Neglecting competitive landscape analysis is a costly mistake—one that’s steadily growing costlier over time.

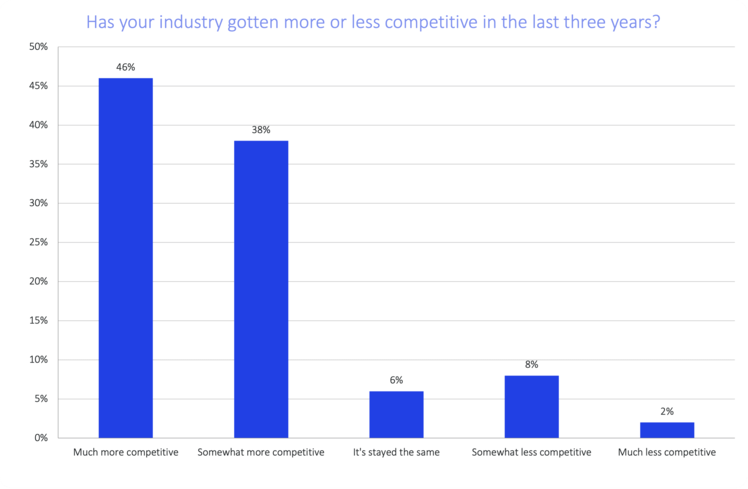

We say that for several reasons. First of all—and as regular readers of this blog are well aware at this point—competition is heating up across virtually every industry. As it becomes easier for startups to toss their hats in the ring and for established firms to steer into new lanes, it becomes more likely that you’ll find yourself in an increasingly crowded market.

This trend, in and of itself, reinforces the value of competitive landscape analysis.

But there’s another trend—a less obvious one—that does the same: To a greater extent than ever before, businesses are investing in competitive intelligence. In 2018, 37% of respondents to our State of Competitive Intelligence survey reported CI teams of two or more people. Now, that figure is 70%. Plus, nearly two-thirds of respondents to our most recent survey said they’re anticipating increased use of CI software solutions in the near term.

But there’s another trend—a less obvious one—that does the same: To a greater extent than ever before, businesses are investing in competitive intelligence. In 2018, 37% of respondents to our State of Competitive Intelligence survey reported CI teams of two or more people. Now, that figure is 70%. Plus, nearly two-thirds of respondents to our most recent survey said they’re anticipating increased use of CI software solutions in the near term.

The upshot here is that your competitors—some of them, at least—are getting better at conducting competitive intelligence. They’re getting better, in other words, at making timely, strategically sound decisions.

It behooves you, then, to keep your ear to the ground.

By the time you’re done reading, you’ll have an answer to each of the following:

- What is competitive landscape analysis?

- Why is it important?

- How do you effectively leverage the insights you uncover?

What is competitive landscape analysis?

Competitive landscape analysis is the ongoing process of surveying your market in order to better understand (1) who you’re competing with and (2) where each company—including your own—stands in relation to the rest of the pack.

The modifier ongoing is a crucial piece of this definition. As we’ve already established, your competitive landscape is dynamic—not static. This is true not only because new competitors are likely to emerge, but also because existing competitors are likely to evolve. Companies you consider Tier II competitors could very well be Tier I competitors in the not-so-distant future.

It’s with this dynamism in mind that we emphasize the ongoing nature of competitive landscape analysis. Depending on your specific circumstances, you may find it warranted to conduct analyses on an annual, semiannual, or quarterly basis.

Why is competitive landscape analysis important?

Because the success of your business depends, in part, on your ability to adequately differentiate your brand and your solution. This is true no matter how many competitors you have. With that being said, there’s obviously a difference between differentiating your business from one competitor and differentiating your business from a dozen competitors. With more competition comes more noise through which you need to break.

Because you can’t break through the noise until you know what constitutes the noise, it’s time to take a closer look at each half of our competitive landscape analysis definition.

Who are your competitors?

The answer to this question is more or less straightforward depending on the complexity of your competitive landscape. Everyone, however, should consider it carefully; if you overlook or underestimate a particular company, you may end up regretting it down the road.

Although there are plenty of valid ways to identify and segment your competitors, we’re going to focus on just one method for the time being. In a nutshell, what you want to do is categorize each player in your market (and adjacent ones) with one of the following designations:

- Direct competitor

- Indirect competitor

- Perceived competitor

- Aspirational competitor

Direct competitors

Direct competitors are those with which you compete—head-to-head—for sales and market share. If a prospect is evaluating your product or service, there’s a good chance they’re familiar with at least one of your direct competitors.

Indirect competitors

Typically, an indirect competitor falls into one of two subcategories: Either they sell a tangential solution to your core audience, or they sell a similar solution to a separate audience. No matter what, you’re not consistently going head-to-head in winner-take-all situations.

Perceived competitors

A perceived competitor isn’t actually a competitor: The problems they solve and the problems you solve are different. Nevertheless, in the eyes of the public, you and this other company are, in fact, competitors. It’s important to be conscious of this perception, as it can most certainly cause headaches throughout the sales process.

Aspirational competitors

Finally, an aspirational competitor is a company that you admire for the work they’re doing in a related field. You’re not currently competing with them for business, but as you formulate a vision for the future, it’s not out of the question.

Where does everyone stand in relation to one another?

Congratulations! With all the relevant companies identified and segmented, you’re on your way to a complete analysis of your competitive landscape.

The next major step is to determine where each company stands in relation to one another. To do this, of course, we’re going to need variables—specific points of comparison between competitors. Just as before, there are plenty of ways to go about this; you can compare companies to one another along myriad dimensions, after all.

Once again, for the sake of brevity, we’re going to focus on just one method for the time being—a method that enables you to scrutinize your competitors along three dimensions:

- Growth & trajectory

- Marketing reach

- Positioning & messaging

Growth & trajectory

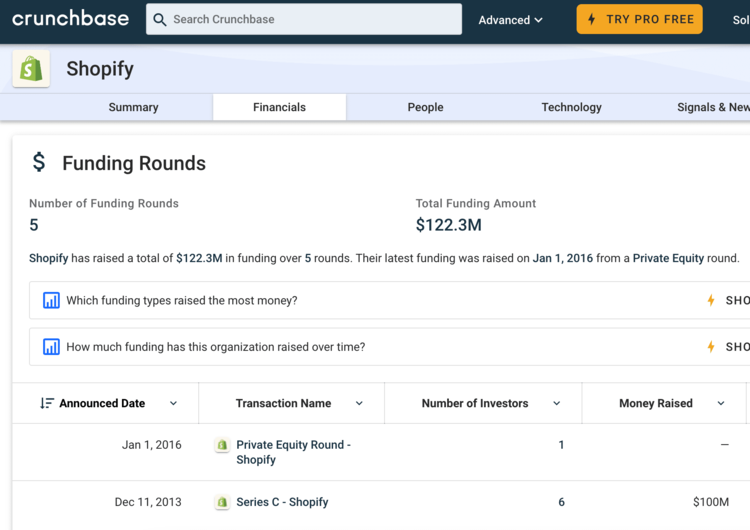

We begin with a combination of firmographic and financial data. For each competitor, answer the following questions:

- When were they founded?

- How many employees do they have?

- Have they raised any funding? If so, how much?

- What is their estimated annual revenue?

- Are they private or public? If public, what is their market capitalization?

Once you’ve answered each of these questions for each of your competitors, your analysis is beginning to take shape. At a minimum, it’s important to differentiate between established players—i.e., competitors founded years ago that have a relatively high number of employees and relatively high revenue—and emerging players—i.e., competitors founded recently that have relatively few employees and relatively low revenue. Amongst your emerging competitors in particular, pay attention to which ones (if any) are accumulating capital.

Marketing reach

Headcount, funding, revenue—as important as these metrics are, they alone won’t tell you the full story of your competitive landscape. To get a sense of who’s attracting the attention of your target audience, look at each competitor and answer the following questions:

- According to Alexa Rank, how popular is their website?

- In terms of followers and engagement, how are they performing on social media?

Alexa Rank is a metric that indicates the popularity of a given website. As a website gets more and more popular, its Alexa Rank goes lower and lower. (Google, at the time of this writing, has an Alexa Rank of 1—it’s the most popular website in the world.) Identifying the top websites in your competitive landscape gives you an idea of who’s in control of the conversation.

Of course, there’s more to a company’s marketing presence than their website. Just because a competitor of yours is doing relatively poorly from a traffic perspective, doesn’t mean they’re failing to generate buzz on sites like Twitter and LinkedIn. Going one by one through each of your competitors, take note of (1) which platforms they’re using to publish content, (2) how many followers they have on each platform, and (3) how much engagement—in terms of likes, shares, views, etc.—they’re getting on each platform.

Positioning & messaging

At this point in your competitive landscape analysis, you’ve begun to scrutinize your competitors in terms of firmographic data, financial data, and marketing data. At a high level, this information tells you where each of your competitors stands in the market at large.

What remains to be seen is (1) how each competitor positions themselves in the market at large and (2) how each competitor articulates their positioning to their target audience (which may or may not be your target audience).

Wrap up your analysis by answering these questions for each competitor:

- How do they position themselves?

- How do they translate that positioning into prospect-facing messaging?

As a reminder, positioning is all about defining the differentiated value that you bring to your market. You can think of positioning as a structure or framework that guides you in your efforts to communicate the value (and determine the price) of your product. Mailchimp, for example, positions itself as an all-in-one marketing platform for businesses with tight budget constraints.

Messaging is the articulation of your market position—it’s the vehicle that takes the unique value of your product and drives it into the hearts and minds of your prospects. Whereas positioning, for the most part, remains relatively static over time, messaging can evolve dramatically. Closely observing the evolution of your competitors’ messaging enables you not only to anticipate strategic changes, but also to ensure that your own messaging never grows stale.

3 tips for leveraging insights from your analysis

The whole purpose of analyzing your competitive landscape is to empower yourself and your colleagues—across sales, marketing, product development, the C-suite, and beyond—to more effectively differentiate your solution and your brand. The purpose, more succinctly, is to uncover and leverage competitive insights.

At this point, you’ve taken care of the uncovering part—now it’s time to help your colleagues understand and capitalize on the things you’ve learned.

Here are three quick tips to help you do just that.

1. Establish the so what

Imagine: You’re a sales rep. You’re hungry for insights and tactics that can help you win competitive deals at a higher rate than you are right now.

One day, your colleague—who you know has been busy working on an analysis of the competitive landscape—sends you a one-sentence Slack message: “Competitor X’s messaging revolves heavily around the ease of use of their solution.”

Interesting? Sure. Useful? Not quite. What’s missing is the so what—the key takeaway. Why is this observation meaningful? In the eyes of a sales rep who wants to win competitive deals, why does this matter?

Now, imagine an alternative Slack message: “Competitor X’s messaging revolves heavily around the ease of use of their solution. We’ve heard from several customers that their customer support is abysmal. Their marketing team is undoubtedly aware of this, and they’re intentionally going to market with messaging that downplays the need for support. If a prospect mentions Competitor X and their ease of use, make sure to double down on the value of hands-on customer support.”

The more clearly you establish the so what behind your insights, the better equipped your colleagues will be to leverage your discoveries.

2. Centralize key information

There’s nothing inherently wrong with disseminating a competitive insight—and the corresponding so what—via Slack or email. These tend to be the communication channels that folks check most often, and using them is a good way to make sure the right information gets in front of the right people in a timely manner.

The downside of these channels, however, is that it’s all too easy for insights to get lost in a sea of messages—especially when you’re trying to empower your executive leadership team. How does one leverage a piece of information that they can neither find nor remember?

It’s a good idea, then, to centralize key insights from your competitive landscape analysis—to create a single source of truth that your colleagues can access whenever necessary. Whether you use a spreadsheet, an internal Wiki, or a competitive intelligence platform, what’s important is that your colleagues are able to quickly and easily find the most up-to-date version of whatever insight they’re looking for.

3. Suggest specific action items

Whether the colleague you’re seeking to empower with a particular insight is a sales rep, a marketer, a product manager, or an executive leader, chances are they’ve got more than enough on their plate. As such, no matter how thorough you are in the establishment of the so what, your colleague may struggle to see how they can act on whatever it is you’ve uncovered.

As an example, let’s say one of the insights from your analysis is related to the marketing reach of a direct competitor. You contact your content specialist with the following: “In terms of Alexa Rank, Competitor Y is pretty far ahead of us. However, their blog content is surprisingly narrow—they write about the same handful of topics over and over again. Our audience cares about a wide range of topics, and Competitor Y is ignoring the majority of them. From a content perspective, there’s a gap in our market.”

This is an awesome insight, but a busy colleague might feel overwhelmed. After all, the task of filling the market’s content gap is a fairly daunting one. If your colleague doesn’t know where to start, they may not take any action at all.

Going the extra mile and empowering colleagues with suggested action items can make a huge impact. Using our content example, that may look something like this: “ … from a content perspective, there’s a gap in our market. I suggest getting the ball rolling by writing a few articles around Topic A, Topic B, and Topic C.”

Thanks to the additional effort, a message that may have fallen flat is now much more likely to inspire meaningful strategic action.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking