Q: How much is a product worth?

A: Whatever people will pay for it.

In some cases, that’s nothing (not great!). In others, it means charging a premium because, well, you can. Today, we’re focusing on the latter.

This principle is what allows the enigmatic restaurateur Salt Bae to charge $1,200 for a ribeye flecked in gold leaf. It’s what makes a shiny rock in a pretty, robin-egg box cost 5x more than a shiny rock purchased from a jewelry shop that shares its parking lot with a Cheesecake Factory.

Welcome to the wonderful world of prestige pricing.

In this post—which expands on some of the material from our competitive pricing post—we’ll dive into what prestige pricing actually is and why it’s so powerful, before taking a closer look at three brands employing it to great effect.

What is prestige pricing? Why does it work?

Simply put, it’s using a high price tag to convey high value.

You see, in some categories, a race to the bottom simply does not guarantee sales. In fact, lower pricing can actually dissuade customers from making a purchase. After all, the customer isn’t just buying X: They’re buying everything that X makes them feel about themselves and, perhaps more importantly, the way X changes the outside world’s perception of them.

There are a ton of examples of brands that use prestige pricing to charge a premium for their products. The Nissan Leaf is a reliable, affordable electric vehicle but who among us wouldn’t prefer the Tesla Model 3?

One’s a purely utilitarian purchase (with just a hint of virtue signaling); the other is synonymous with innovation (and has something called a frunk). When you roll into the Whole Foods parking lot on Sunday mornings, do you want people to think you’re a pragmatist, or the next big tech success story?

If possession is nine-tenths of the law, perception is nine-tenths of the price.

The psychology of prestige pricing

For better or worse, we tend to associate price with quality. If it costs more, it’s better. This is called the price-quality heuristic.

Prestige pricing works because it invites the purchaser (and envious onlookers for that matter) to assume a certain degree of quality and exclusivity.

If your product is priced high and has demonstrably delivered expected quality over time, brand effectively reduces a customer’s perceived need to conduct pre-purchase research. It becomes a given that the price is an accurate representation of the value (actual, inferred, or otherwise).

This creates an incredibly powerful psychological advantage over competitors, though it can be difficult to maintain. If perception shifts—which is to say, the market no longer feels that quality justifies cost—maintaining prestige pricing is all but impossible.

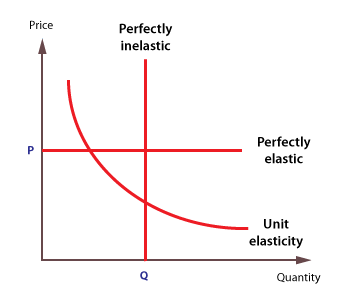

A note on price elasticity

Before you go out and 100X the price of your product in the name of becoming the Virgil Abloh of B2B SaaS, consider this: Prestige pricing won’t work in every market.

Even if you have the brand clout, rolling out prestige pricing requires an inelastic product.

Via Economics Online.

Price elasticity refers to the relationship between supply/demand and price. If customers are still willing to pay for a product when the price goes up, a product is inelastic. However, if fluctuations in price impact demand, you’re going to have a bad time.

Economics—fun!

Prestige pricing in practice: 3 examples

Without future adieu, here are three brands that knock prestige pricing out of the park.

1. Hermes (or, more specifically, the Birkin Bag)

There is luxury, and then there’s Birkin. Produced by French design house Hermes, the Birkin is “a very simple, boxy handbag, kind of on the larger side, with a padlock on the clasp.”

Oh, and it costs sixty grand. And even if you can afford it, you have to wait at least two years.

Before you go on, I highly recommend taking 17 minutes out of your busy schedule to listen to this episode of Planet Money all about the elusive Birkin. It’s riddled with insights like this one:

“This is the bag that proves you've made it, that you are on the top. There are people with Birkin bags and there are the rest of us … Even just getting to see one is kind of a big deal. They won't just show them to anyone.”

But are there really a limited number of these things on the planet? Is it truly impossible to make more of them faster?

Of course not.

Hermes is using the illusion of scarcity in concert with prestige pricing to generate even more demand. When the purchase is about status for the customer, there’s no bigger flex as a brand than telling someone willing to shell out $60k on a bag that they need to join a waiting list like everybody else.

2. Bored Ape Yacht Club (BAYC)

And now for something completely different …

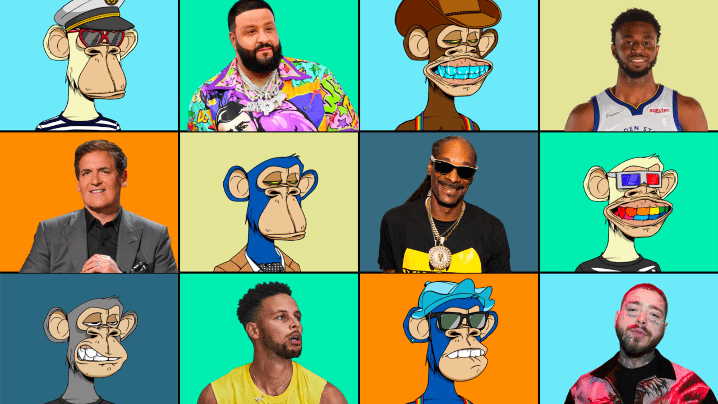

Unless you’ve been living under a rock for the last 12 months, odds are you’ve heard of non-fungible tokens (NFTs). And if you are indeed familiar with NFTs, you’ve undoubtedly heard of Bored Ape Yacht Club, the project that celebrities—from Serena Williams to Jimmy Fallon to Mark Cuban—are clamoring over.

What makes these JPEGs so desirable? Scarcity and community.

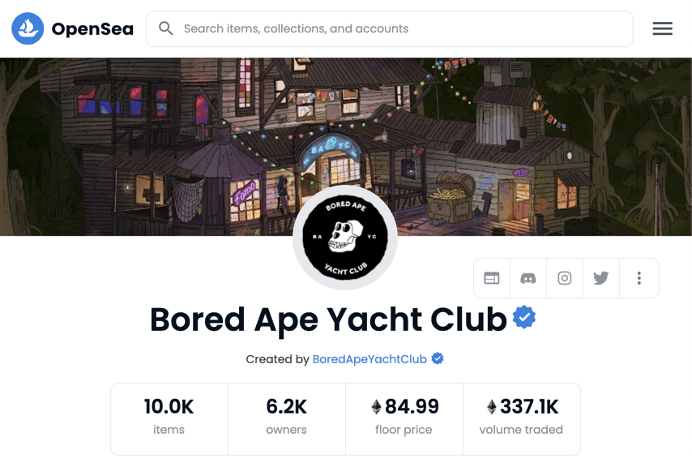

You see, mint price (cost to create) for each of the 10,000 bored apes was .08 ETH (about $200 today) plus gas fees. But on the secondary market, NFT marketplace OpenSea shows 337.1K ETH in trade volume:

That’s about $811M—an insane number.

But perhaps more interesting is the fact that the prestige pricing is driven by the secondary market. Owning a bored ape puts you in elite company; it means you’ve got something in common with Shaq and Paris Hilton and about six thousand other people on the planet.

So what makes BAYC different from any other NFT project?

FOMO.

When someone sells a bored ape, the creators receive a royalty; those royalties are pumped back into the community to do cool things (like create a video game or throw parties) which drive demand from non-holders who want in on the action.

3. Apple (pretty much everything they sell)

Apple, the world's first $3 trillion company, has been leveraging prestige pricing techniques for decades. It’s inherent in the “quality and user experience is more important than affordability” ethos that Steve Jobs brought to the company. They care more about prestige than market share, which has, in a roundabout way, allowed Apple to gobble up market share.

An Apple Watch costs a whole lot more than a Fitbit does.

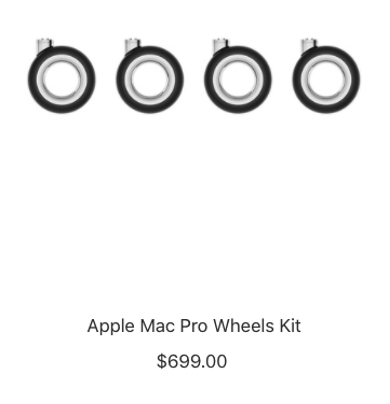

At this point, most Apple products aren’t even that much more expensive than what competitors are selling, but the perception remains (and they aren’t exactly in a rush to change our minds: $700 casters, anyone?).

Is prestige pricing right for your company?

In a word: Maybe!

It’s much more difficult to pull off in the B2B space, but it isn’t impossible, particularly if you sell to enterprise customers. Your product story needs to lead customers to the conclusion that your brand is the holy grail, and to do that, you need a complete understanding of your competitive landscape. To learn more about gathering pricing intel, check out this post.

And, finally, whatever you do, don’t burn $37M worth of your own product to ensure scarcity and maintain prestige pricing. Please.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking