Competitive intelligence is only as good as what it yields: better preparedness, happier customers, stronger revenue growth, and so on. In order to yield these results, you need to activate the intel that you gather—you need to get it into the hands of your colleagues.

To that end, this blog post is all about the folks who use competitive intelligence:

- Product managers

- Marketers

- Sales reps

- Executive leaders

Let’s begin!

1. Product managers

Product managers use intel to determine what to build.

As a simplification, let’s say our product team is solidifying near-term roadmap priorities and they need to focus on either Feature A or Feature B. Each has the potential to improve our customers’ lives, but whereas several competitors provide the former, zero competitors provide the latter—for now.

So, our product team can either:

- Prioritize Feature A, thus improving our customers’ lives, or

- Prioritize Feature B, thus improving our customers’ lives and beating our competitors to market with cutting-edge functionality

Thanks to our real-time knowledge of the inner workings of our competitors’ products, what may have been an excruciating decision-making process just got a whole lot easier.

So, how do you activate intel for your product team? It’s a tricky question—as you may know, many PMs like to conduct their own competitive research. In order to figure out what will work best for your particular colleagues, you’ll first need to chat with them and get a sense of what they’re already doing and how they feel about their existing CI workflows.

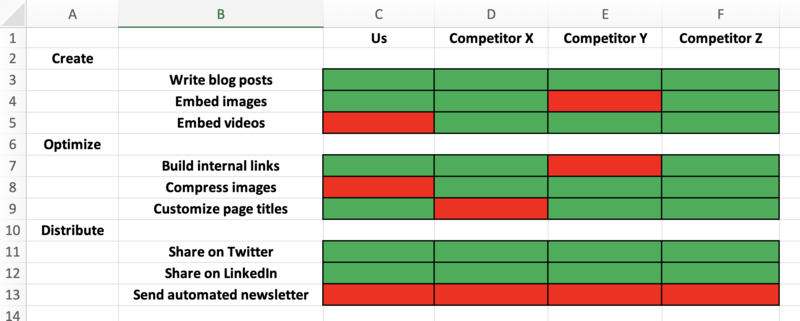

In general, however, a feature comparison matrix is a safe bet:

Provided that it’s always up-to-date, a matrix like the one you see above gives your product team an at-a-glance perspective of the competitive landscape—perspective that, as we’ve shown, proves invaluable when it comes time to make decisions.

To learn how to build a feature comparison matrix (and other competitive matrices) in Microsoft Excel, check out this blog post.

2. Marketers

Like PMs, marketers use intel to identify opportunities for differentiation.

Frankly, writing about marketers and CI is difficult. As you know, even on a mid-sized marketing team, there’s a wide range of specializations: content marketers, email marketers, search marketers, social media marketers, and, of course, product marketers—just to name a few!

There are specific tactics that you can employ to meet the unique needs of different specializations, but that’s beyond the scope of this post.

For now, we’re interested in the value that CI can deliver to a marketing team as a whole. As it turns out, the key to understanding this value—the key to activating intel for your fellow marketers—lay in a single question (technically four questions that we’ve crammed into one):

Who says what where, and how is all of this changing over time?

With the help of data visualizations—which are tremendous activation assets—let’s briefly walk through our four-part mega-question.

Who is driving the conversation in your market?

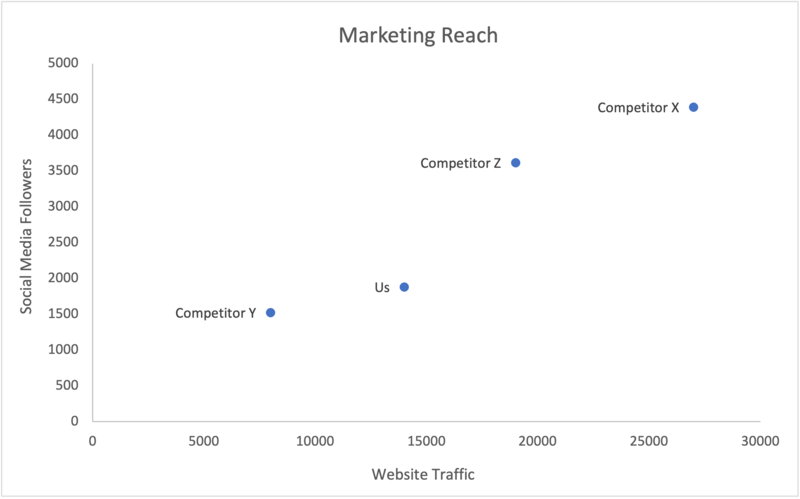

Take a look at this scatterplot, which measures website traffic on the X axis and social media followers on the Y axis:

Right away, we can see that Competitors X and Z are the conversation leaders in our (relatively uncrowded) market. This will become more meaningful in a moment.

What is the conversation about?

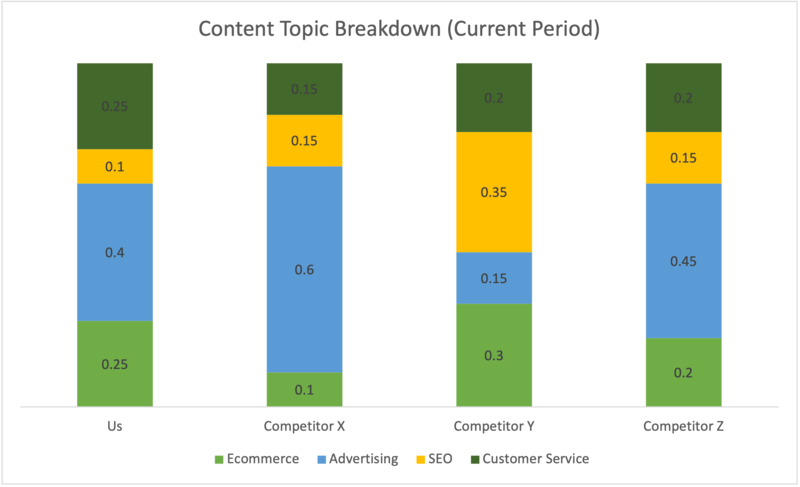

Here we have a stacked column chart, which shows us how often—or how seldom—each company in our market (including our own) discusses a handful of key topics:

Competitors X and Z, the conversation leaders, are saturating the market with advertising-related content, which means that we have an opportunity to differentiate by capitalizing on the whitespace—i.e., the relative scarcity of ecommerce-related content, SEO-related content, and so on.

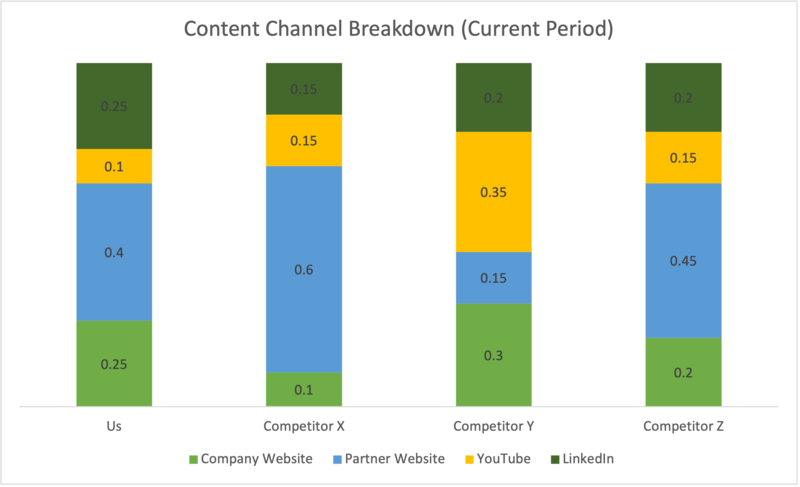

Where is the conversation taking place?

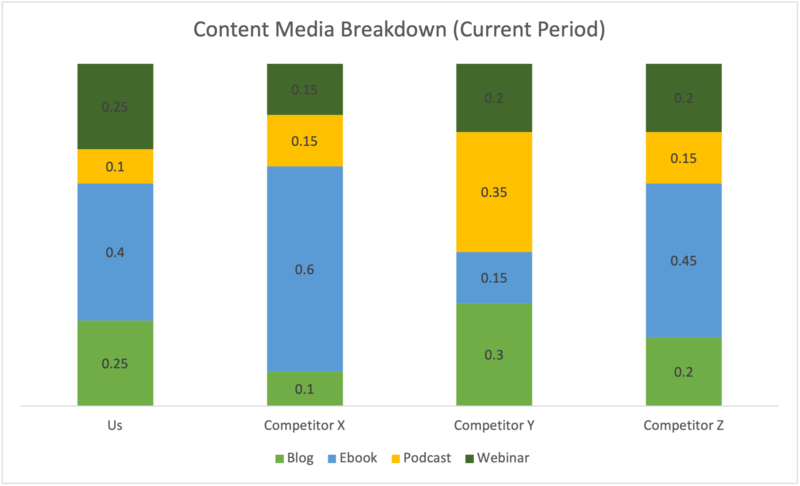

Once again, we’ve got a stacked column chart—but this time, rather than breaking down topics, we’re breaking down media:

Because Competitors X and Z tend to publish their content in the form of ebooks, we can further differentiate from them by leaning into blog posts, podcasts, and/or webinars. If you’d like, you can tweak this part of your analysis to focus not on media but instead on channels:

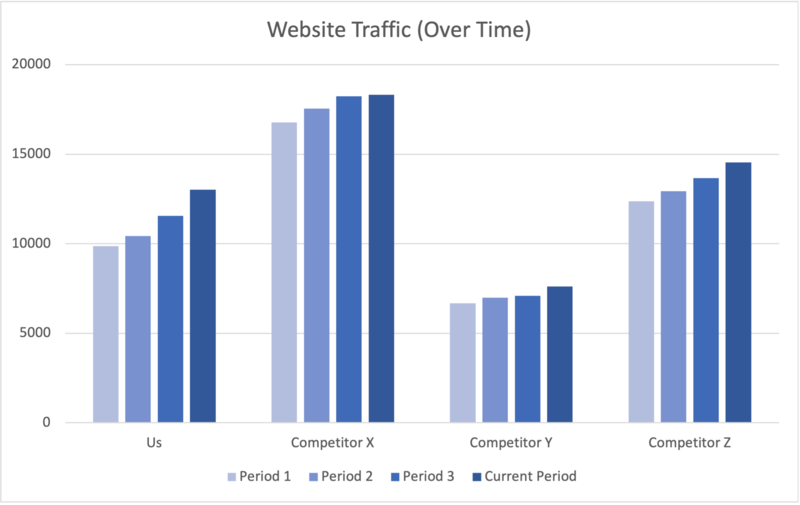

How is all of this changing over time?

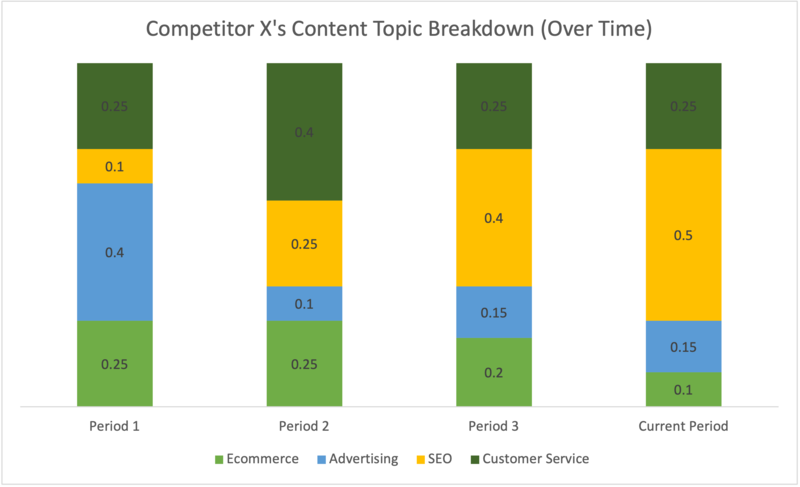

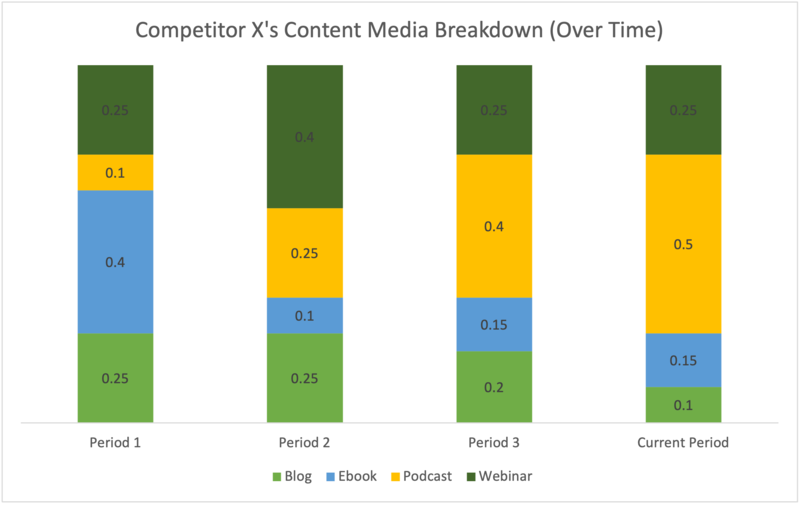

The final piece of activating intel for your fellow marketers is illustrating trends over time. How is leadership of the conversation changing over time? How is each competitor’s strategy—in terms of topics and media—changing over time?

A visualization like this one helps to answer our first question:

And visualizations like these help to answer our second question:

So, there you have it: Who says what where, and how is all of this changing over time? When you break it down piece by piece, it’s actually a very straightforward question—but one that, in order to answer properly, requires quite a bit of data (and a touch of Excel experience).

Also, keep in mind that the whole point of activation is to inspire your colleagues—to help them make decisions and take action in a confident and efficient manner. So, if your analysis leads to paralysis, then you’re not really doing your job as a practitioner of competitive intelligence.

When you’re activating intel for your fellow marketers, consider grounding your analysis with a handful of bottom-line takeaways—maybe even a recommendation or two. This way, your colleagues will walk away feeling not only like they learned something, but like they learned something that they can act on.

3. Sales reps

PMs and marketers use intel to make decisions. What should we build? What should we say?

With sales reps, it’s a different story. It’s not about decisions—it’s about moments. Like the moments before a demo with a prospect who’s evaluating your competitor. Or, in the midst of that demo, the moments immediately after the prospect mentions a feature that your competitor offers and that you don’t. Or how about the moments after that demo, when the prospect says they prefer your product and asks for help in justifying that preference to their boss?

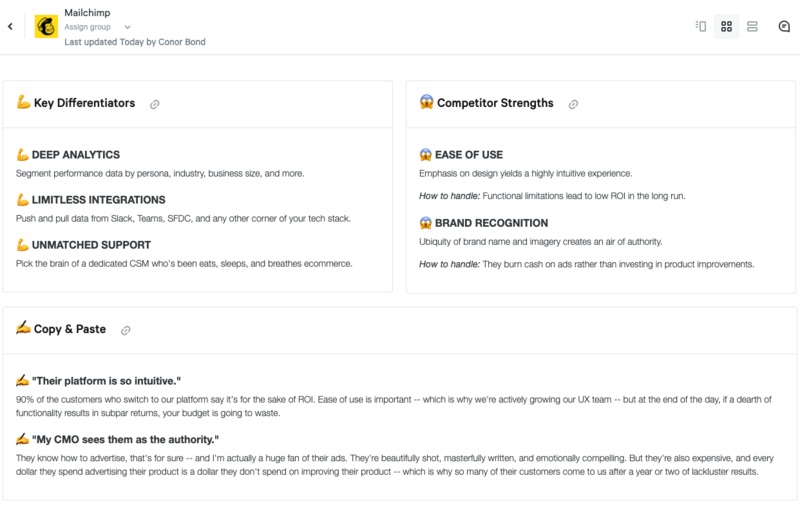

Moments like these can make or break a competitive deal, and in order to help your sales reps stay cool in these moments, you can create battlecards like this one:

To be clear, what you see above is an oversimplification; most of the battlecards you end up creating will likely contain more than three tiles. In this example, we’ve limited ourselves to these three tiles because (1) you don’t have all day and (2) each one is optimized for a specific scenario:

-

-

- The key differentiators tile helps sales reps with pre-call preparation

- The competitor strengths tile helps them stay cool on the phones whenever prospects bring up functionality where our product is relatively weak (or perhaps useless)

- The copy & paste tile helps them respond effectively whenever prospects send emails with competitive questions, claims, and/or requests

-

For a deep dive into battlecard content and best practices, check out this blog post. In the meantime, you get the gist: Sales reps need intel in order to navigate the moments that make or break competitive deals, and battlecards are the best way to address that need.

4. Executive leaders

Like PMs and marketers, executive leaders use intel to make decisions.

Should we break into this adjacent market or that adjacent market? Should we add a team of engineers to build this new product, or should we acquire one of these startups? Should we contract with an outbound sales agency, or should we double down on paid advertising?

Your exec team faces questions like these each and every day, and the cost of a misstep can be extraordinary. As you can imagine, the purpose of competitive intelligence—from an executive POV—is to reduce the likelihood of a costly misstep.

As an example, let’s say your exec team passes on an acquisition opportunity and decides to add a team of engineers who will build a product similar to that of the almost-acquired startup. Three months later, with your new engineering team still two quarters away from an MVP, your top competitor launches their version of the same product.

Had anyone been paying attention to this competitor, it would’ve been obvious that this launch was on the horizon, and your exec team could’ve beaten them to the punch with an acquisition. Alas, no one was paying attention, and now you’re playing from behind.

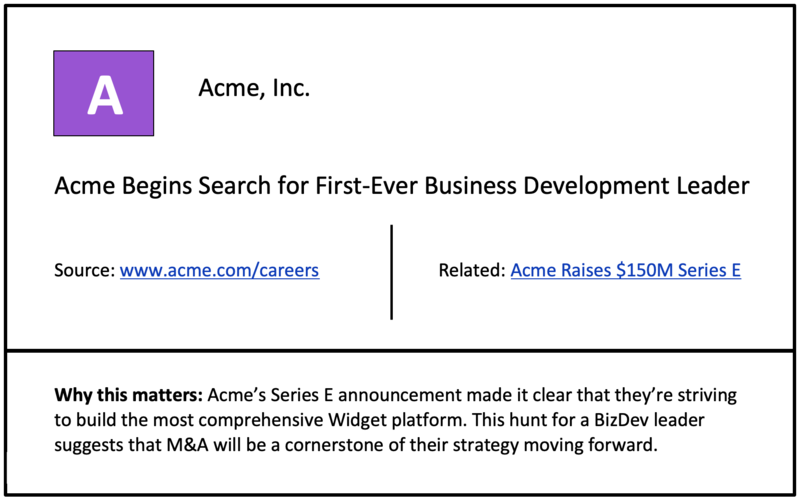

The best way to avoid this sort of nightmare scenario is with a weekly CI newsletter, a round-up of alerts that look something like this:

By far the most important part of activating intel for executives is why this matters—your attempt at connecting the dots between related pieces of information in order to tell a story. It’s through this storytelling that your exec team maintains the real-time competitive perspective they need in order to consistently make the right decisions.

And by the way, everyone—not just executives—benefits from this real-time perspective; ideally, your CI newsletter is a company-wide deliverable. We’re only presenting it as an executive deliverable because its concise and modular formatting makes it perfect for busy stakeholders.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking