Competitor battlecards have become a popular tool for enabling sales teams, and with good reason. Competitive analyses are more in-depth than what a salesperson needs when they encounter a competitive objection. Effective battlecards provide just enough information for a salesperson to counter those objections without getting lost in the details.

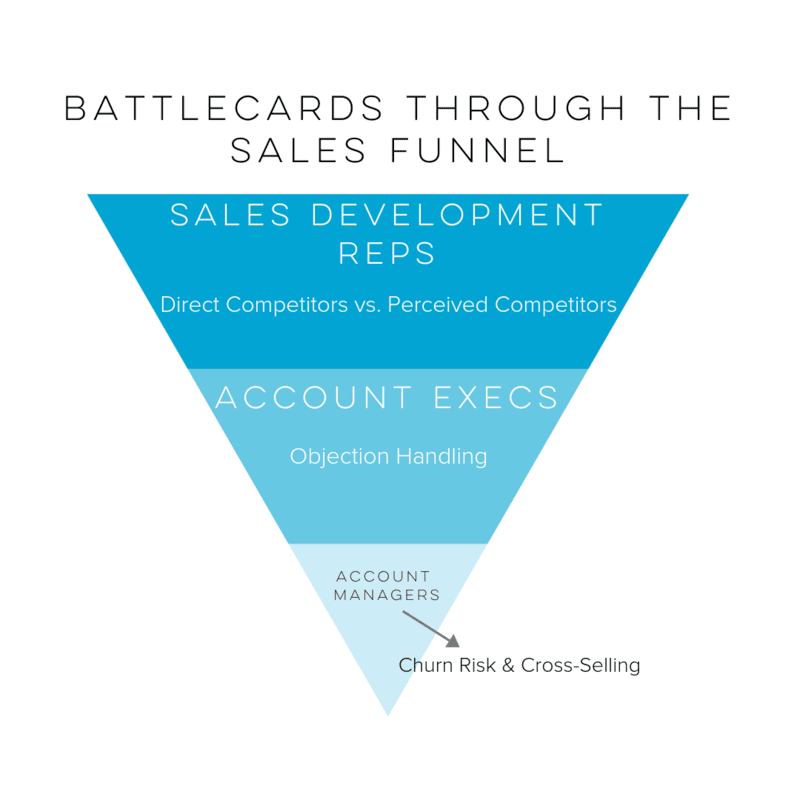

Most organizations only create battlecards designed for their closing sales team. Why should that be the case? Sales functions that occupy other parts of the sales funnel, like sales development and account management, also frequently encounter competitive scenarios. Those teams could use the battlecards created by product marketing or sales enablement, but remember: those battlecards were built for sales reps. Sales development reps and account managers require very different amounts and types of information when they face competitors.

If you’ve already created battlecards intended for your new business sales team, make some minor changes to extend their usefulness to other sales functions.

Top of Funnel: Sales Development

Sales Development Representatives (frequently called SDRs or BDRs) are at the very tip of the go-to-market iceberg. A cold call or email from a sales development rep is often the first contact a prospect has with your company. This lack of rapport means SDRs have far less time to overcome competitive hurdles than any other salespeople.

For this reason, most battlecards are useless to SDRs. While SDRs can study battlecards built for account executives and try to internalize the information they contain, the best battlecards for sales development can be used as a lifeline when competitive objections materialize during a cold call. In other words, they should be much shorter and more to-the-point.

Battlecards for Direct Competitors

The nature of your sales development battlecards depends on the type of competitor. Direct competitors are the most difficult for SDRs to overcome. They need to provide a reason to displace an existing solution, typically in under thirty seconds. Anecdotes of a customer who switched to your solution and achieved quantifiable improvements to key business metrics are best. Absent such an anecdote, a few talking points to sow doubt are the best option. You don’t need to convince the prospect to buy anything, just that exploring an alternative is worth the time. Keep tabs on online product review sites like G2 or Capterra to learn about common complaints these competitors’ customers have. These can serve as excellent pain points your SDRs can use to sow just enough doubt for prospects to consider evaluating an alternative.

Battlecards for Perceived Competitors

The second type of competitor is even more commonly encountered in sales development: perceived competitors. Prospects being cold-called often have an incomplete understanding of your solution and will attempt to dismiss SDRs on the grounds that they already have a solution they perceive to be competitive. Ask your SDR team which perceived competitors they encounter most often and come up with a brief soundbite for each that SDRs can employ to avoid such confusion.

Mid-Funnel: Account Executives

Most battlecards are made for salespeople focused on closing new business, and rightfully so. From discovery calls to contract negotiations, sales reps are bombarded by competitive objections at every stage of the sales cycle. The best battlecards for sales reps acknowledge this and provide competitive insights designed to help at every stage. There are three specific stages at which sales reps encounter competitive objections of differing natures.

Discovery Stage

The first is discovery. At this stage, competitive objections from prospects are higher level, focusing on broader functionality and a basic understanding of where solutions fit in the market. At this point, simple differentiation alone should be enough to progress to the next stages of the sales cycle. Focus on how your offering is different without delving too deep into functionality. That deeper dive should be saved for the next stage: product demos.

Demo Stage

At the demonstration stage, battlecards should focus on specific differences in functionality, services, and other key offerings. Prospects will frequently compare your offering to the competition at this stage at a granular level. An inability to succinctly explain key differences in functionality during a demo can often mean the death of a sales cycle. Intel for battlecards at this stage can be much more drawn out, as salespeople can take the time to prepare and absorb this information before a demo. That said, unanticipated competitive functionality questions can pop up mid-demo. Identifying the most common examples of these questions and creating short “lifeline” bullet points in a battlecard that salespeople can use in such a scenario makes demo-stage battlecards even more valuable.

Proposal Stage

The last stage at which salespeople need competitive information is towards the end of a sales cycle when concrete proposals go out to prospective customers. Buyers have weeded out most of the other competing vendors at this stage, leaving only an incumbent solution and/or a select few other competitors vying for the deal. Any information you can glean about the pricing and packaging terms of your competition is key here. ROI analyses are also important, especially if you know your offering is more expensive than what your competition offers. Ultimately, anything that helps salespeople make a business case for your solution will be helpful at this stage.

Bottom of Funnel: Account Management

Account managers are frequently overlooked in their need for competitive enablement. While they don’t battle competitive objections as frequently as prospect-facing salespeople, account managers frequently encounter competitors in tough renewals and upsells. When they do encounter competitors, the information they need to win is very different from what new business salespeople need. Account managers encounter competitive woes in two situations: churn risk renewals and cross-selling situations.

Churn Risk

Churn risk renewals materialize when an unhappy customer threatens to switch to a competitor. In such a scenario, an account manager is better able to assess the validity of such a threat when they understand the competitor. Effective account managers know the unique challenges and goals of each customer. When that knowledge is combined with an understanding of the weaknesses of competitive solutions, account managers can more effectively navigate difficult competitive renewal conversations.

Cross-Selling

Competitive battlecards should also be provided to account managers charged with cross-selling solutions. If you develop new products/services that complement your existing product/service, there’s a fair chance your customers are using a point-solution for what you’ve developed. Account managers attempting to cross-sell your new solution will have a much easier time displacing existing point solutions if they understand the strengths and weaknesses of those solutions.

The competitive insights in battlecards for account managers should be much more in-depth than those for account executives or SDRs. In fact, if your battlecards are derived from more complete competitive analyses, those may even be more appropriate for account managers. Since they are privy to the specific ways in which their customers use your product/service, they can have much more in-depth conversations about competitive differentiators than new business sales.

Putting just a little bit of additional work into your existing battlecards can extend their usefulness to the entire sales funnel. Competitors appear in conversations across every sales function. Make sure you’re showing every sales team some competitive enablement support!

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

.png?width=500&name=Sales%20Enablement-What%20is%20SE_%20(2).png)