As a practitioner of competitive intelligence, you have to make trade-offs. You can’t gather intel and activate intel at the same time; every minute spent on the former is a minute not spent on the latter. And as we know from the State of Competitive Intelligence Report, it’s the companies that focus on activation that tend to see the best returns on their CI investments.

Translation: You can’t afford to spend too much time in gathering mode.

So, to help you maximize the impact of your efforts, this blog post will explore five next-level tactics for gathering competitive intelligence:

- Use Google search modifiers to find PDFs

- Use Google search modifiers to find discussion threads

- Check out your competitors’ quarterly SEC filings

- Set up Slack keyword notifications

- Give praise and credit to field intel contributors

By the way, when we say “next-level tactics,” we mean tactics that aren’t quite as obvious as others. If you’re looking an introduction to the basics of gathering intel, check out this blog post.

1. Use Google search modifiers to find PDFs

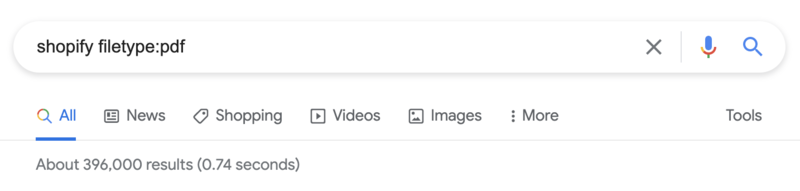

In the Google search bar, type a competitor’s brand name followed by “filetype:pdf.”

Had we simply searched the term “shopify,” Google would’ve served us, quite literally, more than a billion results. But as you can see in the above screenshot, our modified search yielded well under a million results—and that’s because we told Google to serve us nothing except PDFs.

Why? Because your competitors will often use this file format for materials such as:

- Product tutorials

- Onboarding guides

- Integration walkthroughs

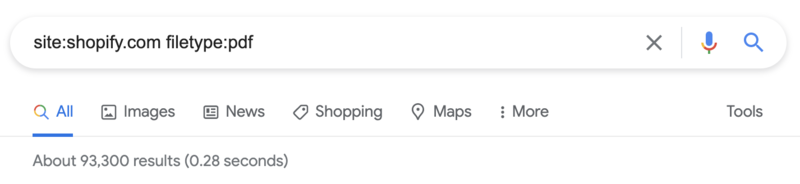

PDFs, in other words, are gold mines. And if you want to narrow your search even further, you can tell Google to serve you nothing except PDFs that are hosted on your competitor’s website:

2. Use Google search modifiers to find discussion threads

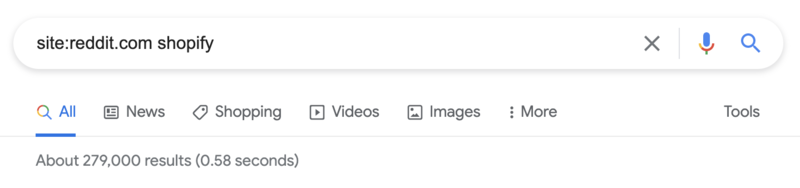

In the Google search bar, type “site:reddit.com” followed by a competitor’s brand name.

What you’ll find in the search results is a series of discussion threads that revolve around (or at least mention) your competitor. Whether you’re trying to figure out what your competitor does well, what they do poorly, how they approach certain pain points, or all of the above, there’s a good chance you’ll strike gold on Reddit.

If you want to narrow your search, try typing “site:reddit.com” followed by a specific product, product line, or function (e.g., “shopify POS”). And if you want to broaden your search, try typing “site:reddit.com” followed by a product category (e.g., “point of sale”).

3. Check out your competitors’ quarterly SEC filings

If none of your competitors are publicly traded, you may want to skip to the next tactic—but keep in mind that you might be competing against a publicly traded company in the near future.

In the U.S., publicly traded companies are required to submit all kinds of regulatory documents to the Securities and Exchange Commission (SEC)—documents that are accessible via those companies’ websites. For our purposes, we’re interested in Form 10-Q, which is submitted on a quarterly basis and “provides a continuing view of the company’s financial position.”

If you head to the table of contents in a competitor’s 10-Q filing, you’ll see a section labeled Risk Factors, which is essentially a breakdown of what your competitor considers to be their greatest vulnerabilities. The following excerpt is pulled directly from one of Squarespace’s filings:

“ … the importance of brand recognition will increase as competition in our market increases and the promotion of our brand may require substantial expenditures. We have invested, and expect to continue to invest, substantial resources to increase our brand awareness …”

Now, if you were competing with Squarespace, this probably wouldn’t be a revelatory piece of intel—but intel need not be revelatory in order to be valuable.

4. Set up Slack keyword notifications

On any given day, there’s a good chance that your colleagues—especially those who regularly interact with prospects and customers—are talking about your competitors. There are myriad reasons these competitor-focused conversations may take place: a prospect shares product screenshots with one of your sellers, a customer shares pricing intel with one of your account managers, and so on.

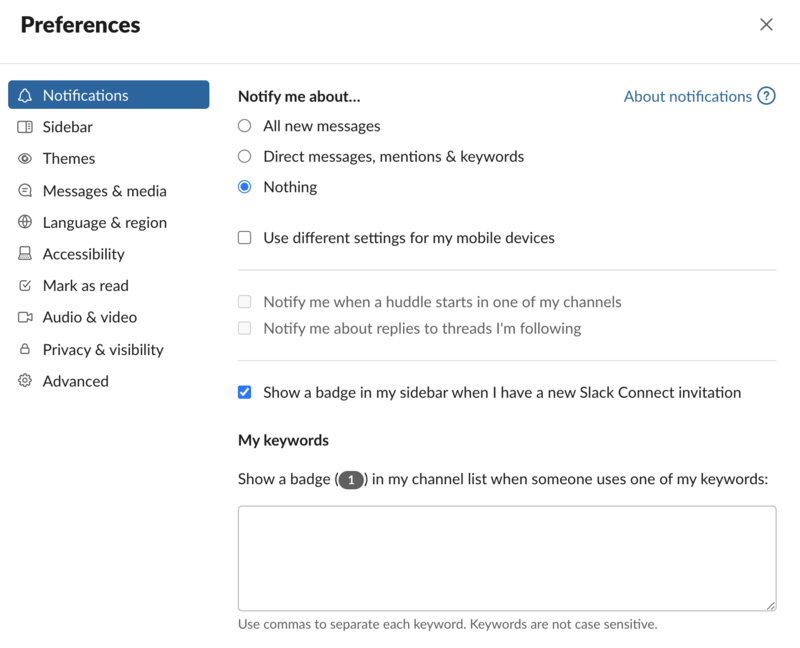

If your company uses Slack, one way to ensure that you’re always in the know is to take advantage of keyword notifications. To do so, navigate to the drop-down menu in the upper left corner of the Slack interface and select Preferences. This is what you’ll see:

As you can see, the Notifications tab includes a section labeled “My keywords,” which is where you can specify the terms that you’d like to trigger a Slack notification. By listing the names of your competitors—as well as the names of their products, if necessary—you’ll dramatically reduce the risk of missing out on valuable field intel.

5. Give praise and credit to field intel contributors

Ideally, as time goes on and your CI program matures, you’ll become less and less reliant on keyword notifications because your colleagues will go to you directly with their prospect- and customer-sourced field intel.

Unfortunately, it’s not guaranteed that you’ll get to this level of maturity. Fortunately, you can improve your chances of getting to this level of maturity by consistently giving praise and credit to those who contribute field intel. This is not only about positive reinforcement—a powerful force indeed—but also about education. Your colleagues may not realize just how valuable field intel is, and it’s up to you to let them know.

So, whenever you’re alerted to a piece of intel, take the time to thank the contributor and tell them that their contribution makes a difference. Doing so will make them feel good, encourage them to continue sharing intel, and send a clear message to everyone else in the Slack channel.

When the time comes, you can take this tactic one step further by dedicating a section of your CI newsletter to contributor spotlights. Who wouldn’t want a company-wide shout-out?

Automate the intel gathering process

Like we said: You can’t afford to spend too much time in gathering mode.

That’s why hundreds of the world’s most successful companies—including Salesforce, Spotify, and J.P. Morgan—use Crayon: the competitive intelligence software platform that makes it easy to track, analyze, and act on competitor activity.

With Crayon, you can automate the intel gathering process and free up time for activation, thus making the value of your efforts impossible to ignore.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking