Conducting a competitive analysis can be time-consuming. It takes time to gather intelligence, analyze the insights, share data, and integrate your findings into your strategy. However, if you’re able to take a quick snapshot of your competitive landscape, you’ll be able to get quick and impactful insights about your market.

Previously, we walked you through the three dimensions of conducting a snapshot competitive landscape analysis. Now, let’s apply that methodology in a series of case studies — a breakdown of four industries, including Conversational Marketing Software, Point-of-Sale (POS) Solutions, Cybersecurity Technology, and Meal Kit Subscriptions. With data from completed competitive landscape reports, we’ll dive into what it means to be an industry leader.

Breaking Down the Competitive Analysis

Our competitive analysis report breaks down your competitive landscape in three ways: Company Growth & Trajectory, Company Traffic & Social Reach, and Company Homepage & Positioning History. All of these aspects are important in analyzing your competitive landscape for different reasons. For our analysis, we’ve also highlighted three areas of market leadership — Industry Billboard, Market Leader, and Top Challenger.

- The Industry Billboard represents the company with the largest voice in the market, as measured by the company with the best Alexa Rank.

- The Market Leader is the recognized front-runner in the industry, as measured by highest estimated revenue for a public company.

- The Top Challenger is the up-and-comer that is getting the most traction, as measured by highest estimated revenue for a private company.

Now that we’ve broken down the key areas of focus for these reports, let’s look at how specific companies in a wide range of industries have gotten themselves to those top spots.

The Industry Billboard: Best Alexa Rank

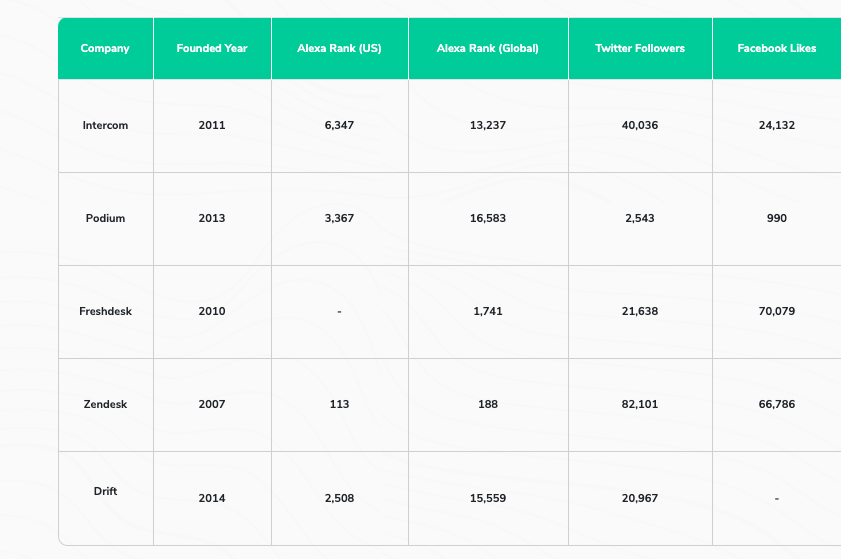

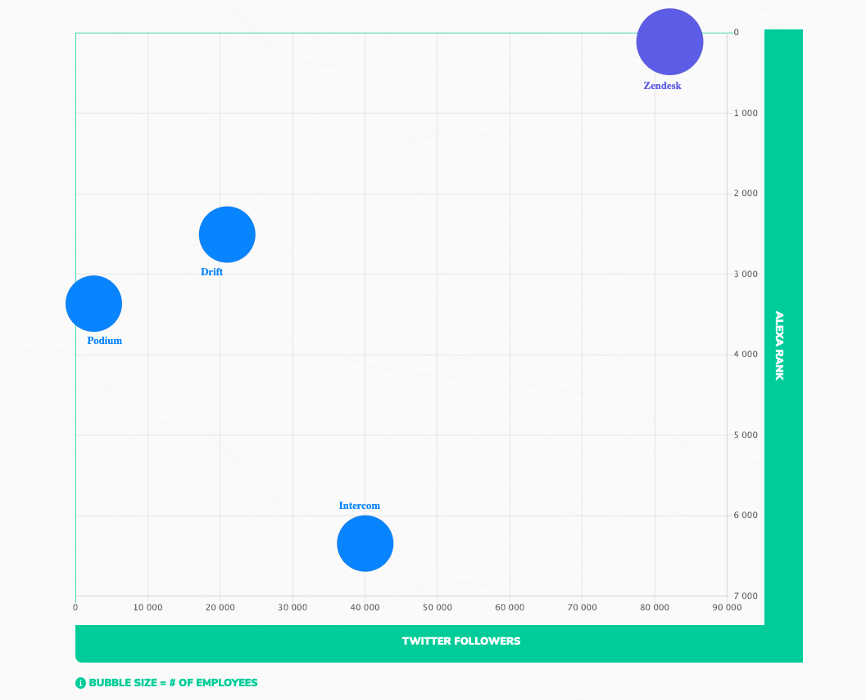

Up first, we took a snapshot of the customer service / conversational marketing software industry, which included Intercom, Podium, Freshdesk, Zendesk, and Drift. To get recognized as an “Industry Billboard,” the company needs to have the lowest Alexa Rank in the industry.

The Industry Billboard for this industry is Zendesk. Zendesk has the best Alexa Rank, at 113, as well as the highest number of Twitter followers, 82k. These are two (of many) metrics that can give you insight into your competitor’s social media influence and reach. Having a low Alexa Rank (lower numbers mean better rankings) means that the site is more popular, and getting high levels of traffic and engagement. Having social influence is also important because social media is often where consumers go to interact with brands, whether that’s to learn more, ask questions, complain, or share good experiences. Brands also use social media to broadcast latest news, announcements, product launches, content, and more. So, having many social followers shows that they have an engaged audience.

To compete with your competitors’ traffic and social reach, you can do a couple of things. It’s important to track their website, including messaging changes, newly published content, and site updates. You’ll also want to track where they’re getting their message out to the market - which social media sites, content syndication, or other platforms are they using. Understanding what each competitor is telling the market and where can help you differentiate your message, learn about what messages customers are engaging with, and even find underutilized channels. If your industry’s marketing leader is much larger than your organization, then consider leaning on new channels and messages rather than copying theirs.

The Top Challenger: Top Private Company by Revenue

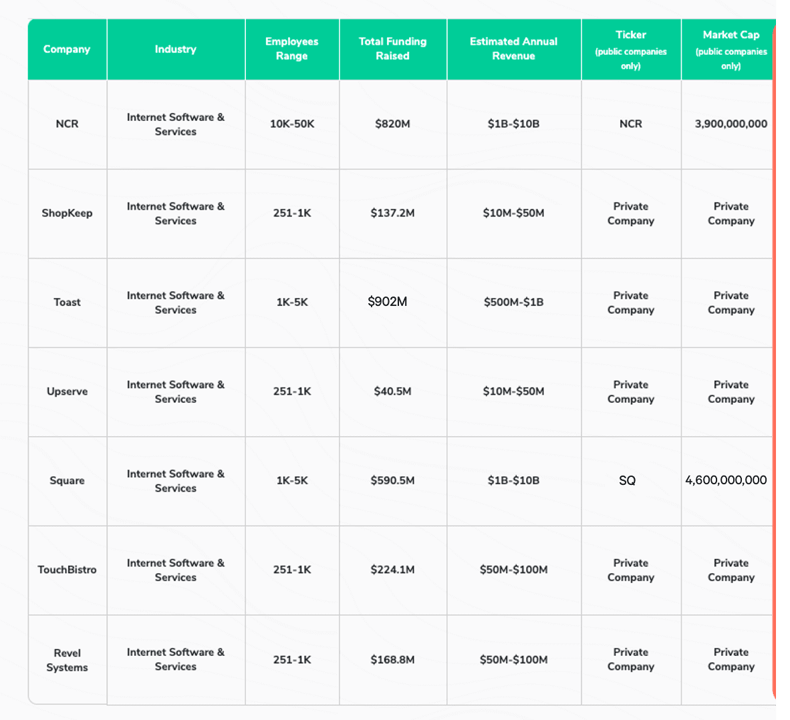

Next up, let’s take a look at the Point-of-Sale (POS) industry. In this landscape snapshot, we analyzed NCR, ShopKeep, Toast, Upserve, Square, TouchBistro, and Revel Systems. To get recognized as the Top Challenger, you need to have the highest estimated revenue and be a private company.

In this industry, the Top Challenger is Toast. In this instance, Toast is the top private company in the POS space, based on its estimated revenue, which is in the $500M-$1B range. In comparison to other private companies in this space, they are the revenue leader. This data is important because it gives you insight into how efficient your competitors are, which ones are up-and-coming based on how long they’ve been in business and their revenue, as well as which competitor is leading the charge. Keeping a pulse on funding as well as revenue matters because you can gain insight into how well a company is performing. If your competitors are raising more funding, it might be a sign that something big is about to happen, that you will definitely want to monitor.

Revenue is a good indicator of success for private companies, but let’s focus on their funding. If you notice an increase in funding, keep an eye out for changes across other aspects of their business. When a company is raising capital, it means that they are planning to grow and invest more resources into their strategy - headcount, product capabilities, new offices, etc. Keep an eye on their funding as well as what happens after funding rounds are completed. Any shift in strategy, especially hiring, can give you insight into where they’re going next. Use this intel to get ahead of your competition.

The Market Leader: Top Public Company by Revenue

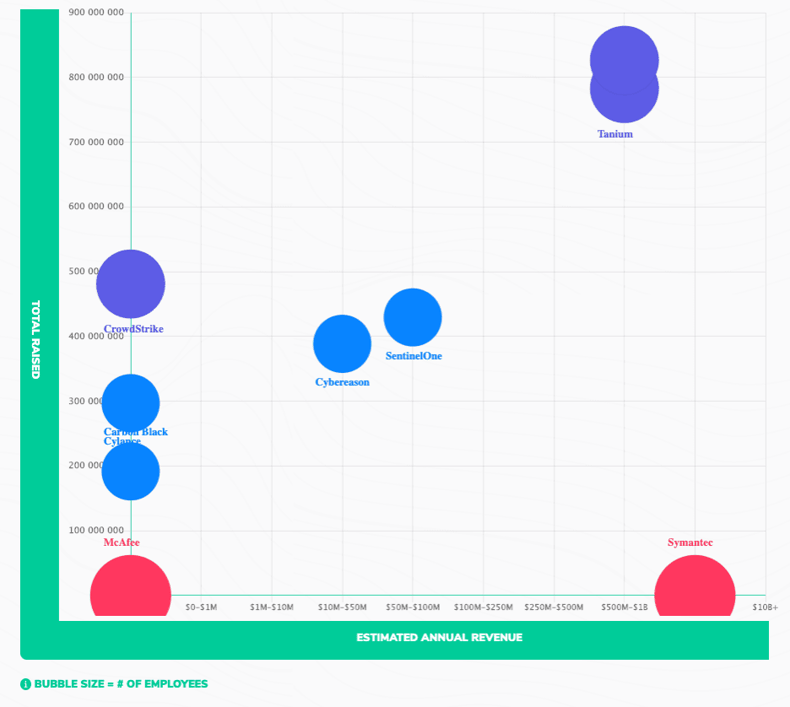

Similar to the Top Challenger, the Market Leader is based on revenue, but for public companies. In this example, we’re going to look at the Cybersecurity space, featuring Symantec, SentinelOne, Cylance, FireEye, Tanium, Carbon Black, Cybereason, McAfee, and Crowdstrike.

The cybersecurity space is highly competitive due to the ever-increasing threat of hacking in every sector, including banking, national security, weapons systems, voting ballots, etc. The cybersecurity industry also has a good mix of public and private companies. For this analysis, the “Market Leader” is Symantec, because they have the highest revenue amongst the public cybersecurity companies. Their estimated revenue is in the range of $1B-$10B, and they’ve raised $1.2B in funding. Compared to many of its competitors, Symantec has high revenue, but not a lot of funding raised. Other cybersecurity companies have much higher funding than Symantec. This shows you how efficient and powerful Symantec is, as they’ve been in business the longest and have the most revenue in their market.

In addition to funding raised, revenue is critical because it’s another measure of the success of a company. Here, the leader is a company that has been around significantly longer than the other players, so they’ve created a sustainable competitive advantage. While it is possible to displace industry leaders, you can also learn from the bigger players in your industry. What did they do over the years to get to where they are today? What did they invest in, who did they hire, how did their product change? By analyzing how they became the industry leader, you’ll be able to iterate on your strategy to incorporate the positive and negative lessons learned by the industry leader. There may be strategies you can apply to your own business, or you may be inspired to try new tactics. Either way, leverage this competitive intelligence to make an impact on your own revenue achievement.

Don’t Forget: Keep an Eye on Messaging and Website Updates

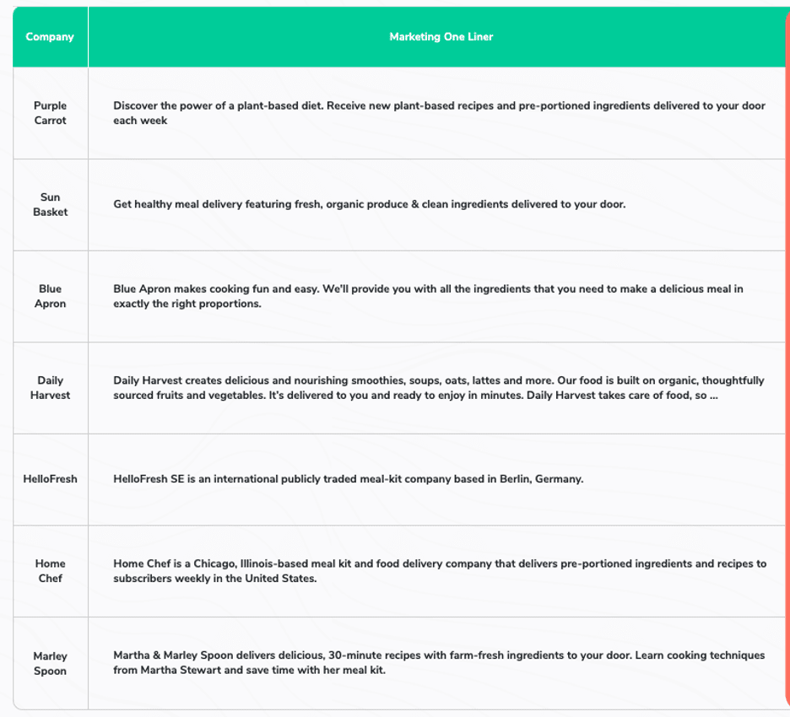

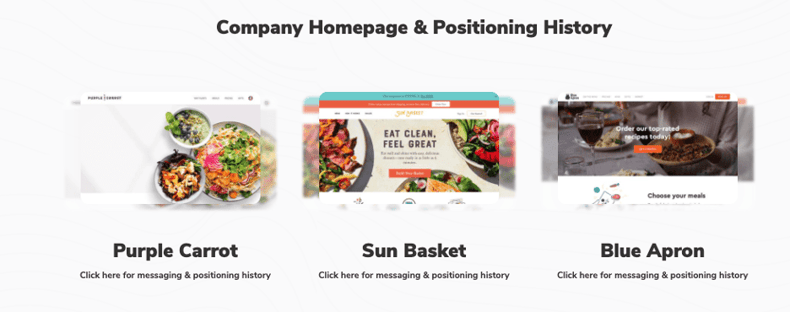

Additional competitive insights to evaluate include homepage updates and messaging history. As an example, we’re going to take a look at the Meal Kit Subscription industry, featuring Purple Carrot, Sun Basket, Blue Apron, Daily Harvest, HelloFresh, Home Chef, and Marley Spoon.

It’s helpful to pay attention to how your competitors are marketing themselves. These one-liners are one way to gain insight into how a company positions itself. They want to reach and resonate with their target customers, so having a strong one-liner, as well as homepage messaging, are critical. An example out of these is Blue Apron, “Blue Apron makes cooking fun and easy. We'll provide you with all the ingredients that you need to make a delicious meal in exactly the right proportions.” This tells potential customers exactly what Blue Apron aims to do, and how they’ll do it. This one-liner is the first impression a potential buyer gets of each company, and it’s important to make sure your first impression is unique. Comparing these key messages allows you to differentiate your first impression.

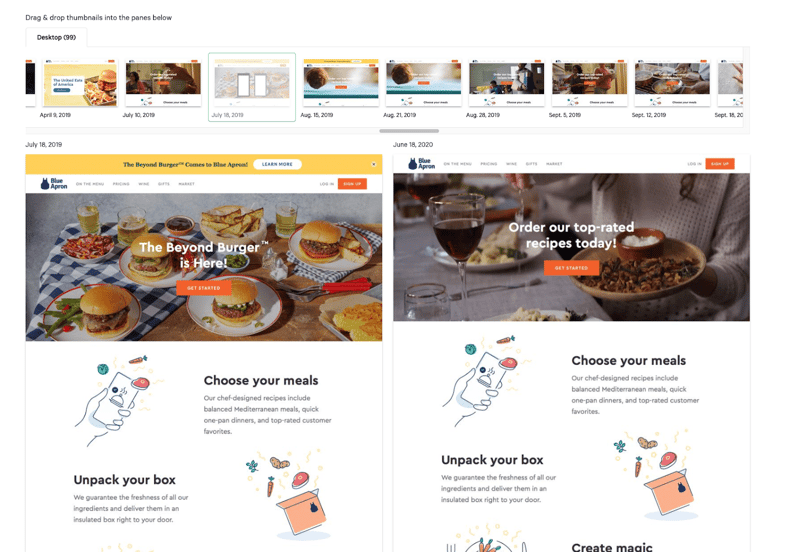

Digging into how companies have changed their homepage over time can give you insight into how their messaging has evolved. You should track everything from minor messaging tweaks to full homepage overhauls so that you can gain insight into how their strategy has shifted.

While we are looking at key competitive data points here, and we have analyzed each competitor’s standing throughout, it’s important to note that just because a competitor leads in one category does not mean that they lead in every category. When you’re working on your competitive analysis, look at each category, and see where you stack up to the competition. Whether the companies you compete against are public or private, funding and revenue are important. So are social influence, site traffic, branding changes, and growth trajectory. For a robust competitor analysis, focus on these key areas to benchmark your success and develop a strategy oriented around the dynamics of your market.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking