Picture this: You’re a sales rep at an email marketing software company.

One day, you hop on a discovery call with a prospect. As you’re chatting with them about their goals, they say this: “Easy automation is really the key here. In order to hit my targets, I need to send a ton of emails, and I just don’t have that much time on my hands these days.”

Good to know. Towards the end of the call, you ask the prospect if they’re evaluating any other solutions, and they say, “Yeah, I’ve got an intro call with XYZ next week.”

As it turns out, your colleague in product marketing recently told you something about that competitor: Their pricing model is based on the number of emails sent (whereas your company’s pricing model is based on the number of templates created). You relay this information to your prospect, and they respond with something that sounds like music to your ears: “Oh. Well, I guess I’d better cancel that call and save myself 30 minutes.”

Obviously, this is a made-up (and idealized) scenario – but the value of finding and activating your competitors’ pricing information is real. As this example shows, pricing intel can empower your sellers to knock rivals out of the picture and accelerate the sales cycle.

That being said, you should never obsess over competitor pricing. It’s not the be-all and end-all of winning competitive deals. Your sellers need to show prospects how your product can relieve their pain points and empower them to achieve their goals. That's what really matters.

Nonetheless, I think we can all agree that, at the very minimum, it never hurts to have up-to-date intel on your competitors’ pricing. So, to help guide you through your research, today’s blog explores five different spots you can lean on to find pricing information:

- Competitors’ websites

- GSA price list

- Analyst reports

- Review sites

- Your prospects (via your sales team)

Let’s dive in!

1. Competitors' websites

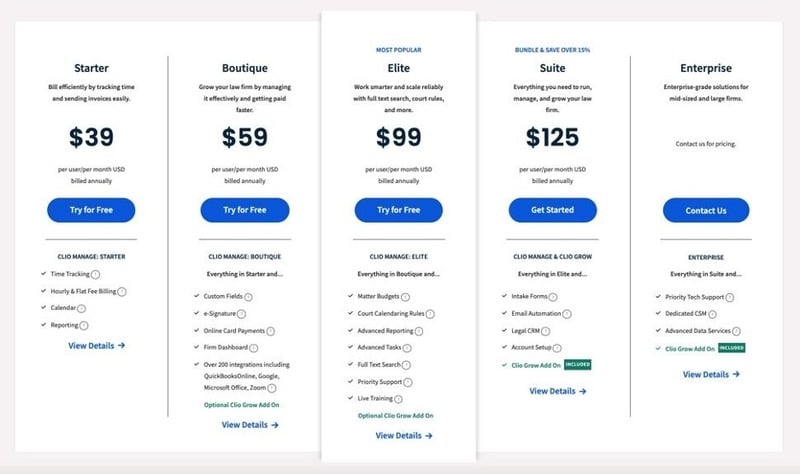

You’d be surprised by the number of companies that list pricing on their website. While some may include it in tiny print on a product page, others are upfront with it for all to see. Take Clio as an example.

Imagine you are a Clio competitor, and one of your sellers is running a demo for a prospect who cannot spend more than $75 per user per month. When your seller starts talking about reporting, the prospect comments on how important it is to be able to dig deep into metrics.

Thanks to the pricing intel that you gathered from Clio’s page (which now lives in your Clio battlecard), your seller can point out that Clio offers advanced reporting for their Elite package – a package far outside the prospect's budget.

When you’re neck and neck with a rival, there’s no doubt that pricing intel can help seal the deal.

2. GSA price list

Thanks to public records, some industries make it easy to keep tabs on competitors’ pricing. If your rival sells to the government, chances are their prices are published on the GSA’s (General Services Administration) price list. Each listed company provides products and/or services to federal, state, and local buyers – over 11 million businesses to be exact.

To unlock your rival’s price list, head over to the GSA website. From there, click on the following:

- Hover over “Buying & Selling” in the left-hand corner, select “Purchasing Programs”, and navigate to “GSA Schedules.”

- From the GSA Schedule “Overview” page, click on "12 large categories."

- Select a category from the left-hand menu (e.g., Information Technology).

- Select a subcategory (e.g., Telecommunications).

- Select a sub-sub category (e.g., Wireless Mobility Solutions).

- Find the list of vendors and investigate their price lists.

Price lists can provide you with vast information including a company’s lowest-priced item, hourly rate, maximum and minimum order pricing, cost per month, and more. While this makes it easy for you to gather extensive pricing intel, we’d be remiss not to point out that the contract practically guarantees increased sales and improved profits for your competitor... pros and cons.

3. Analyst reports

Open up Google and enter your industry, followed by “report” in your search bar. I bet you stumbled across some analyst reports, right? Step one accomplished.

The next step is seeking out the reports that directly compare your company with its competitors. You’ll likely find reports focused on marketplace pricing trends (that include price comparisons) and may even find some focused solely on analyzing pricing. It may take some time to find the right report, but the valuable insights you receive will be worth the digging.

For instance, check out this report preview geared around nine leaders within the software engineering market. To determine whether a report holds strong pricing intel, read through its synopsis. In this case, the synopsis emphasizes that the report covers “price data” and “price patterns”. It even covers revenue and gross profit data as well.

Although you may need to pay to download some reports (this one included), these are effective resources to explore if you’re coming up short with your pricing research.

4. Review sites

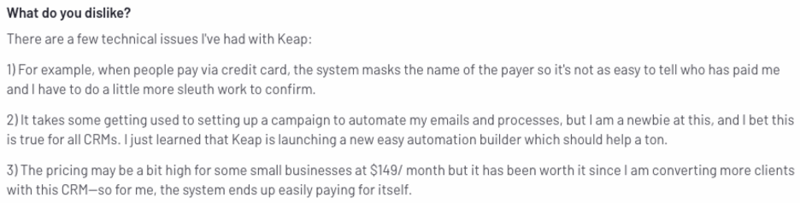

If online reviews are common in your market, you can probably find pricing intel on sites like G2, Trustpilot, Quora, and Reddit. In fact, G2 has an entire review section focused entirely on pricing. Take a look at this Keap G2 review as an example.

Bingo! There’s that intel you were looking for. Under number 3, the user states exactly how much she pays per month... $149.

Now, I bet you’re wondering how you can activate this intel. Let’s imagine you are a Keap competitor. Clearly, this reviewer is experiencing some strong ROI. Assuming that's one of Keap's primary selling points, this nugget of pricing intel might be an indicator that it's time for you to arm your sellers with an ROI calculator. That way, when they're going head-to-head with Keap and pricing is a point of discussion, they're well-equipped to win.

5. Your prospects (via your sales team)

Think about the number of calls your sellers make each month. It’s probably in the hundreds. That means your sales team has ample opportunities to gain insight into competitor pricing. And when you’re talking to that many prospects, chances are at least a handful of them will voluntarily spill pricing information.

So, how do you guarantee that pricing intel is shared in real-time so that you can activate it quickly? You build and maintain strong relationships with individual sellers. It’s crucial to be interconnected with sales and have a plan of action in place, so sellers share the right information, in the right format, in the right place... in real-time.

Some ways to stay in the loop in a timely fashion include scheduling regular check-ins with reps and/or encouraging the use of a competitive pricing Slack channel to share intel directly. Also, emphasize to your sellers that you’re happy to join any calls where conversations are expected to be pricing-driven – whether you’re a fly on the wall or assist in guiding the conversation to close the deal.

Sometimes the answer to your question (in our case pricing) is right under your fingertips!

Gain intel into all aspects of your rival’s business with CI

While having knowledge of your competitors’ pricing is valuable, it’s important to keep eyes on all movements your rivals make – whether that be new leadership hires, product updates, or website copy changes. To fully know where you stand, you need to be well-versed in the activities of every department.

With Crayon’s competitive intelligence platform, your CI research is done for you. Crayon programmatically searches within your organization and externally, generating insights that allow you to create a sustainable advantage in your market.

To learn more, request a demo today!

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking