Last month, we began collecting responses for our 2024 State of Competitive Intelligence survey. So far, of the 106 people who have completed the survey, 62% have said they struggle to gather information about their competitors in a timely manner.

Why? One reason is the simple fact that companies have a lot of competitors. To give you a sense of what “a lot” means, the median Crayon customer uses our platform to track 32 competitors—nearly 3 dozen!

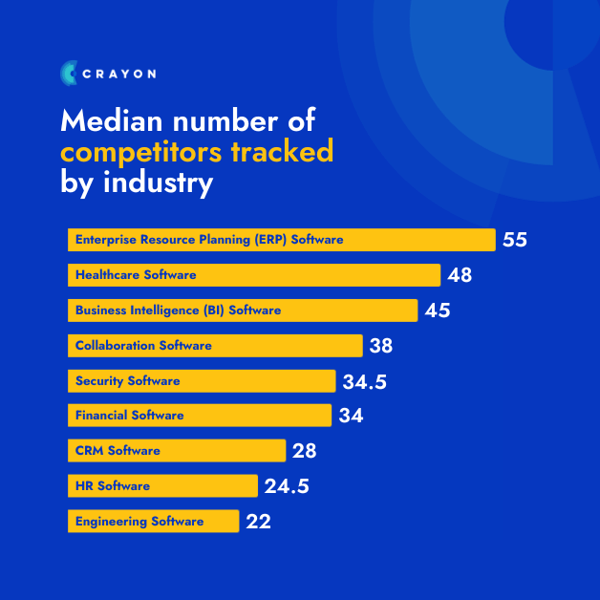

That’s good to know, but it’s not a very helpful benchmark; there’s too much variability from one industry to another. So, we calculated the median number of competitors tracked by Crayon customers across 10 B2B software industries:

The median healthcare software company tracks twice as many competitors (48) as the median HR software company does (24.5). Several factors could explain this difference. It could be that the pace of innovation is faster in the former industry than it is in the latter. Or maybe the pace of consolidation is faster in the latter than it is in the former. Or maybe the people who lead healthcare software companies tend to be really, intensely focused on their competitors.

There’s a lot of nuance at play and I’m not an expert in any of these industries. I’m just the guy with the numbers.

As any good Number Guy would do, I looked at the bar chart you see above and wondered: Would this chart look the same if it were measuring battlecards rather than competitors?

The answer is … sort of. As you can see below, ERP software is once again at the high end of the spectrum, with the median company creating 28.5 battlecards. Meanwhile, engineering software is once again at the low end of the spectrum, with the median company creating 12 battlecards.

.png?width=600&height=600&name=Competitors%20tracked%20%2B%20battlecards%20created%20%2B%20ratio%20(1).png)

But here’s what really jumped out to me: The median healthcare software company tracks 48 competitors and creates only 12 battlecards. In other words, they create 1 battlecard for every 4 competitors they track. Meanwhile, the median CRM software company tracks 28 competitors and creates a battlecard for nearly every single one.

To better illustrate this point, I calculated the ratio of competitors tracked to battlecards created for each industry. I did this by taking the number in the first chart and dividing it by the number in the second chart.

.png?width=600&height=600&name=Competitors%20tracked%20%2B%20battlecards%20created%20%2B%20ratio%20(2).png)

This fascinates me. In the healthcare, business intelligence, and financial software industries, it’s normal to track a competitor without creating a corresponding battlecard. In the collaboration, security, and CRM software industries? Not so much.

Again, several factors could explain the difference. It could be that competitive intel teams in the healthcare software space are reluctant to create battlecards—or, conversely, maybe they’re eager to keep tabs on indirect competitors. Another potential explanation is that CRM software companies more closely follow the traditional SaaS model, with a hefty emphasis on helping sales win deals.

In any case, I hope you found this data helpful (or at least interesting). For more industry-specific data, read this blog post. To learn how to prioritize your competitors, read this blog post. To learn how to create better battlecards, read this ebook.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

.png?width=500&name=Sales%20Enablement-What%20is%20SE_%20(2).png)