98% of the stakeholders we surveyed for the 2022 State of Competitive Intelligence Report said that CI is at least somewhat important to their success.

That’s up from 86% in 2020—a handsome increase over the course of just two years.

Obviously, this is good news for you, the CI practitioner. Product managers, marketers, sellers, and executive leaders are now more reliant on real-time intel than they’ve ever been—which means that, in the eyes of these stakeholders, your work is indispensable.

This positive trend, however, is not only cause for celebration—it’s also cause for ambition. Now is the time to elevate your CI function from good to great.

To help you do just that, we’ve combed through the latest edition of the State of CI and identified the following five action items:

- Expand intel collection beyond your direct competitors

- Develop a system for capturing field intel

- Start building a win/loss program

- Define an initial set of KPIs

- Meet your stakeholders where they already live

To be clear, we don’t expect you to check each of these boxes in the next ten months—that would be a herculean feat, especially if you’re a solo PMM wearing a dozen hats. Rather, our goal with this post is to help you focus your limited time and energy on initiatives that will pay dividends.

Sound good? Let’s get started.

1. Expand intel collection beyond your direct competitors

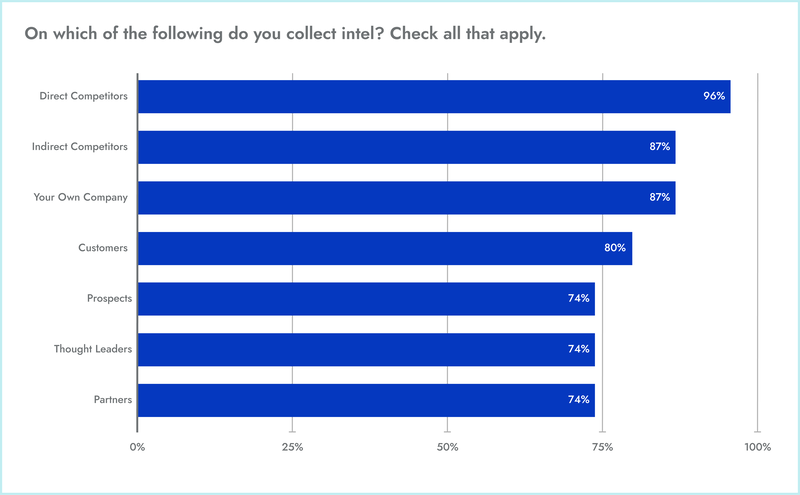

Unsurprisingly, direct competitors—i.e., companies with which you go head-to-head for revenue and market share—remain CI practitioners’ primary focus.

This isn’t a bad thing; in fact, we’d be alarmed if this weren’t the case. Direct competitors stand, well, directly in the way of customer acquisitions and renewals, and for that reason, they demand the closest attention.

But to give all your attention to direct competitors is to set yourself up for failure—and we say that for two reasons:

- Indirect competitors can swiftly become direct competitors. This is especially true in a world shaped by COVID, where companies—as a means of survival—have learned how to pivot and innovate with remarkable speed. Neglect your indirect competitors and you’ll leave yourself vulnerable to getting blindsided—and losing the confidence of your peers.

- Yours is not the only messaging to which your audience is exposed. Indirect competitors, thought leaders, and partners are all, by definition, entities with which you share a common audience. Understanding how they interact with that audience is critical if you want to clearly communicate (and differentiate) what you bring to the table.

If you’re unsure who your indirect competitors are, a simple place to start is with a Google search for “best tools for [insert target audience].” And if you’re unsure who your niche’s thought leaders are, start by checking out the speaker lineups at some upcoming industry events.

2. Develop a system for capturing field intel

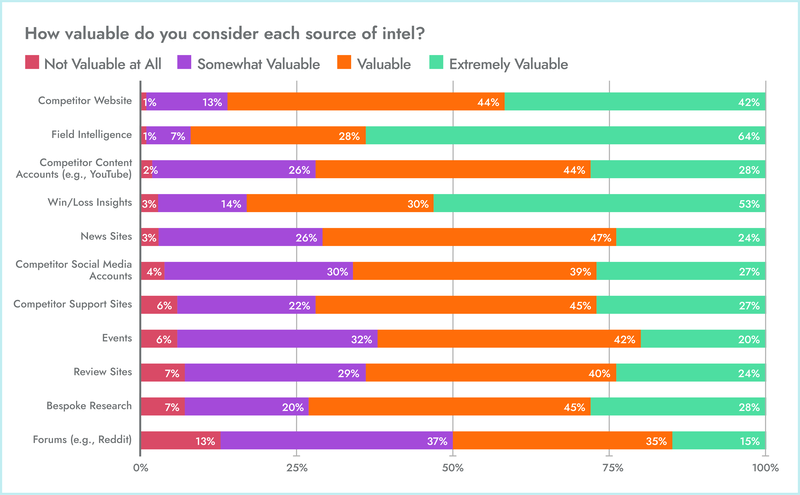

Once again, field intel—which is sourced by your colleagues, typically those who work in sales and account management—has been deemed the holy grail of CI, with 64% of practitioners describing it as “extremely valuable.”

The challenge with field intel is not generation, but rather distribution. Every day, across hundreds of conversations with prospects and customers, your colleagues are naturally exposed to information about your competitors. Unfortunately, it can be difficult to get those colleagues to (1) appreciate the impact of sharing this information with you and (2) actually share this information with you.

Tactics to overcome these difficulties include:

- Centralize the conversation in a dedicated Slack/Teams channel. This is a stone that kills two birds. First of all, by creating a channel dedicated to field intel, you reduce the risk of valuable information being locked away in private DMs. Secondly, by engaging with those who share intel—for everyone else in the channel to see—you make it clear that the intel is impactful, thus encouraging others to get involved.

- Spotlight top contributors in your competitive newsletter. Just like the Slack/Teams channel, this helps to underscore the impact of field intel and reinforce good behavior.

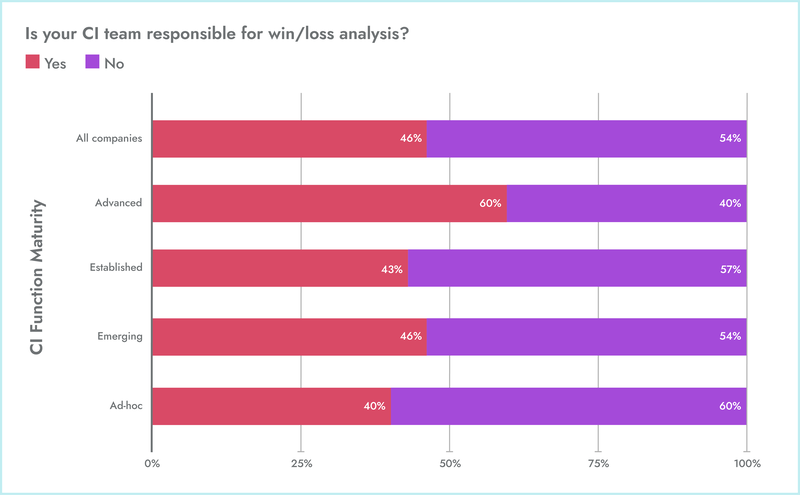

3. Start building a win/loss program

As you can see in our previous chart, win/loss analysis is the only other source of intel that’s considered “extremely valuable” by the majority of CI practitioners (53%). Less than half of CI teams, however, are responsible for their companies’ win/loss programs.

Assuming you have at least one executive sponsor—your head of sales, for example—who supports the creation of a win/loss program, it’s critical that you take some time, at the outset, to speak with this person about their goals and hypotheses.

What, specifically, does this person want to get out of your fledgling win/loss program? Do they want to win more deals against a certain competitor? Do they want to win more deals with customers of a certain size? Do they want to improve the process by which prospects are (dis)qualified?

And what, specifically, does this person suspect is going on? Do they think Competitor X does a better job of positioning Feature Y? Do they think your sellers are ill-prepared to work with enterprise companies? Do they think you’re selling into the wrong set of industries?

Answering questions like these at the outset helps to ensure that your first batch of win/loss interviews is efficient and actionable—because you’ll be asking the right questions to the right people—thus generating momentum for your program and making it easier to secure buy-in from additional stakeholders.

