Many businesses struggle with measuring the impact of competitive intelligence. In fact, less than half of businesses have established key performance indicators (KPIs) for CI. The 52% of companies that either have no KPIs or are in the process of developing them would be wise to include not just the delivery of competitive intelligence but measurement into their program plans.

Perceived Value of Competitive Intelligence is Sky High

This year in the 2019 State of Competitive Intelligence report we explored how organizations consider the value of CI. One of the most striking discoveries was ironically not at all striking: there was near universal agreement about the power of competitive intelligence:

-

91% saw quantitative benefits from their CI program

-

95% saw qualitative benefits

-

93% took strategic actions based on it

-

92% took tactical actions

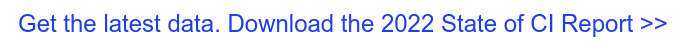

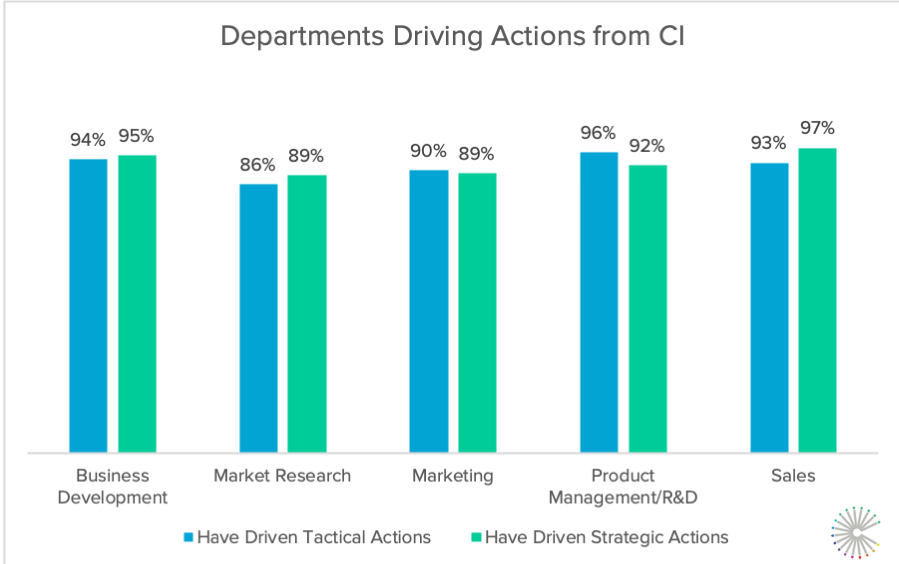

Not only was the perception of value high across the board, but it was similarly high across functional areas and levels of responsibility within organizations.

With none of the key stakeholders falling below 86% and most falling in the top decile, organizations across the board recognize value from the time and effort that they invest in tracking their markets and competitors.

Realized Value is Comparatively Low

Though competitive intelligence has incredibly high perceived value, many of the respondents had trouble identifying the specific areas of impact. When asked to identify areas of direct impact in their organizations, smaller proportions of respondents – less than 53% – saw impacts on key metrics like increased revenues, opportunities, leads, and customer retention.

A probable explanation for this discrepancy could lie in other metrics that those surveyed had in mind as they assessed quantitative and qualitative benefits. Another could simply be the lack of visibility into the metrics themselves, as well as the challenge of linking specific successes directly back to competitive intelligence that might have had an impact.

Since organizations struggle with measuring the direct impact but intuitively know there has been an impact, here are some ideas for bridging that gap.

Impactful Ideas for Achieving CI Value

In the “Results from CI” section of the State of CI, other factors that increased revenues through competitive intelligence emerged from the survey data. Here are three ways to drive value from your competitive intelligence program.

1. Set Attainable Milestones

To drive revenue, one of the most powerful determinants is within reach of any organization: setting goals and tracking key performance indicators (KPIs) generated nearly a 30-point swing over companies with no plans or desires to create a plan. It makes sense because having those expectations in place enforces accountability that requires organized and consistent thinking.

Last year’s report suggested similar advice, and you might benefit from exploring some key metrics that product marketing thought leaders recommend, even if you’re not in product marketing yourself. Regardless, it is worth noting that achieving great results doesn’t require a bevy of well architected and interwoven KPIs. Just having them as a milestone is a great place to start.

Thinking about how you’ll measure success carries substantial benefit. The process of stepping back from the day-to-day busy work to assess what is working and what isn’t can yield significant insights. You could even adapt proven methodologies like Agile or Design Thinking that create structure around your thinking and demand iteration for improvement.

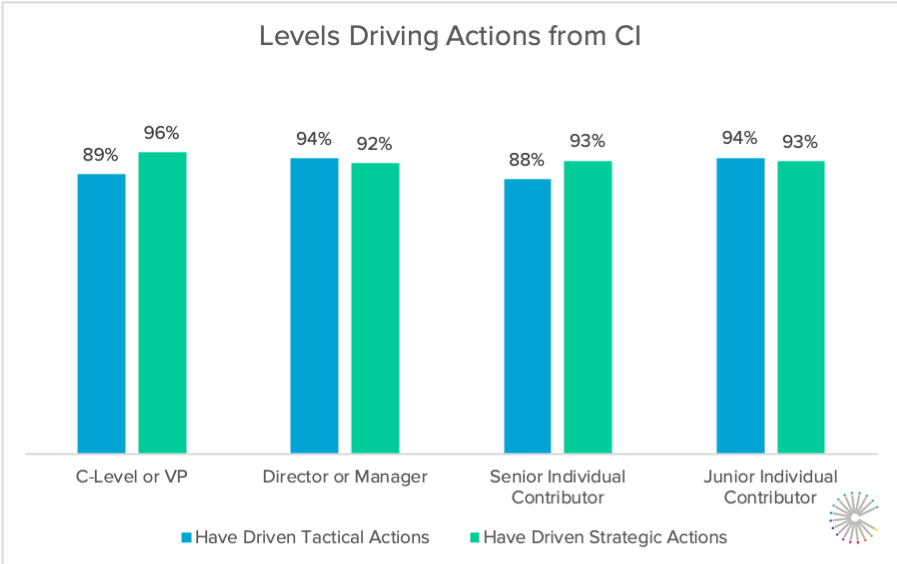

2. Communicate Intel More Frequently

We saw compelling evidence that frequently getting the latest competitive analysis in front of your CI stakeholders will increase revenues.

CI can be lonely work, and when you’re sending information out into the void, the lack of feedback can hamper your motivation to produce more. Don’t let this common occurrence hold you back; keep publishing and try harder to engage with your end-consumers. Go beyond sharing expertise and start to think about CI as internal marketing campaigns. You’ll be surprised how losing the chip on your shoulder and approaching it from a traditional marketer’s POV will transform your expectations that you “deserve” to be read by your audiences. Then you can focus on earning their attention.

A second temptation involves being too precious with your products. It is understandable that you want to get your analysis just right before you put it out for public consumption. But in today’s ever-changing competitive landscape, waiting will only ensure that your “final” product will be immediately out-of-date. The alternative is to launch with less and encourage a conversation with your stakeholders about its quality, their needs, and any different information that they hear in the field. Returning to the theme of running a campaign, why not include CTAs in your deliverables that encourage your stakeholders to respond to the material and interact with you? Regardless, the more you can build the realistic expectation that the intel and the analysis are going to change, the more you can engage your audience in your joint competitive project.

3. Think Like a Bigger Company With a More Mature Program

Two new insights that emerged from the 2019 report were improvements in revenue creation for CI programs at larger companies and programs that have been around longer. At first blush, there seems little within your control since you can’t really grow or age your company artificially.

However, you might answer such a doubt by asking how you might bend the curve on these axes. For instance, how do you artificially accelerate your program’s maturity? You might seek out mentors or peer groups at more established firms who can help you refine your methodology and learn best practices. Since one of the hallmarks of larger CI teams is greater goal orientation, focus your interviews on what goals that might apply in your business and market so that you can apply them immediately.

4. Plan to Measure Impact

In talking with many CI professionals, so many want to measure the impact of their work but find it challenging to take the time away from their daily grind to create the structure and systems to do so. Ironically, the high value explored above creates a barrier to proving that value more concretely – why take the time when you’re already delivering value?

But you know the potential is enormous. Using competitive intelligence systematically across your business would revolutionize how it operates and what it could achieve. In order to reach this promised land, you have to evangelize CI, and the stories that will get your colleagues’ attention are tangible big wins with concrete numbers like revenue gains. So measuring win/loss rates against competitors is a natural place to start this initiative.

Even with minimal visibility, you can calculate an approximate economic value:

(average deal size) (total competitive deals) (win rate against competition) = Competitive Revenue Won

With more sophisticated reporting from your CRM, this number becomes a baseline instead of an approximation. Improving the visibility and validity of key metrics can serve as a key objective no matter the maturity of your CI program.

In nascent programs, you could work with sales leadership to track competition in deals more comprehensively. In a developing program that has competitive deal information, the focus moves to monitoring increases in competitive revenue won over time. With a more granular understanding of the impact on win rates and revenue, a mature program can shift into determining which salespeople and deals have benefited from CI, for instance by tracking interaction with sales battlecards and other deliverables.

Along the way, look for opportunities to communicate your successes and invite more participation as part of your internal evangelization. Lead with your discoveries and latest information to build excitement, communicate your next goal, and look for ways to involve your stakeholders in reaching it.

It’s valuable to step back from your research and analysis to think holistically about how you want to measure your CI program. Identify some initial goals around measurement that fit your needs, put your plan in action, include time to evaluate, and expect to iterate.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking