At all business levels—and especially at the enterprise level—product pricing can be a challenging yet vital activity. How much should your company’s products cost? Should you go with tiered packages, or one-size-fits-all solutions? Do you price for volume, or for higher revenue per order?

The simple answer to these questions—if such a thing exists—is this: You should price each product according to its worth. But determining a product’s worth isn’t as simple as assessing the combined value of its features and benefits; it’s a complex endeavor that needs to be informed by signals from the market.

Of these signals, one of the most crucial is how your competitors price their products.

Whether your company is B2B or B2C, leveraging competitive intelligence when pricing your product is a surefire way to put your brand in the driver’s seat and claim your share of the market. And if your target audiences are prone to comparison shopping—in the enterprise space, that’s almost a given—then adopting a competitive pricing strategy can help ensure you stand out from the rest of the pack.

What is competitive pricing?

Competitive pricing refers to any pricing strategy that’s used to give your product an advantageous market position over its alternatives. It’s not as simple as merely undercutting your competitors, though. There are several strategies your company can employ to encourage consumers to choose your product over other options in the market.

Let’s run through five prime competitive pricing strategies and talk about how you can leverage knowledge of your competitors to attack your pricing problem with vigor.

Competitive pricing strategy #1: Penetration pricing

Penetration pricing is designed specifically to help new products succeed in the market right away. The goal is to initially charge customers a lower rate in order to drive sales volume. Over time—as sales scale and the product gains traction—prices increase, with a twofold goal:

- Retain customers who already have affinity for the product, and

- Generate new customers based upon credibility the product has built in the market.

Penetration pricing is particularly handy in hyper-competitive industries. So, if you’re Head of Product at a mid-to-enterprise level business, and you’re trying to bring a new product to market, you can set that product up for relatively quick success by (1) seeing how other products in the space are priced and (2) recommending a slightly lower initial price point.

Doing so can help do the valuable work of building your customer base, growing your marketing lists, arming your acquisition team with high-intent remarketing audiences, and kick-starting growth that you may not have otherwise experienced if you had initially priced aggressively.

Keep in mind, though, that penetration pricing is a slippery slope. If left unchecked, it can influence your market into joining a “race to the bottom,” where your competitors adjust their rate cards down to compensate for the new entrant’s lower price floor, and the products themselves end up becoming commoditized. So, if you’re embarking on a penetration pricing strategy, have a data-backed plan to back yourself out of it. Don’t price your product so low that you water down its value, or risk alienating a segment of your customer base when you raise prices along your pre-determined timeline.

Competitive pricing strategy #2: Loss leader pricing

Loss leader pricing is similar to penetration pricing, but differs meaningfully in that it's not used to bring a product to market (at least not always). In a sense, you’d price your product lower without having a goal to increase it later, and you’d make up for lost margin on the “back end” of the customer journey.

The initial goal of loss leader pricing, like penetration pricing, is to get customers in the door with prices that are lower than the competition’s. The ultimate goal, however, is to cross-sell or upsell other products once you close the initial sale. The classic example is Gillette, which sold razors at extraordinarily low prices—only to sell replacement cartridges at a higher price point. They got customers in the door, and they drove a profit. Win-win.

Via The New York Times.

In some instances, loss leader pricing can be considered aggressive and predatory. Think, for instance, about WeWork, which kept prices so low for so long that their competitors couldn’t possibly keep up—and many of them folded. This, of course, presented WeWork with a golden opportunity to charge more.

A more traditional, non-predatory example would be a marketing agency that sells an affordable site audit to get clients in the door, with the intention of selling them a complete redesign once they’ve signed on. Or consider Costco, which charges extremely low prices on some items—even taking big losses in some cases—in order to build customer affinity and increase volume on products for which they have better margins.

If you’re considering loss leader pricing, keep in mind that it’s very difficult to run a loss leader strategy if (1) you're a smaller company, (2) you don’t have other products with their own revenue streams, or (3) you don't have complementary products that would be a natural fit for an upsell or cross-sell. This is a strategy best reserved for mid-to-enterprise-level businesses with high budgets and high margins for error.

Competitive pricing strategy #3: Prestige pricing

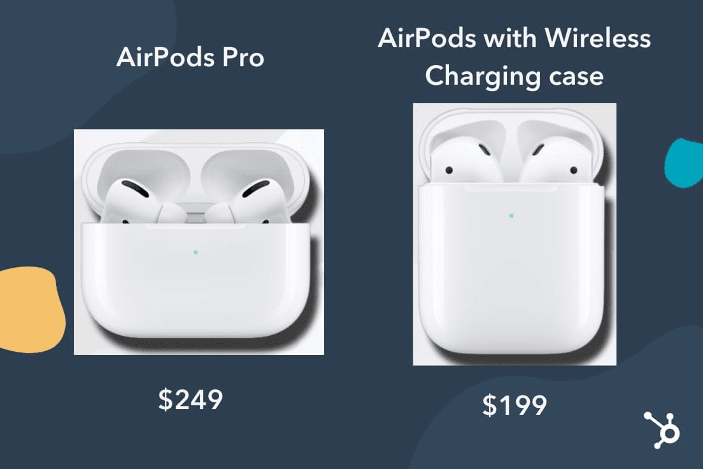

Prestige pricing, also referred to as premium pricing, is a strategy in which a brand purposely prices a product at a higher level in order to ascribe quality.

In theory, prestige pricing is similar to the above two pricing strategies, in that you’re deliberately pricing your product differently than its alternatives in order to position it favorably.

In practice, though, it’s the antithesis. Rather than undercutting your competitors, premium pricing gives your product a cache that it may not otherwise have. It says, this product is more expensive because it is hands down better than the rest of the field.

Think about Apple products, which are consistently priced at higher levels than competitor products. The Apple example is instructive because it denotes one very important thing about prestige pricing: Your product has to actually have some level of functional or aesthetic superiority in order to sell in volume at a higher level. That is to say, it would be easy to disrespect potential customers with a prestige pricing strategy if their out-of-pocket cost far exceeds your product’s value.

If you know, on the other hand, that your product is superior to the field and you have anecdotal data to back that up, a higher price point than the competition would serve to communicate that superiority to your potential customers. This is where it’s especially handy to have competitive pricing data that allows you to track and react to changes in the market over time.

Competitive pricing strategy #4: Sticky pricing

Price stickiness refers to a product’s ability to remain at the same price point while market conditions change. In another blog post of ours that breaks down five examples of companies with competitive advantages, we tell the story of the Ritz-Carlton in the mid-1990s—a time when Southeast Asia was racked by forest fires. While their competitors slashed prices, the Ritz kept theirs as they were and stepped up their game in terms of services and amenities. And the stickiness of their pricing paid off.

We’ve seen, in some of the above examples, how advantageous it can be to have a fluid pricing structure that allows you to adapt to market conditions. While it’s certainly an advantage to be flexible, there is also a ton of value in maintaining consistent pricing despite fluctuations in the market, especially when you’re trying to preserve the relationship equity you’ve built with your current customers. It’s the job of product stakeholders to determine when it’s in the company’s best interest to adapt, and when consistency should take precedence.

Sticky pricing does not preclude the need for competitive analysis. In fact, it makes having an informed understanding of competitor prices all the more important. An effective sticky pricing strategy leverages competitive intelligence to set prices favorably against competitors for the long run. Unlike some of the other pricing strategies, sticky pricing encourages you to be more predictive or anticipatory about how your market may evolve, since you’re trying to establish a price point that will remain constant for an extended period of time.

In other words, advantageous pricing is not mutually exclusive with consistency. If you leverage competitive intelligence to set prices correctly from the get-go, you’ll equip your product with natural resistance to fluctuations in the market.

Competitive pricing strategy #5: Value-based pricing

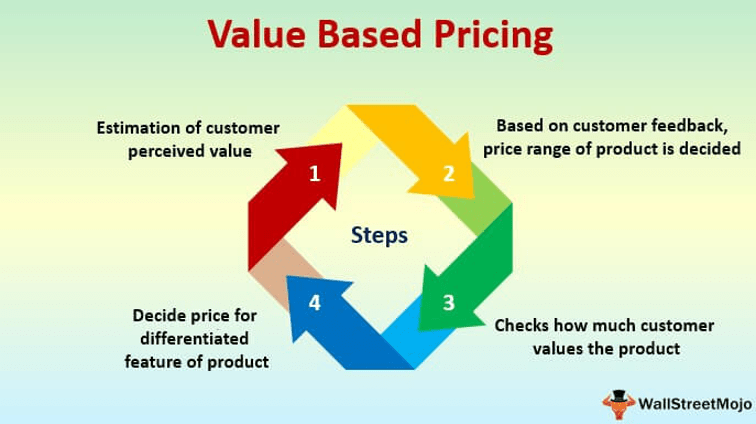

Let’s revisit a concept we introduced at the beginning of this post: Your company should price each product according to its worth.

That is value-based pricing in a nutshell. Value-based pricing looks at key differentiators between your product and its alternatives and puts a dollar amount on those differentiators.

As an example, let’s say your company sells email marketing software. You’re trying to bring to market a new “premium” offering, and you want to know how to price that package in a way that’s going to generate sales. After studying the key benefits and features of your competitors’ products—hopefully you’ve created battlecards—you determine that your premium offering gives customers access to automation that your competitors can’t match.

Ask yourself: If you were a customer, how much would that automation be worth? Can you quantify it? If so, that’s how much more wiggle room you have to increase prices based upon your product’s value.

Via WallStreetMojo.

Value-based pricing has the advantage over some of these other strategies of being highly customer-centric. By putting yourself in the shoes of the customer and measuring demand in the context of your competitors, you can create pricing models that are rooted in data. If you’re selling B2B, that gives your sales team ammunition to back up pricing with raw numbers in conversations with prospects.

A quick note on price sensitivity

Price sensitivity refers to the tendency of prices in a given niche to change due to shifts in the market. With regards to the sticky pricing strategy mentioned above, an understanding of price sensitivity in your market informs just how sticky you can afford to be.

Price sensitivity is less a strategy than a feel for how changes in buyer behavior, competitor behavior, and other factors impact pricing in your vertical. And one of the best ways to cultivate that feel Is to keep track of changes in how your competitors price their products both diligently and regularly.

Getting the right intel for smarter competitive pricing

Here at Crayon, we know that smart competitive pricing can be the difference between selling and not selling. Between driving revenue and being left in the dust. Between winning and losing.

That’s why we’ve developed a suite of competitive intelligence products designed to give brands better insight into how to position, promote, and launch products. Competitive pricing plays an integral role. Take a free spin through our platform today, and learn how Crayon can help your brand price its products to outmatch the competition.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking