Editor's note: The following blog post is based on data from the 2021 State of Competitive Intelligence Report. To get the latest insights, download the 2022 report.

Every year, for the last four years, Crayon has conducted the State of Competitive Intelligence Report — a survey of the competitive intelligence (CI) community that yields deep insights regarding industry trends, investment growth, process evolution, and more.

This year, we fielded responses from more than 1,000 CI professionals and stakeholders. Our survey was 41 questions in total, and based on the data we’ve gathered, there’s no shortage of exciting trends to discuss.

Since 2018, we’ve watched CI processes evolve as competition has heated up and investments in both headcount and technology have grown. This year, we’ve seen the emergence of one major theme in particular: revenue. Simply put, CI is positively impacting revenue like never before.

On that note, let’s dive into the top five insights from the 2021 State of Competitive Intelligence Report.

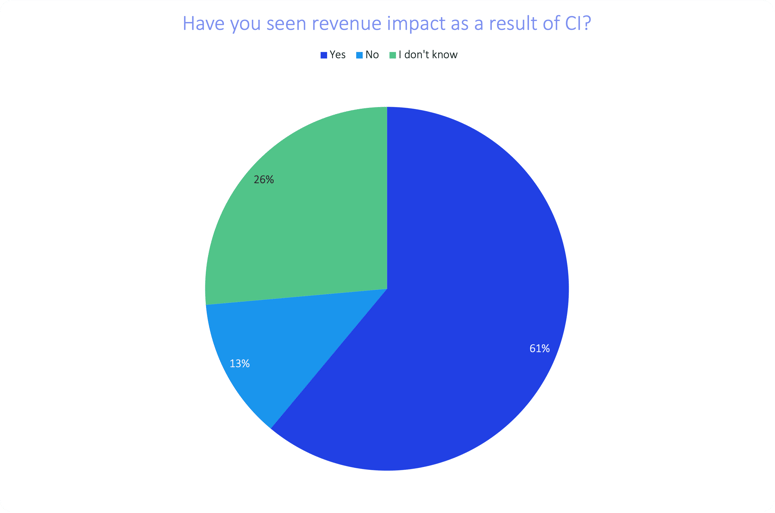

1. The majority of businesses say CI boosts revenue

It hasn’t always been easy for competitive intelligence professionals to tie their work to revenue. With a business function like sales, by comparison, the revenue impact is clear.

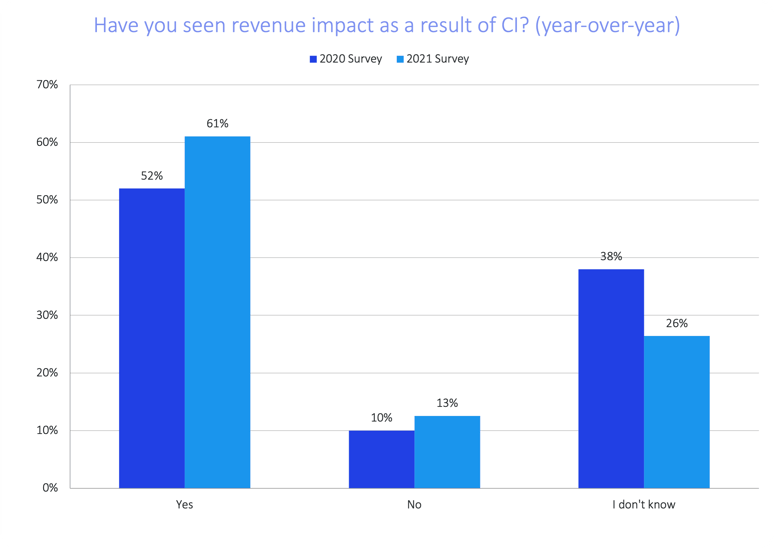

Good news: This year, when we asked survey respondents if they’ve seen revenue impact as a direct result of their CI investment, 61% said yes, and only 13% said no.

In our 2020 report, only 52% of respondents said CI had impacted revenue. With a 17% year-over-year jump, it’s clear that competitive intelligence is increasingly correlated with the bottom line.

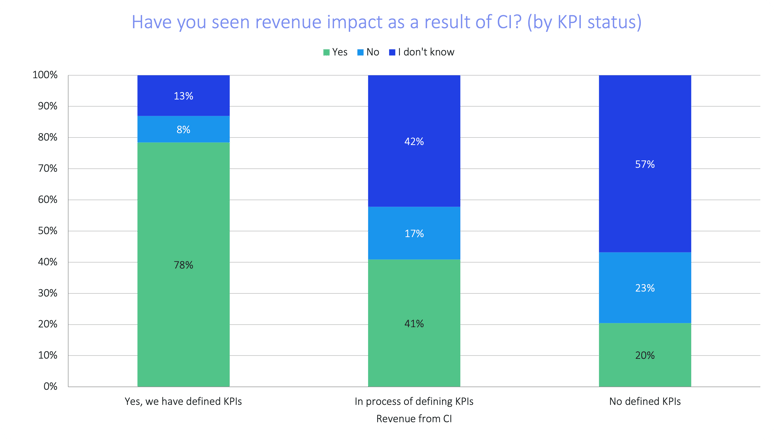

2. Defining KPIs helps to drive greater revenue impact

Whenever you launch a new project, you need to establish goals and KPIs. That way, you can determine what was successful, what was unsuccessful, and what you can do differently the next time around. Launching a competitive intelligence program is no different — you’ve got to set those KPIs!

78% of businesses that have defined KPIs for their CI program say they’ve seen direct revenue impact. Amongst businesses without KPIs, only 20% have seen that same impact.

3. Sharing CI frequently is a major key to success

When you spend time conducting competitive intelligence research and analysis, you want that data to be leveraged across your organization, right? Otherwise, how much value are you actually delivering?

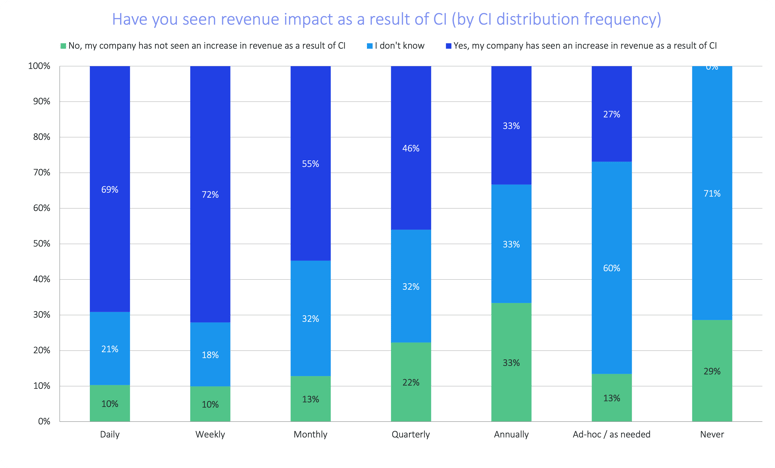

With that in mind, it’s no surprise that businesses that share CI data frequently are more likely to see revenue impact. 69% of those who share competitive intel on a daily basis, and 72% of those who do so on a weekly basis, have seen direct revenue impact as a result of CI.

4. The role of technology in the CI process is growing

If your current CI process runs entirely on manual effort — if you're manually gathering and analyzing each individual insight — the notion of sharing intel on a daily or weekly basis may seem far-fetched. But, then again, when you take into account the clear (and positive) correlation between frequency of sharing and revenue impact, the notion of sharing intel on a monthly or quarterly basis seems insufficient — and it is insufficient.

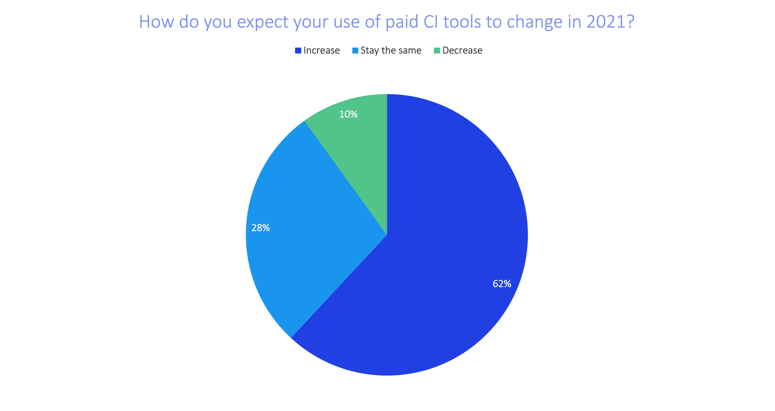

Evidently, this is not lost on CI professionals: Nearly two-thirds anticipate increased use of paid solutions in 2021. We can reasonably assume that a major driver behind the increasing use of CI solutions is the need to more efficiently gather and analyze insights — thus freeing up more time to take action.

5. CI practitioners are shifting their focus

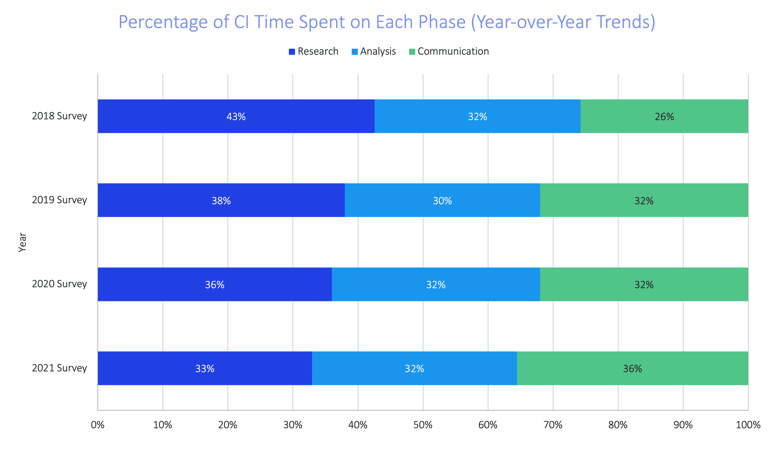

At a high level, we like to think of the competitive intelligence process in three phases — research, analysis, and communication (a.k.a. activation). Each year, we ask CI practitioners how much time they spend within each phase of the process.

This year, for the first time, we see the greatest time investment in the communication/activation phase. Historically, we’ve seen a pretty even split between the three phases, with the most time typically going towards research. But now, it’s increasingly clear that spending time delivering actionable insights across the organization is impactful, and practitioners are focusing their energy accordingly.

Get your free copy of the 2021 SOCI report today!

Competitive intelligence is continuously evolving. Once a manual, nice-to-have process, it’s evolved before our eyes into an automated, need-to-have process. Use of technology is on the rise. Practitioners are able to identify the revenue impact of their efforts. CI communication/activation is happening at a higher rate than ever before.

Want even more insights from the 2021 State of Competitive Intelligence Report? Grab your free copy today!

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

.png?width=500&name=Sales%20Enablement-What%20is%20SE_%20(2).png)