Five years.

When David Bowie sang those two words, over and over again, in the final moments of Ziggy Stardust’s opening track, his point was that five years is not a lot of time. And, sure, in the context of the song’s distressing narrative, I’m inclined to agree.

But if we’re talking about competitive intelligence—one of my absolute favorite things to do professionally—I’m afraid I must disagree with the Spiders from Mars’ frontman: In the CI world, five years is actually quite a lot of time.

To see why, you need not look further than our 2022 State of Competitive Intelligence Report: the 5th installment in the CI industry’s largest and longest-running survey series. Included in this brand new report are several time series that show just how far the discipline has come since our launch of the State of CI in 2018.

You can download your free copy of the report here, and to give you a preview of its contents, I’ve identified 3 trends that illustrate both where CI is today and where it will be tomorrow:

- As competition intensifies, both the appreciation of CI—and companies making strategic investments in CI—are growing.

- Armed with tech, CI practitioners are increasingly well-equipped to drive impact across their organizations.

- Advancements in the measurement of CI are helping to create a feedback loop of investment and growth.

Let’s jump in.

1. As competition intensifies, both the appreciation of CI—and companies making strategic investments in CI—are growing.

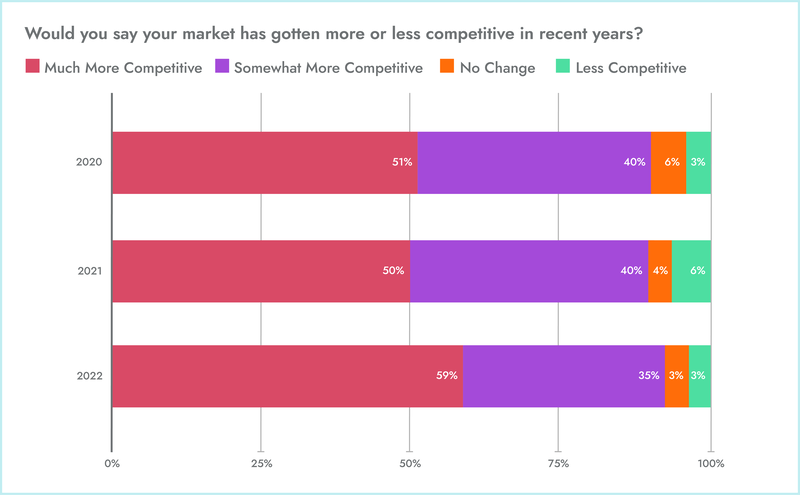

In 2022, it’s not uncommon for companies great and small to “diversify” their product offerings, which will, in many cases, place them directly in competition with established companies who’ve already built up their market share. Given how frequently—and how suddenly—this can happen to even the most “settled” verticals, we were unsurprised to find that the majority of our survey respondents said their markets have gotten “much more competitive” in recent years.

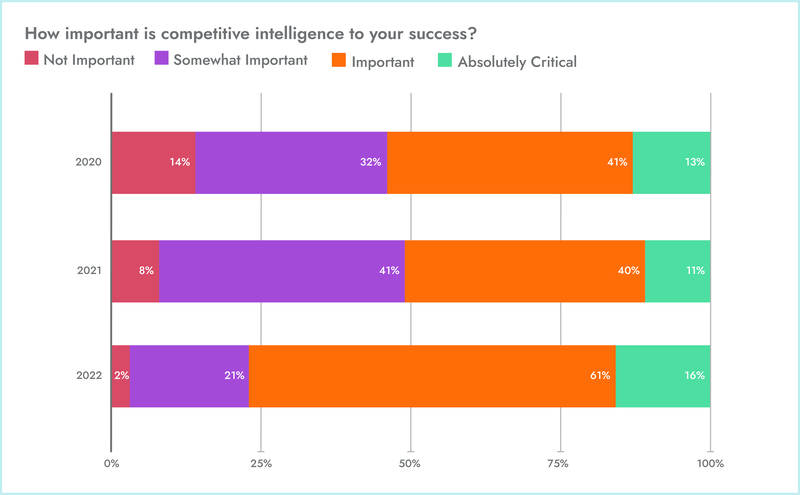

For our stakeholders, of course, more competition means more pressure—more pressure on product managers to differentiate offerings, more pressure on marketing teams to perfect their messaging, more pressure on sellers to say the right things in the right moments, and so on. It makes perfect sense, then, that compared to two years ago, those stakeholders are 23% more likely to say CI is “absolutely critical” to their success.

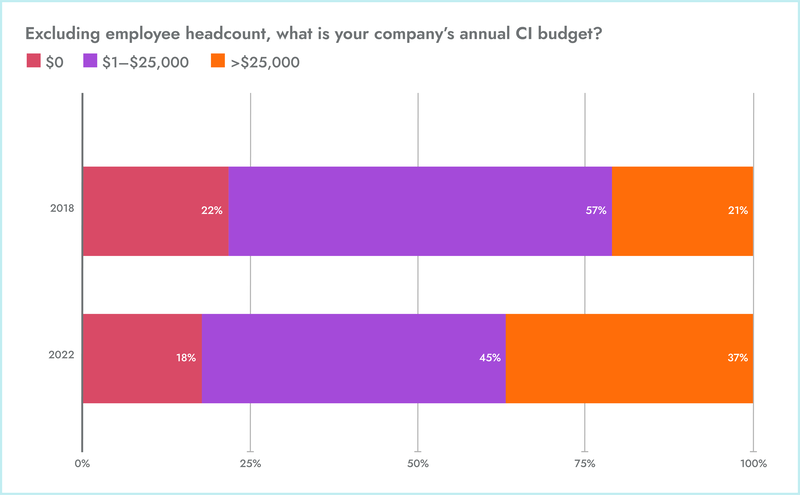

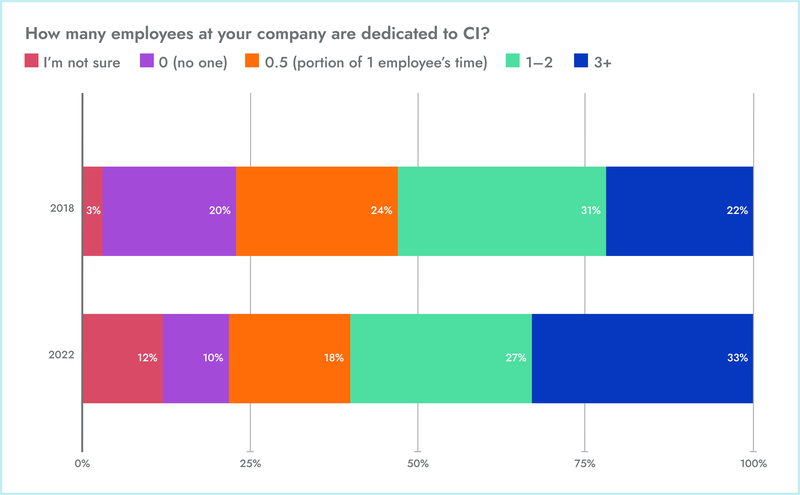

Competitors multiplying and stakeholders clamoring for intel? That sounds like a combination that would naturally drive increased investment in CI. And sure enough, when we compare the response data from our 2018 survey to the response data from our 2022 survey, we’re presented with growth in both dedicated CI budget and dedicated CI headcount.

Talented people command salaries that are commensurate to the impact they can bring to their organizations. So it stands to reason that, as headcount increases, so does the “budget” (in the form of compensation) that’s allocated to a CI program. But what else is that CI budget being spent on?

2. Armed with tech, CI practitioners are increasingly well-equipped to drive impact across their organizations.

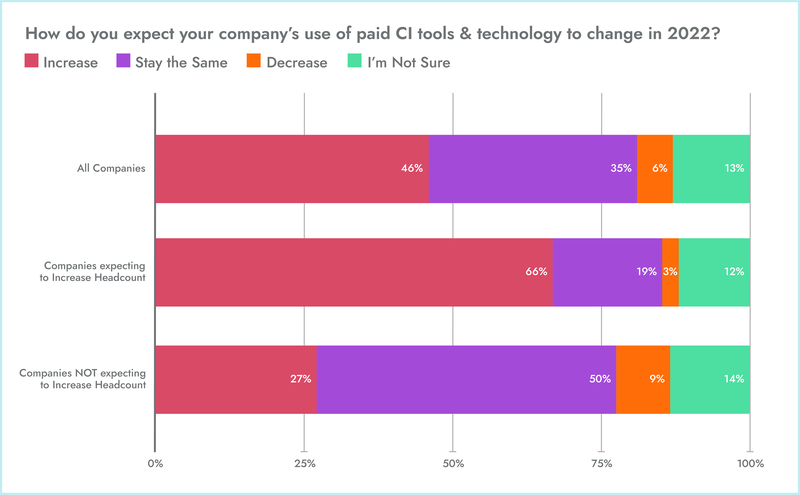

Based on our survey results, one could assume that many CI teams are using their budget to equip practitioners with technology. In fact, nearly half of our respondents expect their companies to increase their use of paid CI solutions in 2022.

And to take it one step further: Compared to teams that are sticking with their current headcount, those that are adding headcount are 144% more likely to say they’re doubling down on tech this year. You wouldn’t hire a woodworker to build custom cabinetry—and then prevent them from opening their tool chest. Quality CI practitioners need quality CI technology to augment and amplify their capabilities, and our survey respondents agree.

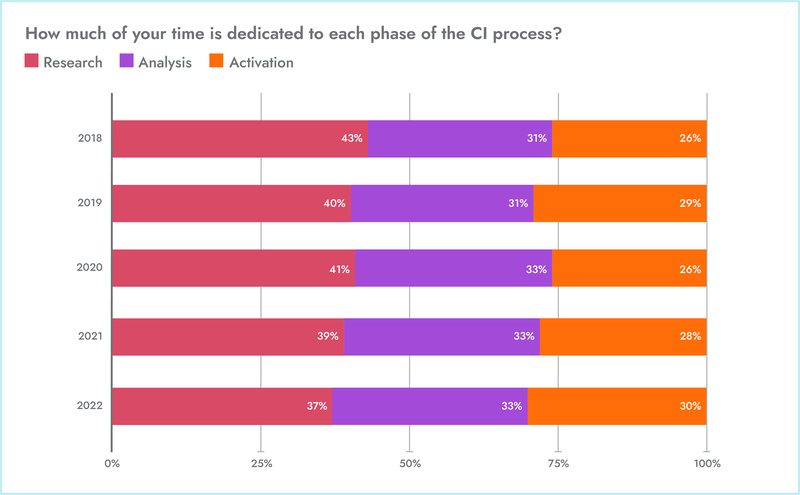

But competitive intelligence experts didn’t achieve that level of professional development by engaging in activities that couldn’t be made more efficient. And one of the primary benefits of the technology that these teams are adopting at an ever-growing rate is the ability to automate intel collection.

Fewer hours spent collecting intel means more time can be dedicated to analyzing and activating intel—i.e., transforming raw data into insights and deliverables that help stakeholders do their jobs better. Unsurprisingly, over the course of the past 5 years, we can clearly see a decrease in time spent on research and a corresponding increase in time spent on activation.

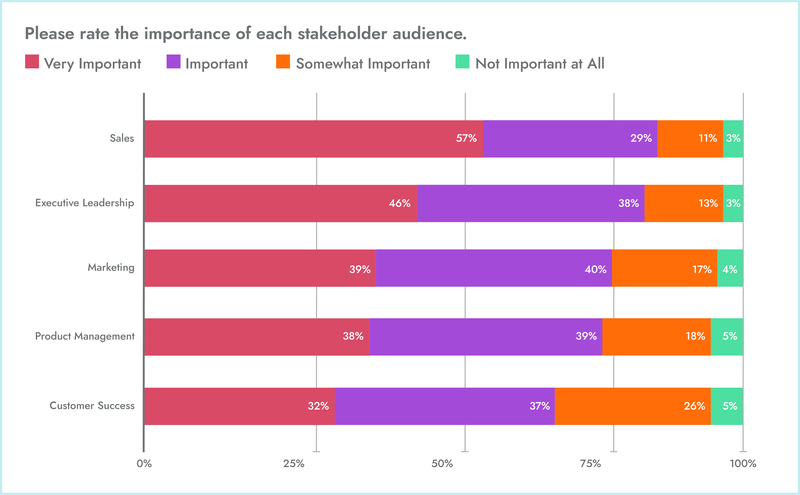

When an organization understands the value that competitive intelligence offers, the activation of CI initiatives quickly translates into business impact: by making it easier for product managers and marketers to differentiate, by making it simpler for sellers to say the right things in the right moments, and so on. This year, practitioners are clearly doing their best to drive the broadest possible impact, with each key stakeholder group being described as at least “somewhat important” by 95% of our survey respondents.

3. Advancements in the measurement of CI are helping to create a feedback loop of investment and growth.

I’ve talked before in this space about the growing trend amongst enterprise companies to view marketing as a profit center. But in order to continue to be observed as something more than a cost center—”the art department”—a marketing team needs to be structured in such a way that the ROI of their efforts can both be intricately measured and easily reported on.

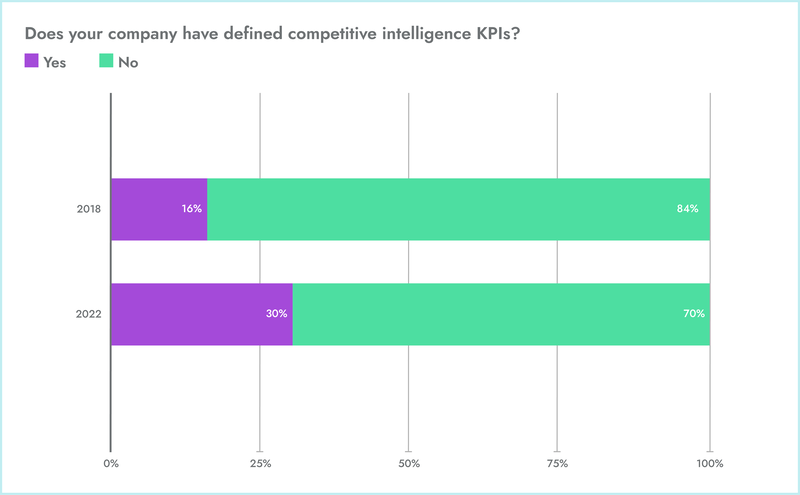

As with any other initiative, the impact of CI needs to be configured in the same way, especially if corporate buy-in and operating budget are going to be maintained (and, ideally, grown). That’s why, since the very beginning of the State of CI, we’ve asked our survey respondents about key performance indicators (KPIs). And while plenty of work remains to be done, practitioners have made impressive strides in this area over the years: Since 2018, we’ve seen an 88% increase in the number of CI teams with defined KPIs.

In the coming years, we expect further advancements in the measurement of CI to bring more of what we discussed in the first section of this post: bigger budgets and bigger teams. Teams that can use technology to free up time for activation, thus enabling them to drive measurable impact and keeping the feedback loop of investment and growth in motion.

Get all the insights from the CI industry’s largest and longest-running survey series

Believe it or not, what I’ve shared in this blog post only scratches the surface of what you’ll find in the 2022 State of Competitive Intelligence Report. To get a complete picture of where CI is today and where it will be tomorrow, click the banner below and download your free copy.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

.png?width=500&name=Sales%20Enablement-What%20is%20SE_%20(2).png)