. Customer case studies may be just the differentiator companies have been seeking to give them that competitive edge. Not only do ...

Here Are 4 Must-Ask Questions For Your Win/Loss Interviews

Win/loss analysis—the process of determining why deals are won or lost—yields insights that practically everyone across your organization can use to their advantage. Sales reps get insights that they ...

5 Product Launch Examples That Are Worth Studying (+ Tips for Success)

For your company’s new product to succeed, a lot of dominoes need to fall. It needs to relieve the right pain points. It needs to be priced appropriately. It needs to stand out—functionally or ...

How to Create an Effective Competitive Comparison Landing Page

No matter your industry or your product, your company likely has dozens of rivals (if not hundreds)—some of them direct competitors, some of them indirect competitors, and some of them aspirational ...

6 Steps to a Strong(er) B2B Value Proposition

Crafting a home run of a B2B value proposition is no easy task. Maybe your company is gearing up to launch a new product. Needless to say, you’ve got a lot on your to-do list: interviewing customers, ...

3 Keys to Crafting an Excellent Brand Promise

Did you check out our post on messaging hierarchies? If so, you know a little bit about brand promises. On the matrix of vital messaging for brands trying to convey their unique value proposition, ...

Your Guide to Conducting a Successful Competitive Product Analysis

To be successful in a crowded marketplace, it is important to understand the competitive advantages of your company’s solution against its alternatives. Enterprises must be well-versed in their ...

How to Gain Valuable Insight From Your Competitor’s Website

According to our 2021 State of Competitive Intelligence Report, 99% of survey respondents found value in monitoring their competitors' website changes. Between messaging and team changes, pricing and ...

PRIDE Month: I’m Not Afraid Anymore

Work is stressful. At times, we all feel overwhelmed, be it because of a growing workload, a shrinking deadline or a hefty quota. What if, in addition to those traditional workplace worries, ...

The 5 Best Brand Positioning Examples We’ve Ever Seen

We’ve talked at length about brand positioning on the Crayon blog—from creating positioning maps to identify where your brand exists in the competitive landscape, to crafting messaging hierarchies ...

Competitive Landscape Analysis: What It Is, Why It Matters, and How to Get a Head Start

Neglecting competitive landscape analysis is a costly mistake—one that’s steadily growing costlier over time. We say that for several reasons. First of all—and as regular readers of this blog are ...

7 Ways to Make a More Effective Message Map

Let’s face it—your product doesn’t sell itself. Most products just don’t. That’s why product marketing focuses on defining the positioning for your solution and the messaging your team should use to ...

Competitive Analysis Frameworks: 3 Ways to Get More From Competitive Data

Competitive analysis frameworks are indispensable for anyone who wants to extract meaning from intel and inspire action across their organization. When we talk about competitive intelligence, we’re ...

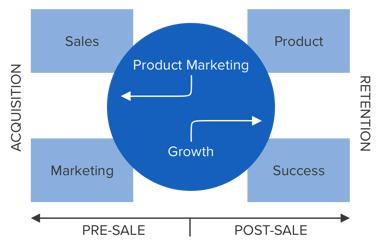

Why You Need to Align Your Product and Marketing Teams + How to Make It Happen [A B2B Guide]

A Google search for “sales and marketing alignment” yields dozens of case studies and blog posts (including one that we wrote). This is unsurprising; it’s generally taken for granted that getting ...

5 Competitive Advertising Examples to Spark Competitive Creativity

Competitive advertising is a well-established practice in our modern media landscape. As the intensity of competition rises, so, too, does the difficulty of earning and maintaining the attention of ...

The Definitive Guide to Win/Loss Analysis: How to Gather, Analyze, and Act On Win/Loss Data

Win/loss analysis is an essential practice for anyone who wants to better understand their competitive landscape and continuously optimize processes across sales, marketing, product management, and ...

Why You Need a Messaging Hierarchy (+ How to Create One)

In the battle against competitors for sales, a positioning statement gives brand stakeholders much-needed ammunition. Across marketing and sales channels, you need to know how to promote your product ...

Celebrating Our 500th Customer and $22M Series B!

It’s a great day for the Crayon community! Today, we celebrate our 500th customer and $22M Series B. Let’s go!!! This round is being led by Benedict Rocchio at Baird Capital, a remarkable investor ...

11 Sales Enablement Statistics Everyone Should Know In 2022

Sales enablement statistics are useful for a number of reasons. Maybe you’re new to the discipline and trying to quickly learn as much as possible. Maybe you’re building a business case for the ...

How to Create a Winning Brand Positioning Strategy

If your brand existed in a vacuum, it’d be easy enough to convey your unique selling proposition to a prospect. You’d be unique because you’d be the only game in town. Your product’s defining ...

10 Essential Examples of Competitive Intelligence (With Tips for Inspiring Action!)

For those who conduct competitive intelligence, gathering insights in a timely manner can be an enormous struggle. On any given day, there may be hundreds — if not thousands — of signals generated ...

What Are the Goals of Competitive Intelligence? Let’s Break Down 5 of Them

Businesses have never been more agile than they are right now. Bringing a product to market, releasing a new feature, launching an ad campaign — these initiatives, though they will never be easy by ...

6 Best Practices to Align Sales and Marketing Teams

The more closely you align your sales and marketing teams, the better. When everyone is on the same page — from content marketers and demand gen specialists to BDRs and account executives — lead ...

What’s the Difference Between Product Marketing & Product Management?

The difference between product marketing and product management is not an especially clear one. Within a given organization, both product marketers and product managers are intimately familiar with ...

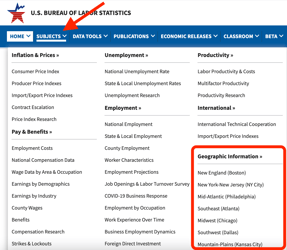

The 8 Free Market Research Tools and Resources You Need to Know

With over 400,000 new businesses opening in the United States each month, the need for individual companies to conduct their own market research has never been more urgent. However, conducting market ...

SaaS Pricing Pages: 8 Tactics to Drive Better Results (with Examples!)

No one cares about the price of your product unless they’re interested in buying it. (Or they're interested in gathering competitive intel. But we'll set that aside for now.) Prospects who visit your ...

5 Things to Get More Value Out of Competitive Intelligence [NEW DATA]

Editor's note: The following blog post is based on data from the 2021 State of Competitive Intelligence Report. To get the latest insights, download the 2022 report. If I had to summarize the brand ...

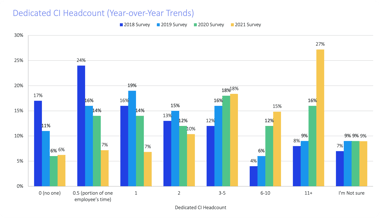

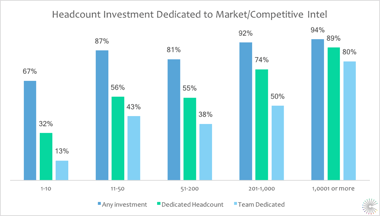

NEW DATA: 70% of Businesses Have CI Teams of 2 or More Dedicated Professionals

Editor's note: The following blog post is based on data from the 2021 State of Competitive Intelligence Report. To get the latest insights, download the 2022 report. As the folks here at Crayon ...

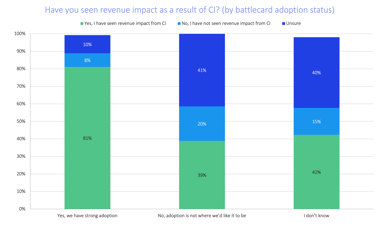

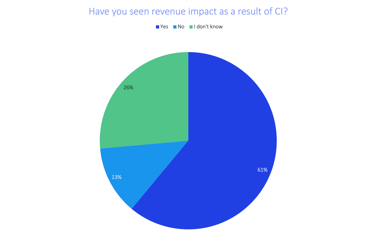

NEW DATA: 61% of Businesses Say Competitive Intelligence Directly Impacts Revenue

Editor's note: The following blog post is based on data from the 2021 State of Competitive Intelligence Report. To get the latest insights, download the 2022 report. Every year, for the last four ...

B2B Buyer Personas: Everything Marketers Need to Know

In order to stand out in a crowded market, you need to position your solution in a manner that resonates with your prospective customers. Nothing you say will resonate with your prospects unless you ...

Sales Battlecards: 8 Tips to Help You Win More Deals

The sales battlecard is an extraordinarily impactful tool for any business in a competitive B2B market. As we'll discuss in the 2021 State of Competitive Intelligence Report (coming soon!), 71% of ...

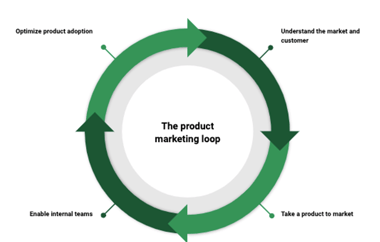

A Guide to Product Marketing Team Structure and Functions

No two product marketers are the same, which means that no two product marketing teams are the same. Some are large, supporting multiple product lines, features, specialties, and more. Some are small ...

3 Ways to Find and Leverage Your Competitors' Weaknesses

In the B2B world, you can’t go to market with a product that’s identical to that of your competitor. Without some form of differentiation, your chances of succeeding over the long term are slim. ...

8 Traits Leaders Look for When Hiring Product Marketers

Hiring the perfect product marketer with the right combination of skills for your organization is no easy feat. In a recent blog post, we discussed what product marketing actually is. Although ...

How to Definitively Prove the Value of Sales Enablement

High-performing sales reps are not born; they’re built. To be more precise, high-performing sales reps are not built in a discrete period of time; they’re built on an ongoing basis. Call analyses, ...

What Is Product Marketing? Key Concepts and Resources

Ask one hundred companies what a product marketer does, and you’re likely to get one hundred different descriptions. Product marketing is one of those roles that varies so much from industry to ...

How to Build a Scalable Competitive Intelligence Program

Today is a great day because you’ve just been hired to spearhead a competitive intelligence (CI) program at your company. When you’re starting a new initiative and integrating a new practice into an ...

24 Questions to Consider for Your Next SWOT Analysis

So, you’re getting ready to conduct a SWOT analysis — fantastic! Whether you’re a marketer, an executive leader, a competitive intelligence (CI) professional, or someone else entirely, you’re on your ...

Competitive Intelligence Spotlight Series: Vinay Nair

Crayon's Competitive Intelligence Spotlight is an interview series where we chat with intelligence professionals to get a glimpse into their careers and gain unique insight into competitive strategy. ...

Competitive Analysis Requires Benchmarking Your Own Company

Most businesses know their own strategy through and through, and recently, more companies than ever before are investing in competitive intelligence. The real secret to success is combining those two ...

16 Questions to Answer in Your Product Marketing Plan

The new year is here and it’s time to dive into the oh-so-beloved activity of building a marketing plan. OK, maybe it’s not so beloved - after all, it can be daunting and challenging to come up with ...

Competitive Intelligence Priorities for the New Year from the Experts

As we head into the New Year, many of us are deep in planning, strategy brainstorm sessions, and goal-setting. For competitive intelligence (CI) practitioners, there are many elements to building ...

Giant Leaps to Growth: Building Winning Strategies

Though we've only a grainy film to guide us, it is likely that Neil Armstrong took a very deliberate approach before making his "one small step for man, and one giant leap for mankind" when he ...

Competitive Intelligence Planning: 15 Questions for Your Annual Plan

The new year is right around the corner. If you haven’t already, you’re likely about to kick-off your 2021 planning. A lot has happened in 2020 that has impacted businesses across the globe and ...

Competitive Intelligence Spotlight Series: Sunanda Thumati

Crayon's Competitive Intelligence Spotlight is an interview series where we chat with intelligence professionals to get a glimpse into their careers and gain unique insight into competitive strategy. ...

5 Tips for Communicating Competitive Intelligence to Your Organization

You work hard to stay on top of your competitors’ moves. You sift through big and small changes alike and analyze the data to identify trends and strategies. But then what do you do with the data? ...

How Product Marketers Prioritize & Elevate Competitive Intelligence

The cool thing about working at Crayon (besides incredible dog and cat Slack channels) is that I get to talk to Product Marketers a whole lot—whether it’s on LinkedIn, in the awesome Product ...

Tools & Resources to Boost Market Intelligence Team Value: Part 2

In Part I of this blog, I addressed what to look for before engaging with a 3rd-party firm to discuss their offerings. Part II today covers the broad range of tools and services our team uses to add ...

Purchasing Competitive Intelligence Tools & Services: Part 1

Every week a new vendor comes knocking on my door with a sales pitch for their – fill in the blank – market research, competitive intelligence (CI) research, industry news, web scraping, expert ...

Critical Areas of Interest for Competitive Intelligence Strategists™

Competitive Intelligence (CI) is one of the most critical methodologies we need to fully understand our markets. Traditionally, CI has been conducted by collecting, analyzing, and sharing single ...

Product Marketing Spotlight Series: Rowan Noronha

Crayon's Product Marketing Spotlight is an interview series where we chat with product marketers to get a glimpse into their careers and gain unique insight into product marketing strategy. In this ...

Why Your Coworkers are a Great Source of Competitive Intelligence

There are many sources of competitive intelligence (CI) that we can tap into. These days, most businesses have a robust digital footprint, so our first thought of a valuable CI source is likely a ...

5 Steps for Effectively Leveraging Competitive Intelligence

You did it. Your persistent competitive research efforts have yielded a key piece of intel about one of your competitors. Maybe a competitor is quietly discontinuing a product line, or maybe they’re ...

How to Eliminate Competitive Battlecard Bias So Sales Wins More Deals

One sales enablement tool we all know and love is the competitive battlecard. Battlecards are an extremely impactful tool for your sales team to have in their toolbox, especially when a prospect is ...

12 Actionable Outcomes of Competitive Intelligence

Competitive Intelligence (CI) is a function that fits into every business strategy. No matter what your product or service is, you’ve got competitors fighting to win the same business as you and ...

Product Marketing Spotlight Series: Anand Patel

Crayon's Product Marketing Spotlight is an interview series where we chat with product marketers to get a glimpse into their careers and gain unique insight into product marketing strategy. In this ...

Why Technology Companies Need to Invest More in Product Marketing

Most startups and growth-stage tech companies are understandably judicious in their outlay of capital. When you’re under the venture capital magnifying glass and trying to prove your product is ...

How to Master Internal Communication for Your Next Product Launch