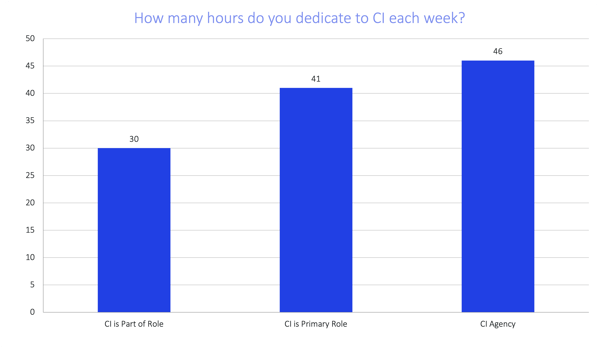

The Competitive Intelligence (CI) process can be time-consuming. Whether or not you’re a full-time CI professional, researching, analyzing, and communicating competitive intelligence information can take up the majority of your time. In fact, our State of Competitive Intelligence Report found that CI pros spend the majority of their workweek on this process alone - an average of 39 hours, to be exact. Even for those who consider competitive intelligence to be a part of their role, they still reported spending 30 hours per week on CI.

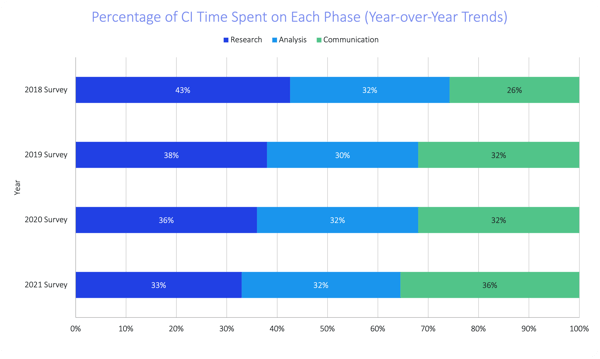

The CI process can be broken down into three main pieces: research, analysis, and communication. Over the last couple of years, the time dedicated to each section has shifted slightly. In 2018, it was clear that people were spending more time in the research phase (43%), followed by analysis (32%), with the least amount of time (26%) dedicated to communication. As time has gone on, the three sections are becoming more of an even split, with the amount of time breakdown being 33% research, 32% analysis, and 36% communication.

It’s clear that professionals are shifting more of their focus to the communication stage. This is potentially due to the fact that their research and analysis processes have become largely automated rather than manual. Now that automation is making the research and analysis stages easier, CI pros are able to focus on getting those insights to their key stakeholders. Making sure that key stakeholders are armed with timely and relevant intelligence is one of the most critical outputs of CI.

Who Should You Share Intel With?

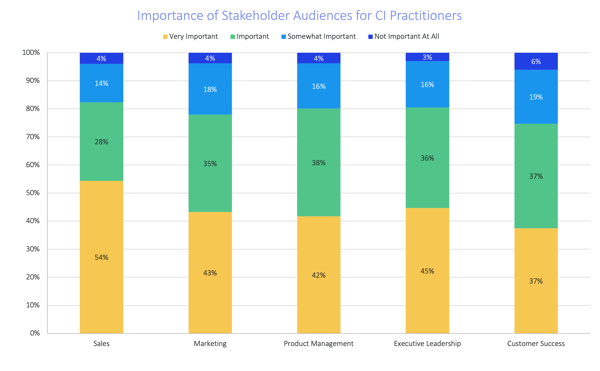

Researching and analyzing competitive intel won’t benefit your business if you have no one to share your findings with. When it comes to sharing competitive intelligence data, there are numerous people that you could include. Based on our report, the most common stakeholder receiving competitive intelligence data is Executive Leadership, followed by Sales, and Marketing.

How Often Should You Share CI?

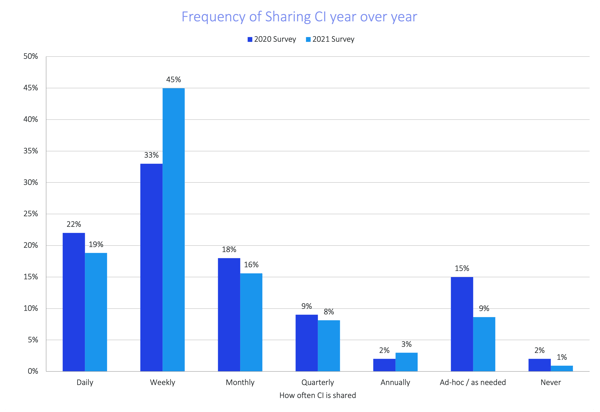

Our most recent State of Competitive Intelligence report found that 57% of businesses update their CI resources on a daily or weekly basis, which is 30% higher than the rate from our previous report. This means that more companies are keeping their competitive intelligence deliverables more up-to-date than ever before.

Mirroring the update frequency is the sharing frequency. The top two time periods for sharing competitive intelligence data are weekly (45%) and daily (19%). In our previous report, we found that the frequency of sharing CI was correlated with the likelihood of seeing revenue increases. So, it’s no surprise that businesses are updating and sharing out fresh intel to their teams more frequently than ever.

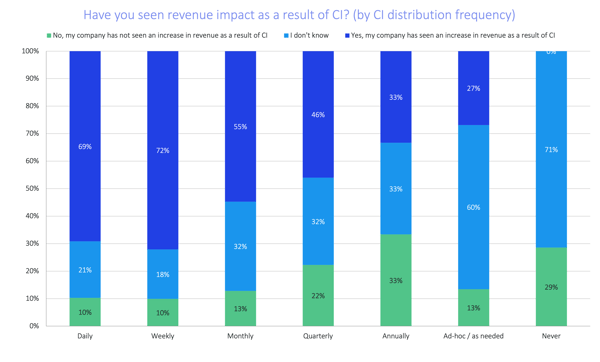

Diving even deeper into the connection between sharing competitive intelligence data and revenue increase, this year's report found that those who are sharing their intel daily or weekly have seen an increase in revenue. 69% of companies who share intel daily, and 72% of companies who share intel weekly have seen an increase in revenue.

What Methods Should You Use to Share CI?

There are many methods in which you can share competitive intelligence data. The most common types of communication reported this year are

- Meetings

- Sales Enablement Platform

- Slack/Chat

- Wiki/Intranet

- CI Platform

- CRM

- None

Top 6 Competitive Intelligence Outputs

While there are many types of outputs to share competitive intelligence with your team, there are six deliverables that rise above the rest. Not only are these the most common, but they also resonate with the stakeholders who are most commonly high priority for receiving CI. With executives being at the top of the stakeholder list, it makes sense that the top deliverables cater to that audience, followed by materials that are beneficial for sales, marketing, and product.

- Competitor Profiles

- Competitive Landscape Reports

- Executive Slide Decks

- Battlecards

- Sales Slide Decks

- Product Sheets

Over the last few years, Competitive Intelligence has evolved, and is now a critical piece of every business strategy. Through our State of Competitive Intelligence report, we found that the most common methods of sharing competitive intelligence haven’t proven to be the most impactful on revenue - but that doesn’t mean they aren’t positively impacting your business. Sharing competitive intelligence data frequently with your key stakeholders does have a direct correlation to revenue impact. As for the methods of delivering that intel, the CI community has given insight into their most common as well as their most impactful. So, it’s up to you and your team to decide what’s best for you. At the end of the day, competitive intelligence is key to moving your business forward, closing more competitive deals, and positively impacting your revenue.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

.png?width=500&name=Sales%20Enablement-What%20is%20SE_%20(2).png)