After the digital explosion of the last 20 years, it’s easy to get overwhelmed by the staggering amount of competitive data available today. In many ways – and for many organizations – it can be easier to plant-head-firmly-in-ground than confront the problem of information overload. It’s also all too easy to index too far on the other end of the spectrum, deciding that you must process every data point to ensure that you don’t miss something important.

Finding a happy medium is key, whether you’re using a competitive intelligence (CI) platform like Crayon or not. And one vital skill is learning to identify the less obvious signals that could have the most impact on your organization and building process around them.

No Signal, Strong Signal, Weak Signal

The word “signal” carries the connotation of incomplete information, and in the world of competitive intelligence, we often swim in very fluid seas. The classic iceberg metaphor fits nicely with knowledge about competitive moves. Of course, the worst position is to ignore all potential competitive information, whether from arrogance or lack of time. You may make many trans-Atlantic trips without incident, but eventually, some other company is going to tear a hole in your hull.

On the other end of the spectrum are the most obvious signals that sit above the water line, like press releases, news stories, and other prepared public moves by a competitor. Depending on the asset itself, one might even argue that it isn't a signal at all, but more of a complete truth; however, in most cases, there is some degree of varnish to such discussions that needs parsing. Moreover, what that data point reveals about the competitor’s strategy and internal discussion is open for debate, so it is best to think of them as signals.

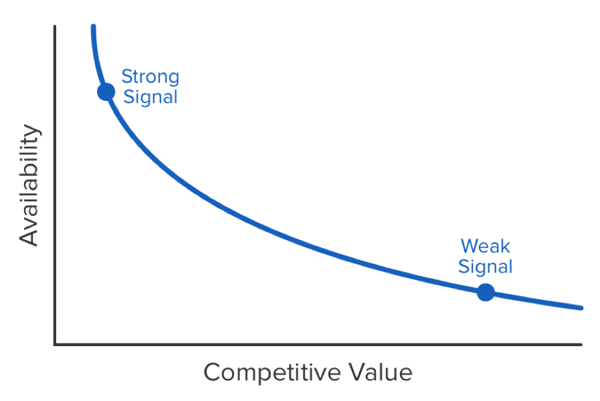

Regardless, the weakness of these very apparent “strong signals” is that they are equally available and apparent to all observers, so much so that many companies have teams dedicated to combing through press releases and web pages finely for any unintentional tells that competitors might see. Certainly, news stories have the potential to reveal more thanks to probing from a curious reporter or an under-coached executive. But generally speaking, if you know to look out for these in your shipping lanes, so does everyone else in your space and thus the value of the intel rapidly becomes commoditized in your market.

Naturally, there must be a higher value cousin: the “weak signal” that lurks below the surface but has enormous weight. Not only is it harder to find, but it is also hard to know when you have found it because you may or may not know its validity. You may not even be sure that it is a signal, in fact, and separating no signal from the weak signal can leave you feeling like you’re chasing your tail at times. But its value to your company is higher because it is not immediately visible to everyone in your market space, and thus can provide a strategic or tactical advantage to just your company.

The prevailing wisdom in the competitive intelligence community is that such powerful, proprietary weak signals must come from primary research. While talking to customers, partners, prospects, and other market players can yield great leads, there are plenty of weak signals that appear in the publicly available online properties of competitors. A few quick examples:

- Discussions of pricing, packaging, discounting, and promotions in online forums

- Comments about products, features, capabilities (or the lack of them) in reviews

- Negative and positive employee comments on hiring review sites

Even on the corporate website – arguably the most commoditized source for competitive intelligence for those keeping a close eye – seemingly tiny ice floes sometimes have great mass beneath the surface. Consider a few provocative examples:

- An update to a site's terms and conditions might signal a major advance in security standards or indicate new target audiences

- Dropping the single word "our" from the headline on a page might reveal a move to outsource key operational processes or physical infrastructure

- An update to a skill or responsibility in a job posting might tip the hand on an evolution of technology architecture or betray challenges staffing important functional areas.

- The launch of a new media page could precede a major marketing campaign or even presage major financial events like an IPO, acquisition, or private funding

- An obscure event added to the company calendar might suggest an aspirational business segment or foreshadow a new vertical solution line

The list only expands from there, but it’s hard to know just how big the ice is beneath the surface. The advantage of early knowledge is enormous, and the absence of it risks putting your company into a reactive position without your ever knowing it. So how do you tell an ice cube from an iceberg?

Moving from Hypothesis to Action

In order to know the weight of a weak signal, you have to move beyond that one data point and begin to look for other signals that confirm, dislodge, or reframe your first hypothesis. You must approach your work much like a detective would, collecting the evidence that creates a clear narrative.

One of the first things that detectives do is to seek out other sources that confirm their hypotheses, and the CI professional needs to do the same. You should pursue both primary and secondary research sources so that you cast as wide a net as possible. Whether you’re monitoring your competitors’ online properties manually or with a dedicated solution, your hypotheses from weak signals now provide powerful lenses for new updates. And like a detective, you can develop your pool of confidential informants to help with verification. Your most trusted customers who might get pitches from competitors can give you valuable intel. Your sales team can be seeded with questions to ask or topics to explore right from an updated battlecard, although it is worth fostering special relationships with top performers who can reach out to their best accounts directly.

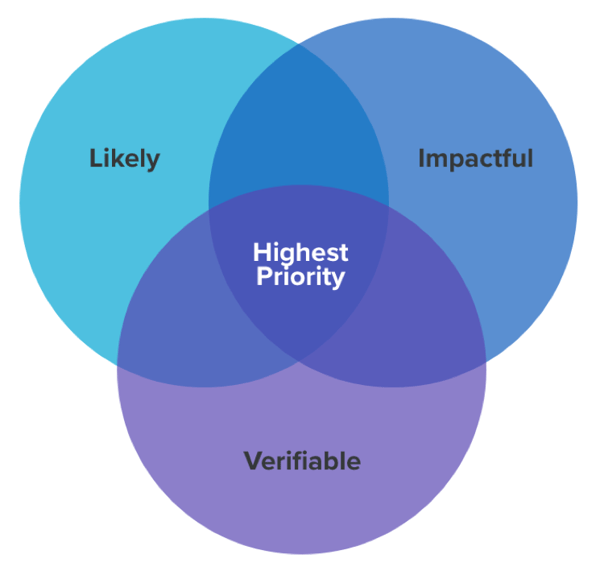

As the number of hypotheses you’re developing grows, you will want to consider how to prioritize your limited time to those most likely to deliver actionable intelligence. The three filters that can help hone your focus are:

- Likelihood: Based on your knowledge of your competitors’ business and historical moves, how likely is this hypothesis? Is it in character with previous actions? Does it address known gaps in product, go-to-market, or other strategic areas? Is there new management or other developments that might make out-of-character moves more likely?

- Impact: Shifting focus to your business and your personal prioritization, how much would the hypothesis impact your organization? Can you model out the ramifications on your business that would result if your hunch proves true? How much time would your organization need to adjust to such a change in the market?

- Verifiability: From a more objective perspective, to what degree can you verify the predicted competitive move? What other types of evidence might you obtain, and how realistic is it that you could obtain them?

With a realistic sense of the likelihood, impact, and verifiability of your hypothesis, you can then start amassing other signals that might strengthen your hypothesis. Whether you perform extensive research on a topic or wait for updates to inform your work will likely depend upon how fresh the development is and how fast your market is evolving. With some honest appraisal and consistent tracking, you and your team can create a plan to turn weak signals into your competitive advantage.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking