Editor's note: The following blog post is based on data from the 2021 State of Competitive Intelligence Report. To get the latest insights, download the 2022 report.

If I had to summarize the brand new 2021 State of Competitive Intelligence Report with a single word, I’d use the word revenue. Now more than ever, companies are growing their revenue by tracking, analyzing, and acting on their competitors’ movements.

This raises an important question: How?

If you were to look at all the companies that are yielding returns on their competitive intelligence investments, what commonalities would you observe?

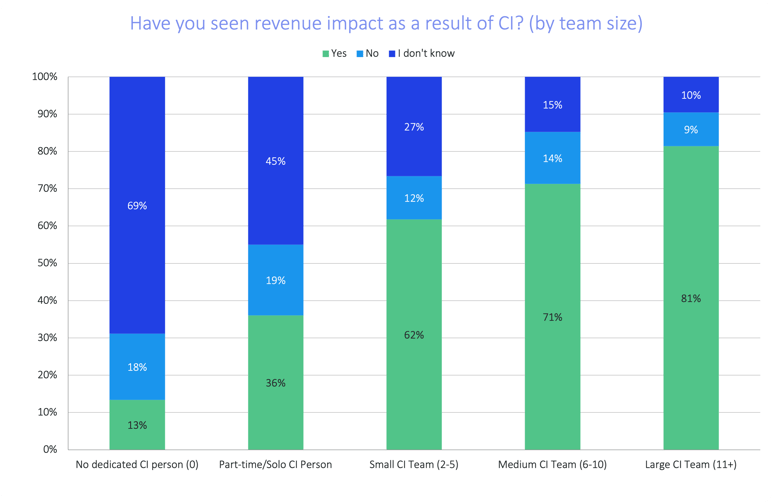

Two obvious commonalities come to mind: big teams and big budgets. Compared to companies with small CI teams (2-5 people), those with large CI teams (11+ people) are 31% more likely to report direct revenue impact as a result of competitive intelligence.

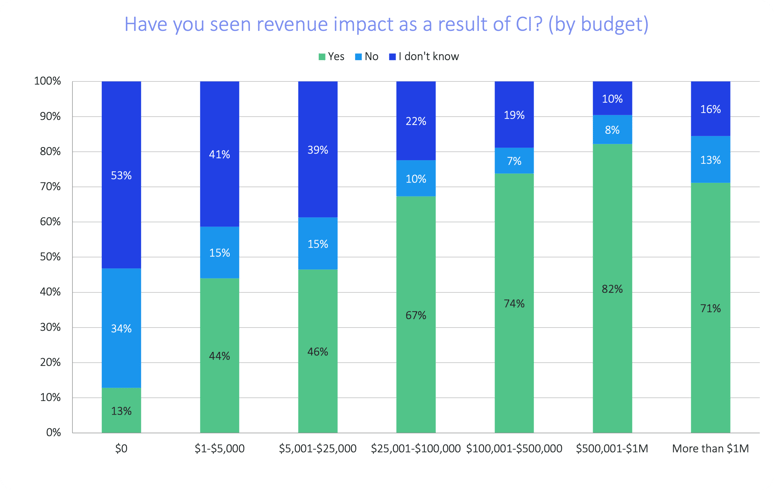

And compared to companies with CI budgets in the $25,001-$100,000 range, those with CI budgets in the $500,001-$1M range are 22% more likely to report direct revenue impact.

Interesting? Sure. Actionable? Not quite. Sadly, neither headcount nor budget is magically falling out of the sky any time soon. But here’s the good news: Amongst companies yielding returns on their CI investments, big teams and big budgets are far from the only commonalities.

After carefully reviewing the data, we’ve compiled a list of five steps you and your colleagues can take to get more value out of competitive intelligence. To be clear, this is not a list of silver bullets; we are not suggesting that these action items will yield the same magnitude of impact as, say, a 400% increase in budget.

Here’s what we are suggesting: Even with no additional budget and no additional headcount, you have the power to level up your CI program. It’s a matter of executing the right tactics.

Without further ado, here are five data-backed ways to get more value out of CI.

1. Establish KPIs

Trying to optimize your CI process without key performance indicators (KPIs) is like trying to do a cross-country road trip without Google Maps. You might luck into a correct turn every now and then, but at the end of the day, you’re shooting yourself in the foot.

KPIs are essential because they enable you to determine which decisions are successful and which ones are not. Let’s say you’re about to launch some kind of competitive initiative with the primary objective of helping your sales team win more deals. Without any way to measure the change in your win rates, you’ll have no idea whether your initiative was effective.

You can’t level up your CI program unless you consistently make good decisions, and you can’t consistently make good decisions unless you establish KPIs.

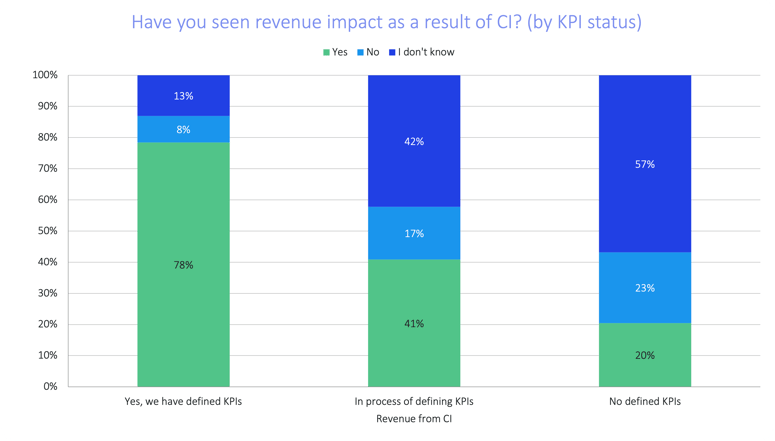

Here’s the data to back it up: Compared to companies without competitive intelligence KPIs, companies with KPIs are four times more likely to report direct revenue impact as a result of CI.

And if you’re wondering which KPIs to use, think in terms of specific goals. If you’re trying to win more deals, you should measure win rates. If you’re trying to build a better product, you should measure retention and ARR. The list goes on and on.

2. Establish quantitative KPIs

KPI is a pretty broad term — we should be more specific. Whereas a qualitative KPI is based on subjective inputs, a quantitative KPI is based on numbers.

Sales team confidence (via survey) is an example of a qualitative KPI. You could share statistics based on the survey responses — e.g., 18% of our sales reps say they feel “very confident” — but the responses themselves are inherently subjective.

Win rate, on the other hand, is a quantitative KPI. If your win rate increases by 11% YoY, that’s an objective measure of the impact you’ve made.

KPIs in general are powerful, but quantitative KPIs in particular are extraordinarily powerful.

Intuitively, this makes sense. Let’s say it’s been three months since you refreshed your sales reps’ email templates in order to better leverage competitive intel. Which of the following insights would be a more convincing indicator of success?

- Sales team confidence is up 16%.

- Our win rate against Competitor XYZ is up 28%.

Although the former is a nice soundbite, the latter is the superior insight — an unambiguous sign that your email initiative has been effective.

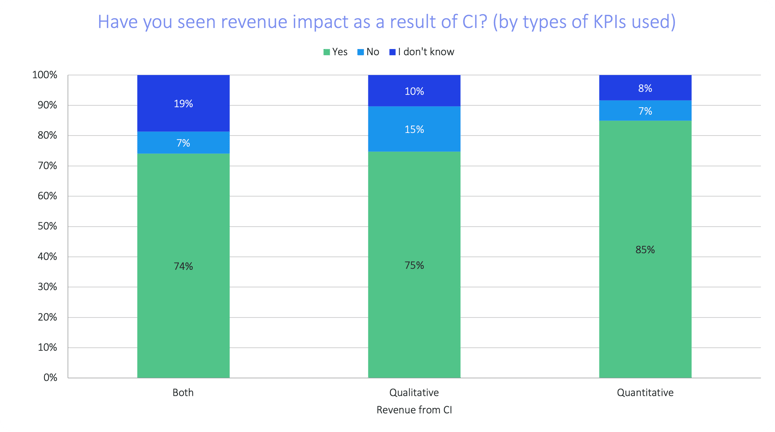

Again, we’ve got the data to back it up. Compared to companies using qualitative KPIs, companies using quantitative KPIs are 13% more likely to report direct revenue impact as a result of CI.

3. Drive battlecard adoption

While we’re on the topic of sales enablement, let’s take a moment to focus on battlecards.

As you probably know, a battlecard is a piece of content designed to make it easier for your sales reps to position your solution against that of a competitor. For obvious reasons, the battlecard is one of the most common outputs of the competitive intelligence process.

Unfortunately — and for a number of reasons — it’s not a guarantee that each of your reps will automatically adopt a new (or refreshed) battlecard as soon as it’s published. If, in other words, you don’t proactively take steps to drive battlecard adoption, there’s a chance your competitive insights will be put to use far less often than they should be.

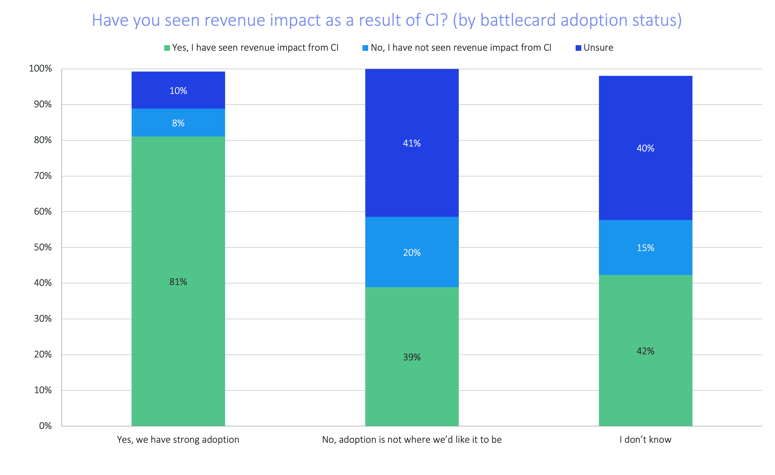

And if you’re thinking the consequences of weak battlecard adoption are marginal, you’ve got another thing coming: Compared to companies that are unhappy with current levels of battlecard adoption, companies with strong adoption are more than twice as likely to report direct revenue impact as a result of CI.

Pro tip: One surefire way to improve battlecard adoption is to set aside time with your reps for in-depth, highly tactical training sessions.

4. Share CI on a weekly (if not daily) basis

We opened this blog post with the assertion that, now more than ever, companies are growing their revenue by tracking, analyzing, and acting on their competitors’ movements.

We’ve emphasized the final phase of the process — activation — for a reason: It’s absolutely critical, and yet it’s not always executed to the extent that’s necessary for satisfactory ROI. It sounds painfully obvious, but it needs to be said: Failure to act on competitive intelligence renders useless all the time you spend on research and analysis (dozens of hours per week).

Of course, those who gather and analyze competitive intel are far from the only ones who act on it. Across the average B2B organization, everyone from sales and marketing to product and CS is a stakeholder in the CI process. Getting these stakeholders to take action is a key step towards succeeding with CI.

Catalyzing action across your company is a subject for another post, but here’s something you can internalize right now: Those who share CI frequently — i.e., at least on a weekly basis — are the ones who tend to see results.

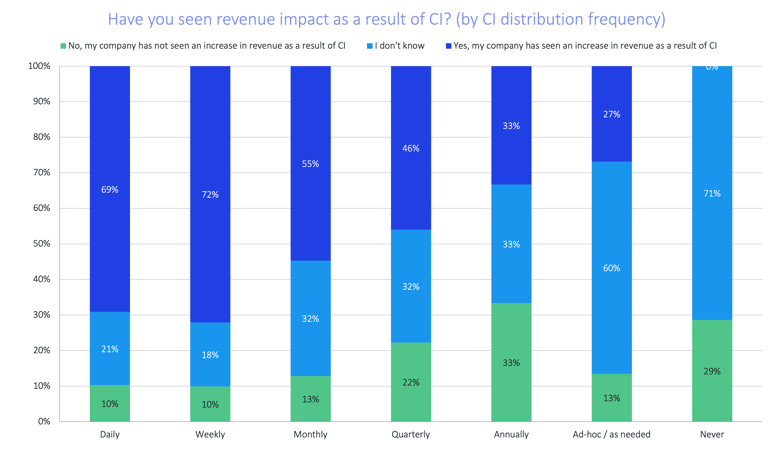

More specifically, compared to companies that share CI on a monthly basis, companies that share CI on a weekly basis are 31% more likely to report direct revenue impact.

5. Embrace technology

The negative impact of spending too much time conducting manual research is twofold:

- You have less time to take action — train sales reps on the ins and outs of battlecards, communicate insights to key stakeholders, etc. — which, in turn, reduces ROI.

- You’re at greater risk of analyzing and acting on insights that are no longer relevant, which further reduces ROI.

Only by embracing competitive intelligence technology can you both (1) give yourself and your colleagues more time to initiate action and (2) capitalize on real-time insights. Note that we’re not suggesting that buying a solution means putting your CI program on autopilot; it means improving the quality of your intel while enabling your team to get more value out of that intel.

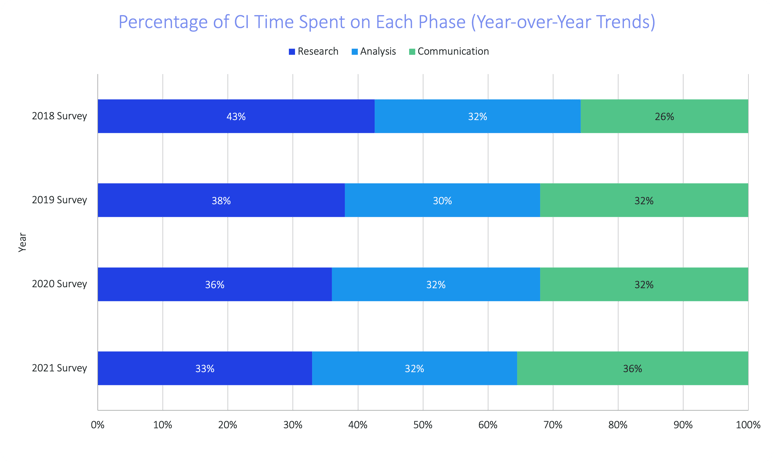

If you can find a way to reallocate existing budget towards CI technology, chances are you’ll see positive returns. And if you’re not convinced, consider this: Between last year and this year, we can observe a 13% jump in the amount of time spent communicating competitive insights …

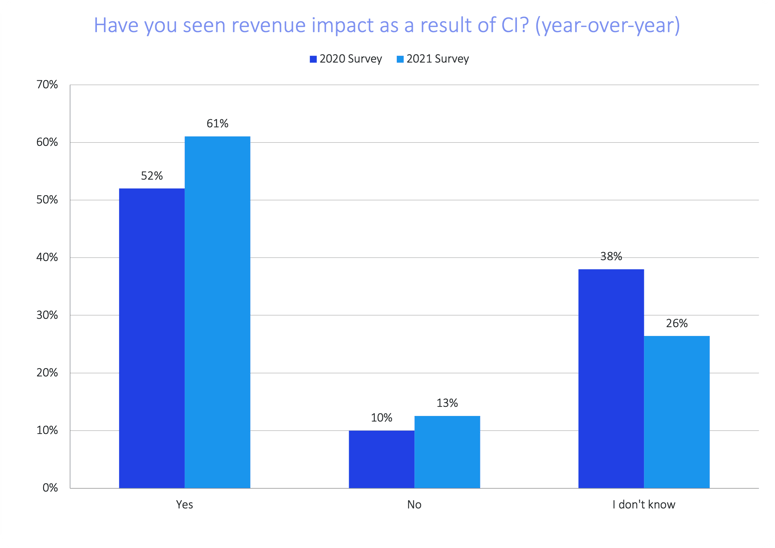

… as well as a 17% jump in the number of businesses yielding ROI from their CI programs:

Coincidence? We think not.

Get your free copy of the 2021 State of CI Report

You need neither an enormous team nor an enormous budget to get value out of competitive intelligence. At the end of the day, you’re using information to build and maintain a competitive advantage in your market — and there’s so much more to that than simply hiring and spending.

Experimenting with new tactics and deliverables. Helping sales reps internalize and leverage the insights you uncover. Enabling marketers, product managers, and executive leaders to make the right decisions at the right times. Different CI practitioners will approach these duties in different ways, but one thing is true for everyone:

It never hurts to stay in the loop. Get your free copy of the 2021 State of CI report here.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

.png?width=500&name=Sales%20Enablement-What%20is%20SE_%20(2).png)