Imagine you lead the intelligence function at a CRM software company. One day, you notice that your closest competitor has recently published a couple blog posts about contracts and document management—which is out of the ordinary for them.

The first explanation that comes to your mind is, “They’re building an esignature solution.” And that could absolutely be the case! That’s a perfectly plausible explanation.

But it’s not the only explanation, is it?

Given what you know at this point, it’s equally valid to conclude that your competitor is not building a solution, but rather acquiring one. Or maybe they’re getting ready to announce an integration or partnership. Or maybe they’re simply trying to grow their website traffic by ranking for a new group of keywords.

So—you’ve got four different explanations of what’s going on. Each of them is valid. And each of them demands a different proactive response from your company. And the clock is ticking.

Where do you go from here? How do you determine which explanation is most likely to be the truth? One option is to use a technique called analysis of competing hypotheses.

How to use analysis of competing hypotheses (ACH) to predict & prepare for your competitor’s next big move

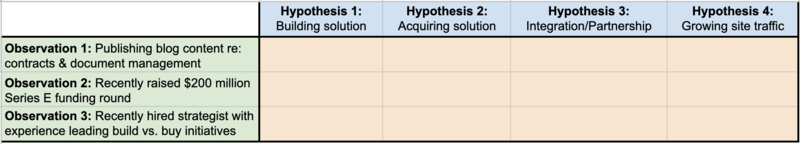

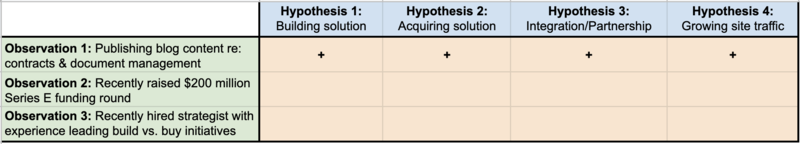

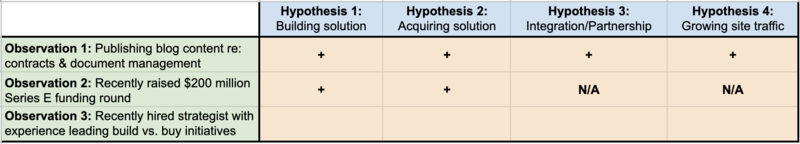

At the core of ACH is a simple matrix like the one you see below, where each column is one of your hypotheses and each row is a relevant observation or piece of intelligence.

For the sake of the example, let’s assume that after you came up with the four hypotheses—more on this process later—you went out and found two more relevant pieces of intel in addition to the blog content: (1) six months ago, your competitor raised $200 million in Series E funding; (2) not long after the announcement of their Series E round, they hired a strategist with experience leading build vs. buy initiatives.

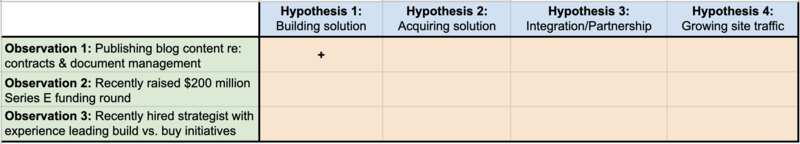

To use the matrix, start with the first piece of intel. Ask yourself: If we knew for a fact that our competitor was building an esignature solution, would we expect them to publish content about document management? The answer is yes, so we’ll put a plus sign in the corresponding cell:

Next: If we knew for a fact that our competitor was acquiring an esignature solution, would we expect them to publish content about document management? Yes, we would. Add a plus sign:

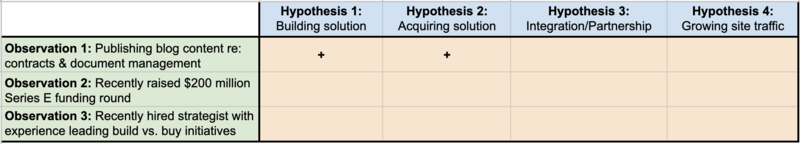

How about if they were creating an integration or partnership? Yes—in that case, we’d expect them to publish this content. And the same would be true if they were simply trying to grow their website traffic. Add two more plus signs:

So it turns out that your first observation, the blog content, supports all four hypotheses. I know we already knew this—that this observation supports all four hypotheses is precisely why you’re doing this exercise in the first place—but I wanted to make sure you saw the visual of a single row with nothing but plus signs.

When you use ACH for real and see a single row with nothing but plus signs, that tells you that this particular piece of intel is not going to get you any closer to the truth—so it’s time to move on to the next observation.

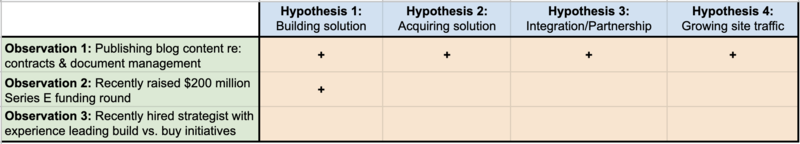

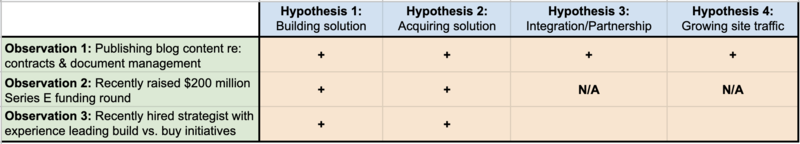

Ask yourself: If we knew for a fact that our competitor was building an esignature solution, would we expect them to use financial capital? Yes—you need money to do R&D, hire engineers, and so on. Add a plus sign:

Obviously, if you knew for a fact that your competitor was making an acquisition, you would expect them to use financial capital. Add another plus sign:

Here’s where things get interesting. If you knew for a fact that your competitor was creating an integration or partnership, would you expect them to use financial capital? Not necessarily. An initiative like that certainly requires time and energy, but not the kind of money you need to build a product from scratch or acquire a company. Therefore, the $200M Series E is not applicable to the integration/partnership hypothesis:

Using the same logic, it’s not applicable to the website traffic hypothesis either:

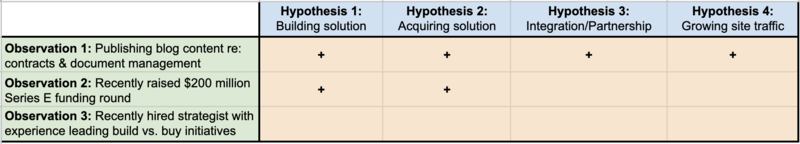

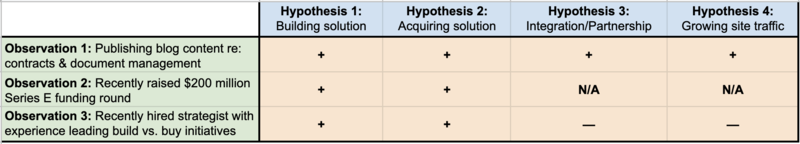

One more observation to assess! If your competitor were building something that they could just as easily buy, would you expect them to hire someone with experience leading build vs. buy initiatives? Absolutely. And the same would be true if they were buying something that they could just as easily build. Add two plus signs:

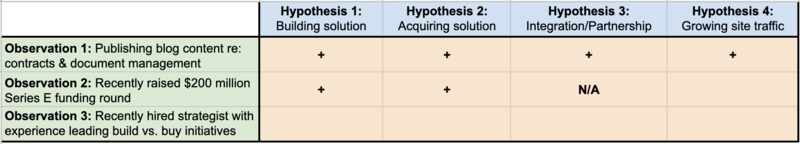

Because the hiring of this strategist seems to outright undermine our third and fourth hypotheses, we’re going to fill in the last two cells with minus signs:

Well done! Using ACH, you’ve narrowed it down to the two most plausible hypotheses: Given what you know at this point, it seems likely that your competitor is either building or acquiring an esignature solution.

Creating early warning systems for your remaining hypotheses

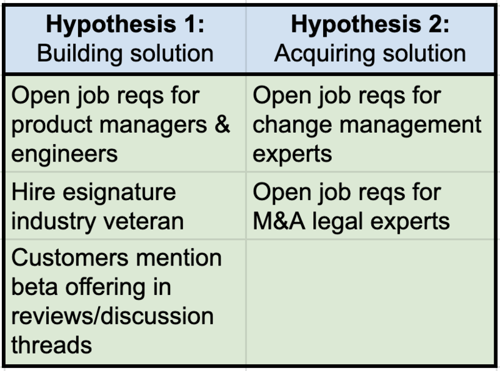

From here, your next step is to ask yourself a slightly different version of the question you’ve been asking yourself this whole time: If it’s true that your competitor is building a solution, what else can you expect to observe going forward? Alternatively, if it’s true that your competitor is acquiring a solution, what else can you expect to observe going forward?

I suggest answering these questions using a T diagram:

This diagram, simple though it may be, is a very powerful tool known as an early warning system. If one or more of the items listed on the left-hand side actually occurs, you can safely assume that your first hypothesis is correct: Your competitor is building a solution. If one or more of the items on the right-hand side actually occurs, go with your second hypothesis.

Your next step: Take your ACH matrix and T diagram to your senior stakeholders in sales, marketing, product, and customer success and bring them up to speed. Show them how you narrowed it down to the two most likely scenarios and tell them what you’re looking out for moving forward. Then, start working with them on contingency plans.

Until you catch wind of a silver bullet piece of intel—like a beta offering (hypothesis 1) or a change manager job req (hypothesis 2)—you’ll need to prepare your internal teams for both the build scenario and the acquisition scenario. Worst case, you learn the truth along with everyone else in the world when the big event actually happens, but as far as worse case scenarios go, that’s a pretty good one—because no matter what, you’ve already done the prep work.

So that, in a nutshell, is analysis of competing hypotheses—a simple yet powerful way to:

- Keep yourself from jumping to the first conclusion that comes to mind,

- Identify gaps in your intelligence and create an early warning system, and

- Ensure that when you go to your stakeholders with a prediction (or two competing predictions), you’re able to show your thought process and defend your work.

Now, there’s one last question we need to address.

What if you hadn’t considered the acquisition hypothesis?

For the sake of our ACH example, we assumed that you had thought of every plausible explanation—but what if you hadn’t considered the acquisition hypothesis? In that case, the ACH matrix would’ve led you to the conclusion that your competitor was building a solution.

And what if that had been the wrong conclusion? You would’ve worked with your senior stakeholders to prepare for a product launch, only to get blindsided by an acquisition.

It’s true: For ACH to work, you need to consider every explanation for what you’re observing. The best way to do that is to loop in your most trusted colleagues as soon as you realize that your competitor is up to something. Brainstorm hypotheses with them until you’re confident that you’ve collectively thought of everything. From there, you should have what you need to start looking for relevant pieces of intel and filling out the left-hand part of your matrix.

To recap, here’s the step-by-step process you should follow as soon as you realize that your competitor is up to something:

- Brainstorm hypotheses with your most trusted colleagues.

- With your hypotheses in mind, search for relevant pieces of information. Focus your search by asking, “If X were true, what would I expect this competitor to do?”

- Fill out your matrix using the process outlined above.

- If Step 3 does not lead you to a single plausible hypothesis, look at each of your remaining hypotheses and ask yourself, “If this is true, what else can we expect to observe?” Create an early warning diagram.

- Use your matrix and your early warning diagram to bring your senior stakeholders up to speed. Work with them on contingency plans.

- Keep your eye out for the silver bullets outlined in your T diagram. And remember: Even if you don’t see any of them, you’ve already put your company in an excellent position.

Happy analyzing!

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking