Editor's note: The following blog post is based on data from the 2021 State of Competitive Intelligence Report. To get the latest insights, download the 2022 report.

As the folks here at Crayon combed through the results of our 2021 State of Competitive Intelligence Report, an exciting theme jumped out at us: Competitive intelligence (CI) programs are growing, they’re growing fast, and they’re more important to their organizations than ever before.

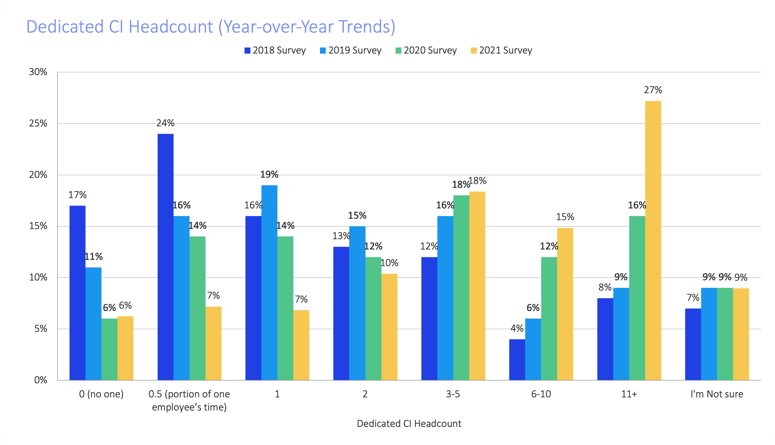

It was only a year ago that 58% of businesses told us they had CI teams of two or more dedicated professionals. Today, that figure is up to 70% — a 21% year-over-year increase in the number of businesses with CI teams of two or more people!

There is no better indication of importance within a company than the dedication of additional headcount and resources to a certain department — especially in the midst of the COVID-19 pandemic and the corresponding economic hardship. By rapidly growing their CI teams and budgets, companies are shouting from the rooftops that they know competitive intelligence to be an increasingly important investment.

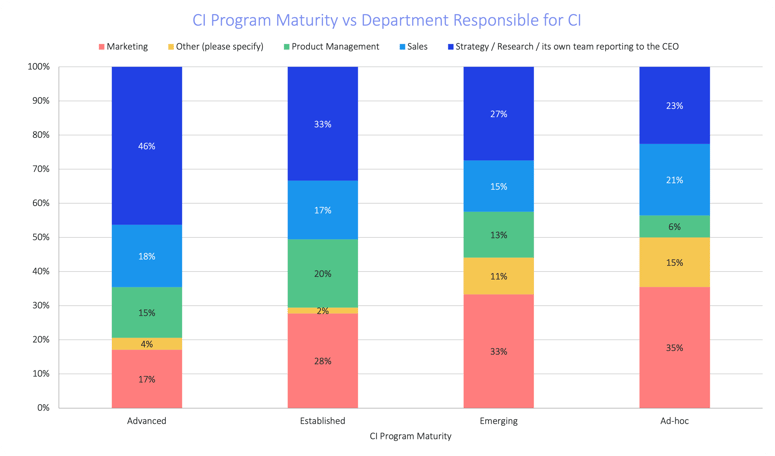

27% of businesses now report CI headcount of 11 or more, compared to just 15% last year. These are growing teams that, within their respective companies, are rising in terms of maturity and sophistication. Respondents to our survey described their CI programs on a range from “ad-hoc” to “advanced,” and when asked who their CI departments report to, it’s clear that the majority report either into marketing or directly to the CEO.

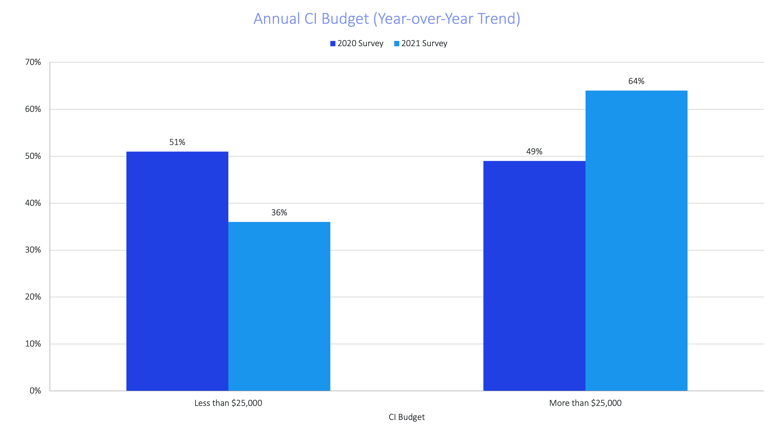

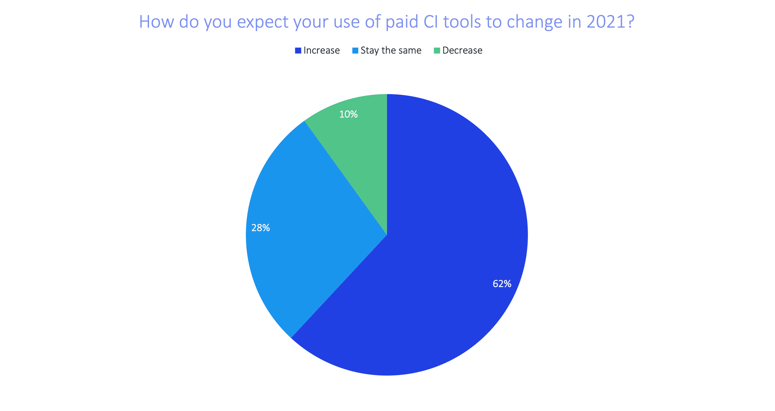

As CI teams get larger and increasingly important within their businesses, the need for reliable, detailed, and easy-to-use tools continues to grow. Not only are organizations dedicating personnel to their programs, but 64% say their annual CI budget exceeds $25,000 (compared to only 49% in 2020).

Paid competitive intelligence solutions have long been considered “nice-to-haves,” but the results of our 2021 survey are a clear indication that they are, in fact, “need-to-haves.” This year, nearly two-thirds of businesses will put additional budget towards CI solutions.

With competitive intelligence teams, budgets, and tech stacks growing rapidly, what can you do to ensure you're keeping up with the rest of your industry? Here are a few ways to stop on top of your game:

Invest in people

This almost goes without saying after reading through the stats above. Organizations are investing more into CI personnel than ever before, so if you have the resources, adding headcount is a great place to start. Whether hiring a seasoned CI veteran or a handful of eager-to-learn new hires, investing in CI professionals will get you on track for competitive success.

Invest in technology

Of course, not everyone has the ability to grow their competitive intelligence program with unlimited dollars. In fact, the majority of businesses don’t have that. But there’s no reason that should stop you from trying to compete at the highest possible level. By investing in CI technology that your team believes in and trusts, you are, in more ways than one, giving yourself another teammate. Let technology do the manual work and heavy lifting that one, two, or even three analysts would have done. Let technology be the means of activating competitive intelligence via emails, chat messages, and battlecard data.

Stay up to date on best practices

Staying in the loop with all things competitive intelligence is completely free, and doing so will enable success in an organization of any size. Whether you’re a CI beginner or a CI expert, there is always more to learn. Discover new battlecard tips, learn about key components of your competitors to keep an eye on, and more.

Take advantage of free resources

There are tons of free resources out there to help you at any level of the competitive intelligence process. Use battlecard templates, take online courses, join CI communities, and subscribe to CI blogs and newsletters. There are so many resources that can get you started, answer burning questions, or help you fine-tune your CI skills.

Educate your organization about CI

If you’re reading this, it’s safe to say competitive intelligence is important to you. But it’s also your job to make CI important to those around you. Identify the key stakeholders in your organization and learn what exactly it is they need from a great CI program. And then shout it from the rooftops. Share your favorite stats from the report, share the intel you gather, and make sure key stakeholders across your organization understand CI and its value.

Get your free copy of the 2021 State of CI Report

The world of CI is constantly shifting, and that’s never more clear than when the latest edition of the State of CI Report is published. With 2020 behind us, it’s time for organizations of all sizes to take a closer look at their competitive intelligence programs and invest in team growth, resource dedication, and a strong strategy. And make sure to download your free copy of the full 2021 report to get insights spanning all facets of competitive intelligence.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

.png?width=500&name=Sales%20Enablement-What%20is%20SE_%20(2).png)