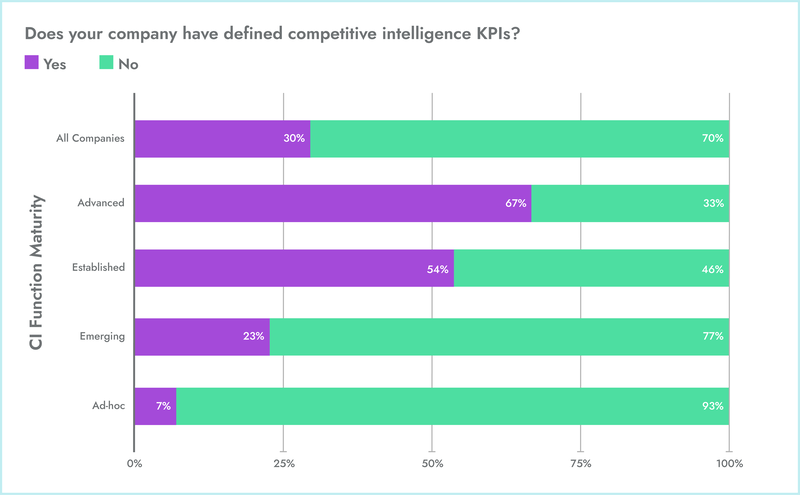

4. Define an initial set of KPIs

At this point, just under one-third of CI teams are measuring their impact with a defined set of key performance indicators (KPIs).

For a time-crunched, resource-constrained CI practitioner, KPIs deliver value in two key ways:

- They help you focus on what matters most, and

- They help you make the case for additional buy-in, budget, and headcount.

Candidates for your initial set of KPIs include:

- Engagement with deliverables. This encompasses everything from the number of messages sent each month in your field intel Slack channel to the number of unique views of your Competitor X battlecard.

- Competitive win rate. This is calculated by dividing the number of closed-won competitive opportunities by the total number of competitive opportunities. Consider segmenting this not only by competitor, but also by industry, company size, buyer persona, and sales team.

- Stakeholder feedback. Ultimately, CI is not about your competitors, but rather your stakeholders—the people you’re empowering to work more confidently and efficiently. Simple surveys go a long way towards determining how these folks are feeling about the competition and where they need additional support.

5. Meet your stakeholders where they already live

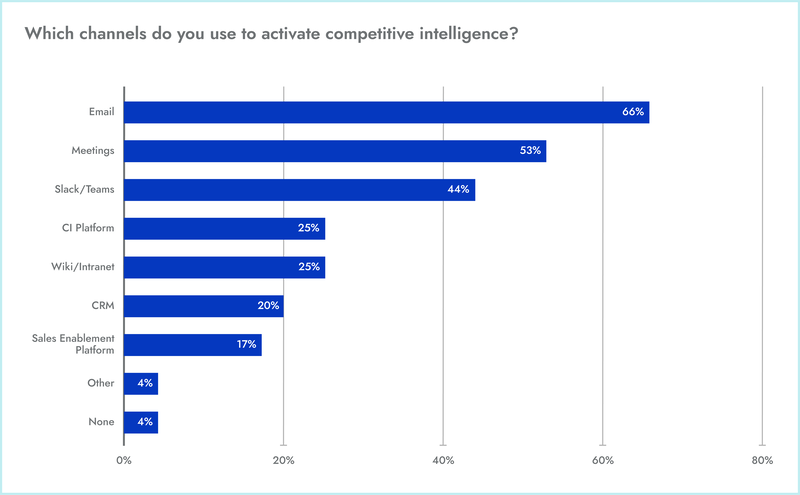

If engagement with a particular deliverable is lower than you’d like it to be, one potential explanation is that it’s not properly integrated with the workflow of the target audience. Although two-thirds of CI teams are supporting sellers with battlecards, only 20% are activating intel via CRM, and only 17% are activating intel via sales enablement platform.

Those seeking support for their CI programs often find themselves in Catch-22s: To earn support, they need to deliver value, which they attempt to do through assets like battlecards. But stakeholders (e.g., sellers) may be reluctant to adopt such assets until they’re convinced that CI is valuable.

This is why it’s so crucial to make it as easy as possible for stakeholders to access and understand the deliverables you create for them. If an AE is skeptical about the value of CI, there’s no way they’re digging up a battlecard that’s hosted in Microsoft Word. But a battlecard that’s embedded directly in Salesforce? That has a much better chance of being used—and if it’s a good battlecard, that first use certainly won’t be the last.

Get all the insights from the CI industry’s largest and longest-running survey series

Believe it or not, this blog post has only scratched the surface of what you’ll find in the 2022 State of Competitive Intelligence Report. Click the banner below to get your free copy and learn all about the ways in which companies are supporting, practicing, and measuring CI!

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

.png?width=500&name=Sales%20Enablement-What%20is%20SE_%20(2).png)