Sadly, the impact of good product marketing is often obscured. A flawless product launch, an inspiring positioning statement, a face-melting slide deck—you and I both know that each of these things contributes to the success of your company. But the people calling the shots? They may not realize just how vital you are.

That’s about to change—because when you’re finished reading the brand new 2022 State of Battlecards Report, you’re going to drive up your win rates to heights previously unimaginable.

Based on our industry-leading State of Competitive Intelligence survey—which recently fielded more than 1,200 responses from people just like you—the 2022 State of Battlecards Report provides the benchmarks and best practices you need to maximize the impact of the competitive intelligence you deliver to your sales team.

The best practices you’ll find in the report are based not only on our data, but also on the insights provided by your peers—including Spiff’s Anna Fisher, Gong’s Elvis Lieban, and Swing Education’s Erin Parkins.

Here’s a sneak peek.

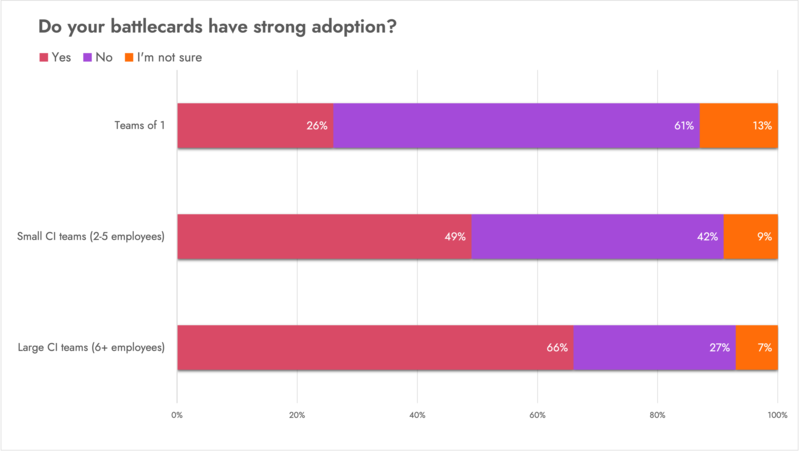

Benchmark: Compared to teams of 1, large CI teams are 3X more likely to say their battlecards have strong adoption

Admittedly, what qualifies as “strong adoption” will change from one company to the next.

Still, this data speaks to a crucial point: When you’re a team of 1, simply creating the battlecards themselves can be a challenge—let alone creating the competitive culture that’s necessary for those battlecards (and CI more generally) to actually get used.

Challenging—but far from impossible.

Best practice: Put battlecards in the places where you sellers spend their time

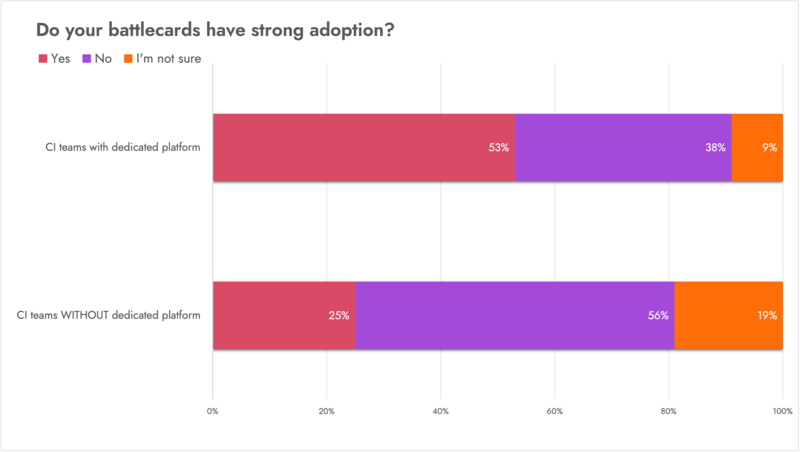

A CI team with a dedicated platform—i.e., a software tool that enables the collection, analysis, and activation of intel—is more than twice as likely to say their battlecards have strong adoption.

With a dedicated CI platform, you’re able to embed your battlecards directly into your sellers’ workflows. Salesforce, Seismic, Teams—no matter where your sellers spend their time, your battlecards are there, ready to be put to use.

Alternatively, when you don’t have a dedicated CI platform, your sellers are forced to adopt a new workflow. Whenever they need competitive insights, they’re forced to go to Google Drive, or SharePoint, or some other generic repository that they would never otherwise use.

And here’s the thing: Forcing your sellers to adopt a new workflow is a non-starter; they will not do it. If the chart you see above isn’t sufficient evidence, here’s an excerpt from an article published by Prosci, a leading change management consulting firm:

“Research on human brain function shows that resistance is not only a psychological reaction to change but also physiological … When presented with a new way of doing something, the physiological reaction is to revert back to what the brain already knows. Human beings can adapt their behavior, but it is a difficult and painful process—even for the brain itself.”

Putting your battlecards in the places where your sellers spend their time eliminates that difficulty and pain, leading to stronger adoption.

Best practice: Don’t give your sellers intel—give them tactics

Let’s say you work for an SEO software company. Through the process of win/loss analysis, you’ve uncovered a key differentiator: Whereas Competitor XYZ only provides a year of historical data, your tool provides five years—which is tremendously valuable to your customers when they’re trying to understand seasonality, predict surges and drops in traffic, etc.

If you give your sellers nothing but that piece of intel—”We provide 5X more historical data than Competitor XYZ.”—it might raise some prospects’ eyebrows, maybe elicit some reactions along the lines of “Wow, that’s pretty cool.”

But will it knock anyone’s socks off? Erin Parkins, Director of Product Marketing at Swing Education, doesn’t think so—which is why she goes a step further.

“I like to use a 3-pronged framework for battlecards: To Ask, To Know, To Show,” Erin told me. “Ask the right questions to lead into your differentiators against the competitor, know what those are and how to position them, and show how that comes alive in your product.”

Get all the insights

This blog post has merely scratched the surface of what you’ll find in the State of Battlecards Report. Click the banner below to get your copy and take your first step towards better win rates, faster revenue growth, and a well-deserved promotion. And for more battlecard best practices, check out the Ultimate Battlecard Breakdown—a live event featuring experts from Gong, Hootsuite, and Salsify.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

.png?width=500&name=Sales%20Enablement-What%20is%20SE_%20(2).png)