A few weeks ago, we showed you how to make the case for an official competitive intelligence program. We showed you, in other words, how to convince an executive decision-maker (EDM) that CI is a vital, complex process—something that needs to be a priority for at least one person.

(A priority—not necessarily the priority. You can run a successful CI program while fulfilling other responsibilities, so long as CI is considered a core part of your role.)

Once you’ve checked that first box, the next step is convincing your EDM to allocate budget for a CI software tool—which is what we’ll be discussing today.

To be clear, you can make the case for a CI program and a CI tool in a single presentation; you don’t need to break them up into separate conversations. You just need to make sure your EDM sees the value of CI as a formal, dedicated function before pitching them on software.

Cool? Cool. Now, here are three tips to keep in mind as you build your case for a CI tool:

- Clarify the meaning of “competitive intelligence software”

- Prepare to be asked, “Why can’t you do this manually?”

- Talk about ROI in terms of your specific objective

Here we go.

1. Clarify the meaning of “competitive intelligence software”

Your company is probably using several tools that capture competitive intelligence in one way or another. Hootsuite, for example, can track your competitors’ social media activity; SpyFu can track their website traffic.

To you, it’s obvious that neither of these qualifies as “competitive intelligence software”—but that may not be obvious to your EDM. They may see those words and ask, “Don’t we already have this?”

To eliminate confusion, use the definition that Forrester used in their New Wave report: A CI software tool is one “with capabilities for data collection from internal and external sources; AI/ML-enabled search and automation; distribution of intelligence; usage analytics; collaboration; and integration with enterprise collaboration, CRM, and business intelligence (BI) tools.”

2. Prepare to be asked, “Why can’t you do this manually?”

Okay, fine—competitive intelligence software is a unique category of technology. But, why? Why do you need one of these tools? Why can’t you do this manually?

There are dozens of answers to this question. Let’s focus on three of them:

- Because you’ll waste your time.

- Because you’ll get blindsided by major events.

- Because you’ll fail to drive adoption of your deliverables.

Let’s break these down.

Because you’ll waste your time

Each of your competitors has a digital footprint: a public record stored on the internet. This includes not only the content that the company itself produces—blogs, videos, tweets—but also the content that’s related to the company: news mentions, customer discussion threads, employee reviews, etc.

Please feel free to use this GIF to illustrate the magnitude of each competitor’s digital footprint.

If you were to do CI manually, you’d spend most of your day criss-crossing each competitor’s digital footprint, leaving little time to analyze and disseminate relevant information—which, of course, is the whole point. Make this clear to your EDM: “The time I’d spend refreshing our competitors’ websites and combing through discussion threads is time I wouldn’t spend delivering value to our company.”

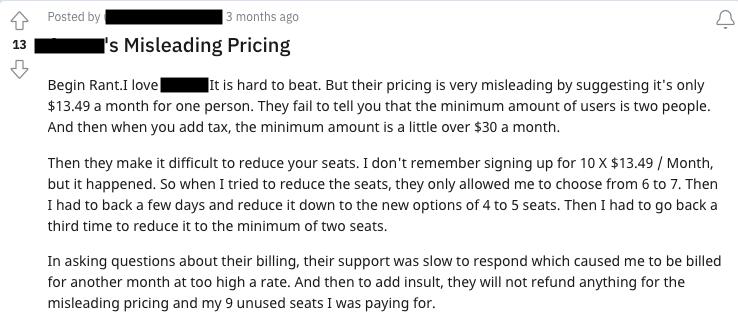

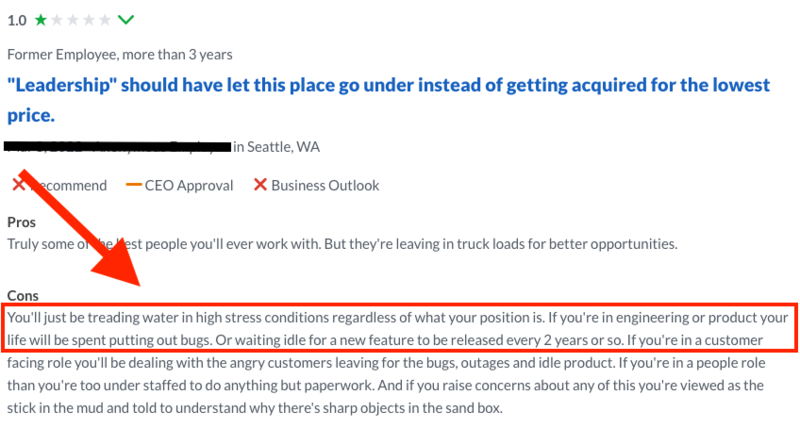

Be ready for your EDM’s counterpoint: “I get it—there’s a lot of information out there. But isn’t most of it just noise anyway? Why do you need a tool to pull in Reddit threads and Glassdoor reviews?”

Because Reddit threads and Glassdoor reviews are gold mines!

To be fair, these two sources in particular may not necessarily be gold mines for you; it depends on your audience and your competitors’ employees. The point is that valuable intel can be found in every corner of the digital footprint. So, as you’re preparing your presentation, visit the “unconventional” intel sources with which your EDM may take issue and see if you can find gold nuggets like the examples above.

Because you’ll get blindsided by major events

When you do CI manually, it’s difficult to centralize and organize the information you collect, thus hindering your ability to connect the dots between data points, detect patterns over time, and make educated predictions. And as a result, you’re susceptible to getting blindsided by major events like product launches, mergers and acquisitions, and the like.

By automatically centralizing and organizing the information it captures, your CI tool will make it much easier for you to detect patterns, thus minimizing the likelihood of unpleasant surprises.

To drive this point home with your EDM, here’s what I recommend:

- Pick a recent major event from your competitive landscape.

- Work backwards in time to see if there were clues leading up to this event.

- Create a timeline.

Here’s an example:

As you can see, HubSpot hinted towards the launch of their payments solution by publishing payments-related content—something that, at the time, was out of the ordinary for them. Without a CI tool, it’s almost impossible to pick up on trends like this as they’re developing in real time.

So, again, I encourage you to illustrate a real example from your competitive landscape. If it was a big enough event, this tactic should resonate with your EDM.

Because you’ll fail to drive adoption of your deliverables

Let’s imagine you have superhuman abilities—that you’re able to efficiently collect, organize, and analyze competitive intelligence without the help of automation. In this scenario, everything I just said about wasting time and getting blindsided is null.

Even if this were the case, you’d still be unsuccessful. Because without a CI tool, you have no way to integrate your insights into your peers’ workflows; your only option is to house your insights in something like Google Drive or Microsoft SharePoint.

Now, if that’s where your peers spend their time, then that’s not so bad. But I’m willing to bet that that’s not the case. I’m willing to bet that you have some peers who spend their time in Salesforce, others who spend their time in Slack, others who spend their time in Confluence, others who spend their time in Seismic—you get the idea.

If this is, in fact, the case, then housing your insights in Drive or SharePoint is a non-starter. Asking your peers to adopt a new workflow is asking too much—it will not happen. Your deliverables will go unused, and your CI program will fail to make an impact.

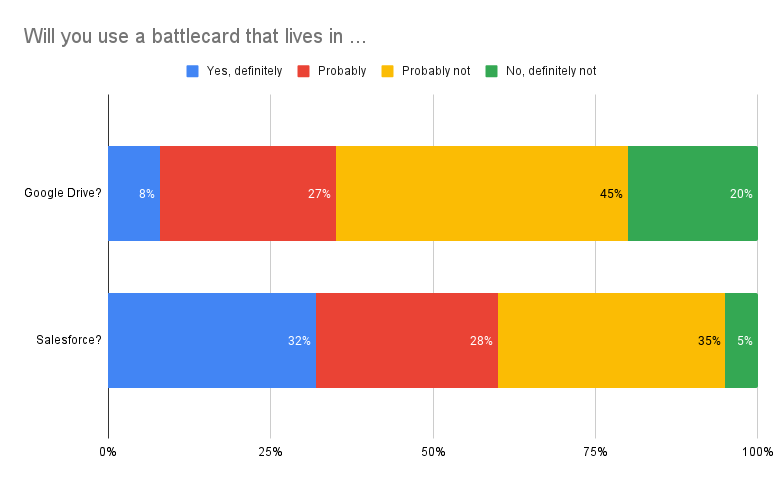

To drive this point home with your EDM, I recommend surveying your peers and using their responses as evidence of the need for a CI tool. Here’s an example of what that might look like:

I made these numbers up for the sake of the example. They are realistic, given what we’ve seen across our customer base of nearly 700 companies.

If these were actually the results of your survey, you could tell your EDM, “Our sellers are 4X more likely to use a battlecard that lives in Salesforce versus a battlecard that lives in Drive. Without a CI tool that connects to Salesforce, the impact of this program will be negligible.”

But, hey—maybe I’m wrong. Maybe the people you work with would be happy to adopt a new workflow. Maybe they’d love to go to SharePoint for all things CI.

Even if this were the case, you’d still be unsuccessful. Because without a CI tool, you are responsible for keeping everything up-to-date. It’s on you—a human being—to make sure the deliverables to which your peers have access are 100% accurate 100% of the time.

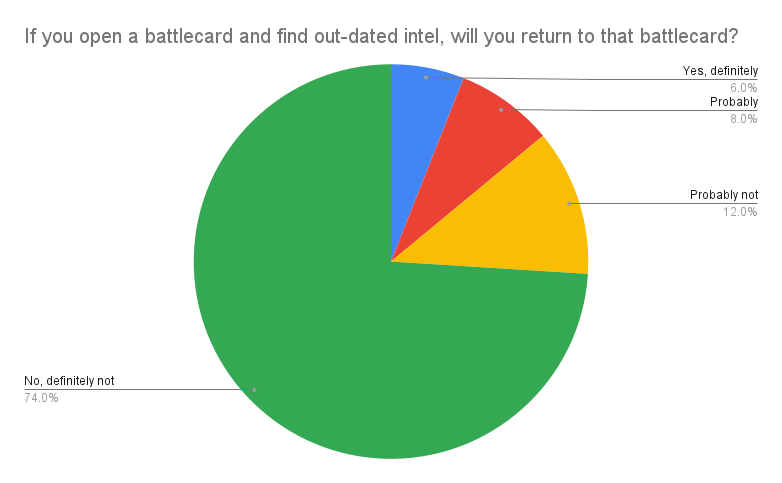

This, of course, is not feasible. Inevitably, something will slip through the cracks. And when that happens, you’ll lose your peers’ trust. Adoption will suffer. Once again, I recommend surveying your peers and using their responses as evidence:

Again, I made these numbers up for the sake of the example.

One way or another, the lack of a CI tool will undermine the success of your program.

3. Talk about ROI in terms of your specific objective

ROI is an intimidating subject, one that might fill your head with big, scary questions.

How much is a CI tool really worth? Do you need to boil its value down to a nice, round number? Should you put on your mathematician hat and concoct an algebraic formula?

Not necessarily. Remember: By the time you’re making the case for a CI tool, you should’ve already made the case for a CI program—and, in the process, specified the objective of said program.

There’s a reason for this: Your objective determines your ROI model; it’s the lens through which you evaluate your performance. It enables you to answer the question, “Is our CI program working?”

What does this have to do with software? Well, the sole purpose of a CI tool is to help you fulfill your objective. So, when your EDM asks you about the ROI of such a tool, you don’t necessarily need to give them a nice, round number or walk them through some fancy formula—all you need to do is convince them that you will be unable to fulfill your objective without it.

Recall the tactics from the previous section. If your objective is to help your AEs win deals, use data to show that they won’t adopt battlecards unless they’re integrated into their workflows, proving that software is necessary. If your objective is to inform product strategy, use timelines to show that pattern detection is the key to anticipating competitor activity, proving that software is necessary.

Here’s the bottom line: As long as the objective of your CI program is aligned with your company’s overarching priorities, communicating the ROI of CI software should be very straightforward.

We’re here to help

Making the case for a software solution—of any kind—is no easy task.

But here’s the good news: You don’t have to do it alone. Get in touch with a member of our team today. Not only will you get a demo of the CI software tool trusted by Mastercard, Dropbox, and ZoomInfo—you’ll also get a partner who will work with you every step of the way.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking