Performing a win/loss analysis is one of the single most valuable things a product marketer can do for their company. It helps sales understand why they are winning (or losing) deals, pushes marketing to refine their messaging and tactics, and informs the strategy of the product team by having them evaluate their roadmap.

Like anything worthwhile, win/loss analysis is a serious amount of work. Normally it’s done on a yearly or if you’re lucky, a quarterly basis. Win/loss analysis requires gathering a large amount of both quantitative and qualitative data in order to gain a full and accurate picture of why you’re winning or losing. To be effective, it’s important that you do a thorough win/loss analysis, but here’s the just the baseline data to get you started.

Get your free ebook + template: The 3 H's of a Successful Win Loss Project.

Sales Data

Dig into your CRM and examine all the deals in a specific time period. Look at factors like company size, industry, and sales notes on why the opp was won or lost. Here are some examples of sales data points to include:

-

Sales activity (calls, emails, meetings, etc.)

-

Opportunity status details (won, lost, etc.)

-

Sales assessment of prospect’s needs, why the deal was won/lost

Prospect Feedback

Input from the prospect or customer, collected through win/loss interviews. Example data points include:

-

Description of the prospect’s buying process

-

Prospect’s impression of the product and company, feedback on strengths and weaknesses

-

Prospect’s impression of alternative solutions, feedback on their strengths and weaknesses

Demographic Data

Basic information about the individual prospect/customer and their company, collected through forms, conversations, or data appending services.

-

Annual revenue

-

Industry

-

Employee count

-

Job title

-

Tenure

Marketing Data

History of marketing interactions, as collected by a marketing analytics platform, such as website visits, traffic sources, and content downloads. Knowing the marketing interactions of your prospects and customers is particularly helpful in understanding the buyer’s journey—did customers from your won deals download a particular piece of content or visit a specific page? Did prospects from lost deals interact with your content or emails significantly less than customer from won deals? Answering questions such as these can help clarify which marketing activities are more valuable than others. Some data points to pull from your marketing analytics platform include:

-

Website visits (including individual pages visited)

-

Emails clicked

-

Content downloads

All of these data points are great and necessary—but here are some awesome sources of qualitative data that win/loss often overlooks.

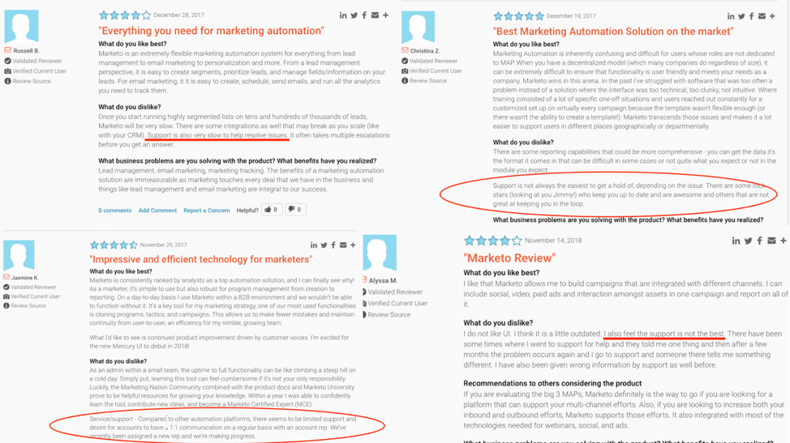

Third Party Reviews

Reviews on third party websites like G2Crowd and TrustRadius are a goldmine for any competitive intelligence program, but they can also function as an informative source of qualitative data for your win/loss analysis. Third party reviews give you deep insight into a competitor’s product features, as well as their sales process, customer service, etc.

Take stock of your competitors’ (and your own!) reviews. Look for any patterns in both the positive and negative reviews—is there a specific product feature that customers love? Is customer service mentioned at all, and if so—in what way? Dig into the reviews and then pull out high-level themes to take back to your win/loss analysis.

Now, go back to your win/loss analysis. How do the themes and insights from your review aggregation match up with your internal sales data and win/loss interviews? Do the reviews validate or confirm any findings from your win/loss interviews? For example—let’s say a recurring theme in your loss interviews was lack of customer support, and you see multiple reviews praising your competitors’ support offering. In that case, your findings in your loss interviews are being validated and should signal to leadership the need for a change in strategy.

Conversely, you should be able to do the same thing for won deals. Let’s use the same example but in reverse—let’s say that a big reason for your wins was that you had excellent customer support. Now head back to the reviews and you’ll potentially see negative feedback on your competitors’ lack of or poor customer support. Surface that in your win/loss analysis and share with the rest of your team so that sales and marketing will play up customer support in conversations with prospects and include it in more collateral.

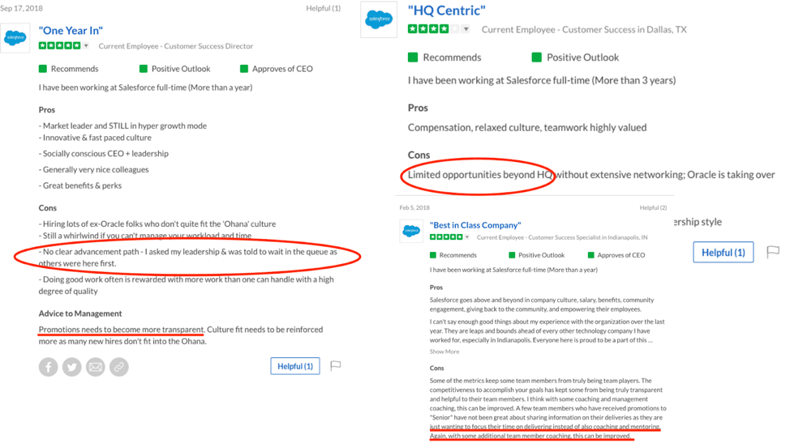

Glassdoor Reviews

You might be thinking—what do competitors’ employee reviews have to do with why we might be winning or losing deals? A lot more than you might think.

Employer reviews are interesting because people tend to be pretty gloves off when it comes to reviewing their company (or former company) anonymously. Sure some reviewers might be jaded, but both positive and negative reviews can be indicative of which areas your competition is beating you and where they are struggling to gain ground.

Another example—a customer success employee at your competitor’s company gives negative feedback about lack of career advancement and training within their department. Those things can signal a lack of investment in services overall and potentially validate some of the reasons for the deals you won.

Overall, you can treat employee reviews similar to third party product reviews—pull out key, high-level themes and then compare them to your win/loss analysis to see what’s validated—and what’s new.

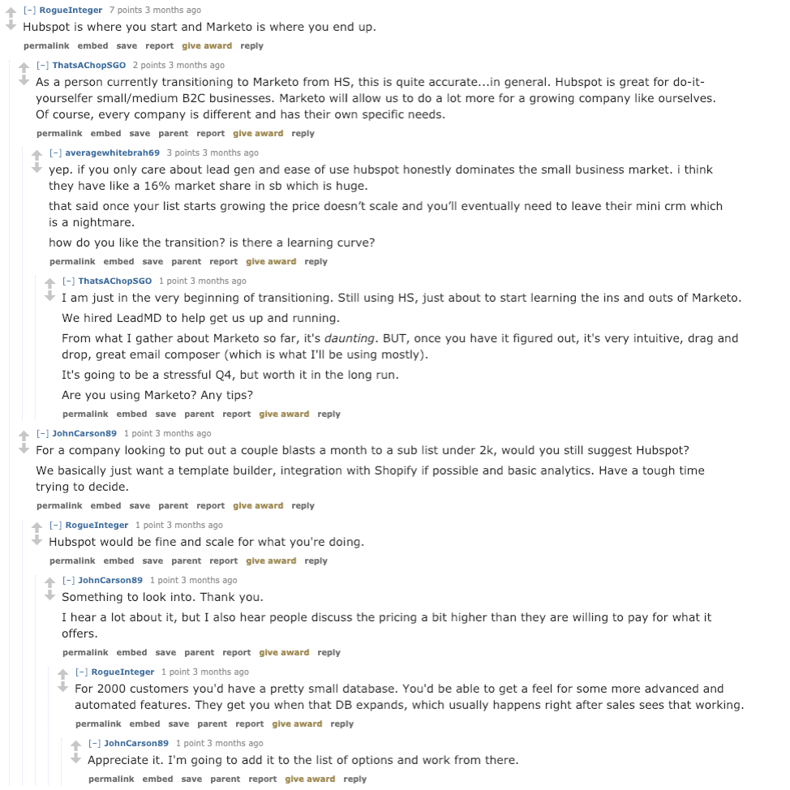

Forums

Forums like Reddit and Quora are where people go for honest answers about you and your competition. They want to hear and interact with other practitioners in their field in an open manner—without plugging or interference from vendors.

I’m a big fan of forums because not only do I find them personally helpful, but they are a treasure trove of intelligence that offers you an unfiltered view of what your target prospects are saying about you and your competitors in the market.

Head over to Reddit and see if your industry has a dedicated subreddit. If so, you’re bound to see some interesting threads on redditors asking for advice on the best email marketing software, or best CRM software, etc. Similar with reviews, pull out key themes from Q&A threads and run it against your win/loss analysis.

Just be wary of chiming in—these forums, and Reddit in particular, can be quite hostile to vendors. If you must, make sure to be helpful and not to overtly plug your company/product.

Integrating This Data into Your Win / Loss Analysis

As mentioned previously in the post, each of these qualitative data types are excellent sources to enrich the data you gathered in your win/loss analysis. Take screenshots and link to reviews and threads that validate major reasons for your wins/losses. This takes your audience (presumably, your sales and leadership teams) out of the internal data gathering and shows them real examples of how prospects are speaking about you and your competition.

While a formal win/loss analysis usually happens periodically, these intelligence types should also be used as part of your ongoing competitive intelligence program. Keeping track of these intelligence types on a weekly or daily basis, and sharing them with your sales team, can help you react quickly to any moves your competitor might make throughout the year—without having to wait for a formal win/loss analysis.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking