Are you feeling in a rut with your competitive intelligence (CI) deliverables? Want some ideas to help you take the content to the next level? Below are some different ways to spice up your battlecards, competitor profiles, and other competitive intelligence content to make them more engaging. Pick and choose the best from this list for your team and business!

Competitor Overview

Everyone wants to know the basic facts about the competition, and collecting those in one place makes it easier on your team to find them. The basic information includes company name, website, headquarters, and financial performance.

Since this information doesn’t change often, you can add one or more of the following options to make it even more robust and relevant for your teams:

- Target Markets: the key segments that the competitor pursues. You can provide prioritization or importance weighting of certain markets to help your team understand where they are most competitive.

- Target Verticals: the key industries that the competitor pursues. Again, prioritization or weighting can be helpful, in addition to strengths or weaknesses for particular verticals. Keep it high-level here, and break out any deeper discussions in a Use Cases section (see below).

- Customers: named or known customers of the competitor. A great first step is to gather these from the company website. Listing logos can add some visual interest, and identifying what parts of large companies are customers if known can add more value.

- Partners: Similarly to customers, you can add logos of key partnerships. Any information about how the partnership operates can add relevance.

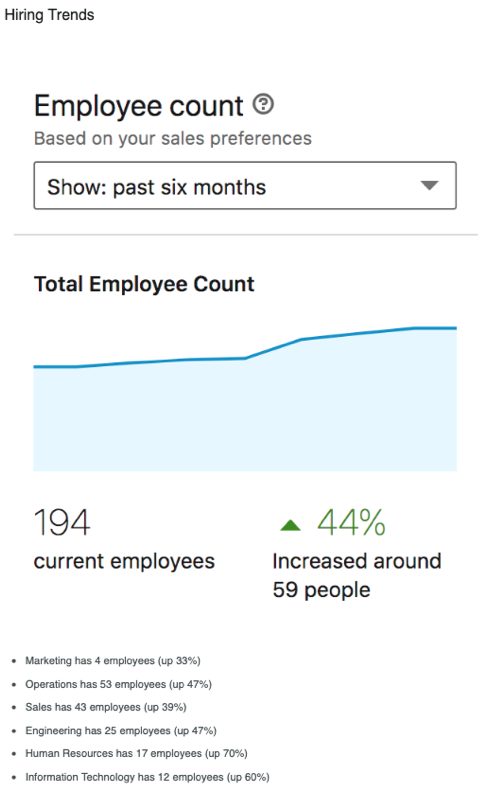

- Hiring Trends: growth or shrinkage in hiring by the competitor. Identifying specific departments doing a lot of hiring can be very helpful in understanding where the competitor is investing.

Source: LinkedIn

- Human Resource Profile: a breakdown of employee distribution at the competitor. You can combine this with trends or include the HR profile of the most competitive business unit(s).

- Geographic Reach: a breakdown of key geographies and locations. You can combine this with the Human Resource Profile to create a deeper understanding of the competitor’s commitment to specific geographies. Incorporating a map will appeal to visual learners, and many companies publish one on their websites.

- Merger/Acquisition History: a timeline of ownership changes for competitors in accelerating consolidation or divestment. This can combine well with both HR Profile and Geographic Reach to create a more comprehensible narrative of the competitor’s business changes.

- Important Background: a summary of the competitor’s business trajectory, or information about a relevant business unit of a larger organization.

- Key Takeaways: a summary of the most important information about the competitor across different areas.

Competitive Tactics

After summary information about the competitive business, the next highest priority is helping sales and other external-facing teams. You should focus on brief, targeted information that they can use in tactical situations and communications with prospects and customers. Here are the most common topics:

- Kill Points: a list of short statements that will help disqualify competitors early on in deals. Kill Points are great, fast ways to put a competitor in a box that makes it hard for them to establish credibility with a buyer. It is good to provide training or context that these will be less effective when a competitor has made progress in a deal. (Other titles: Quick Dismiss; Silver Bullets; Questions to Ask)

- Warning Signs: a list of verbiage, concepts, or framings that signal a competitor is in a deal. Salespeople can listen for these clues with prospects who are reluctant to name who else they’re evaluating. (Other titles: Watch Your Step; What to Listen For; How to Know ____ is in Your Deal)

- Landmines: a list of topics or questions that customers might ask that put your company at a competitive disadvantage. Usually, these are more direct versions of competitive Strengths. You should also include ways to redirect the conversation to your company’s strengths. (Other titles: Trap Questions; Topics to Avoid)

- Competitor Glossary: a list of words that the competitor uses in the sales cycle. They might relate to the competitor’s products, methodologies, or philosophy. It’s best to include some context so that your field teams know how to use this glossary.

- Win Draw Loss: a short summary of where your company excels, is even with, and beats the competitor. This may have a deeper dive in Go-to-Market comparison sections or relate to content in Win/Loss material. (Other titles: Competing with _____; How We Win; How We Lose; What Makes Us Better; Why We Win; Where We Win - Their Weakness - Our Advantage; Where They Win; Claims and Counters)

- Competitive Stats: statistics about your competitive history against the other company. Obviously, this will only be helpful if there’s a clear advantage historically.

- Copycat Examples: examples of how a competitor has mimicked your company’s innovations. These might be product-focused or broader business strategies, and sales reps can use these to paint the competitor as a follower instead of an innovator.

- What They Say About Us: examples of how the competitor’s reps talk about your company. These stories will come from your reps, and you can provide accompanying questions to help reps identify and explore the competitor’s framing of your solutions and company.

Win/Loss Material

Sales reps thrive on stories, so you can take advantage by providing them with win and loss material on your battlecards.

- Success Stories: examples of customers that were won in a competitive deal. The more that these reflect the realities of the field, the better. Try to provide practical advice directly from the mouths of the winning sales rep. Even better, have that person record a video that other reps can watch to help your team win more competitive deals. (Other titles: Win Stories; Latest Win)

- Loss Stories: examples of deals that were lost to the competition. Unlike the Success Stories that you publish, these should be generic so that you don’t embarrass a rep. Find specific moments in the sales process where opportunities were missed to change the narrative. (Other titles: Cautionary Tales)

- Top Loss Reasons: a list of specific competitive loss reasons. Make these reflect your CRM reporting, and give some advice on how to steer the deal away from a competitive loss for each reason.

- Replacement Stories: examples of when you’ve sold to a former customer of a competitor. You can include key moments in those rip and replace deals to highlight themes that can help in any competitive opportunity. (Other titles: Switch Case Study; RIP _____; Where We Replaced Them)

Go-to-Market Summaries

Many companies like to capture information about how their competitors approach the market. These categories are commonly listed as comparisons side-by-side in a table, so that the differences between the company’s and the competitor’s offerings are clear. Doing so has the side benefit of reinforcing how your team should be talking about your solutions.

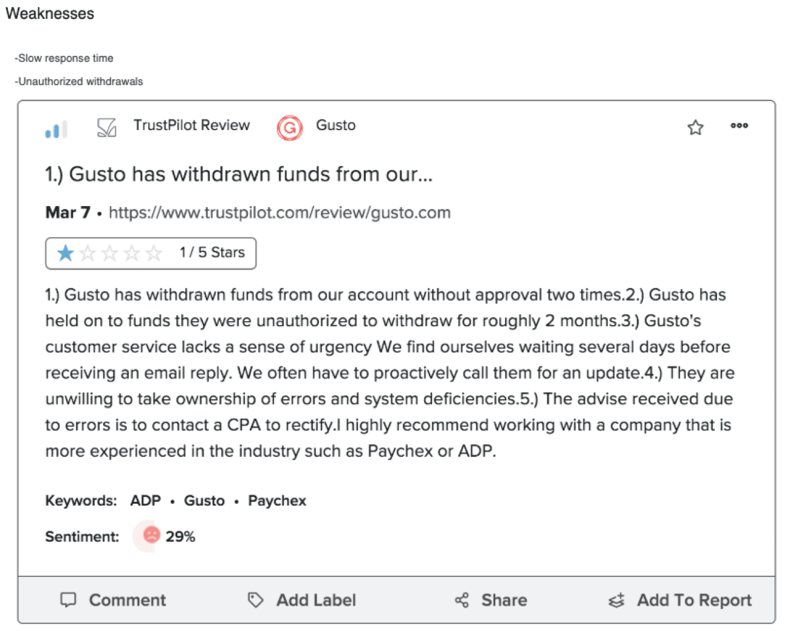

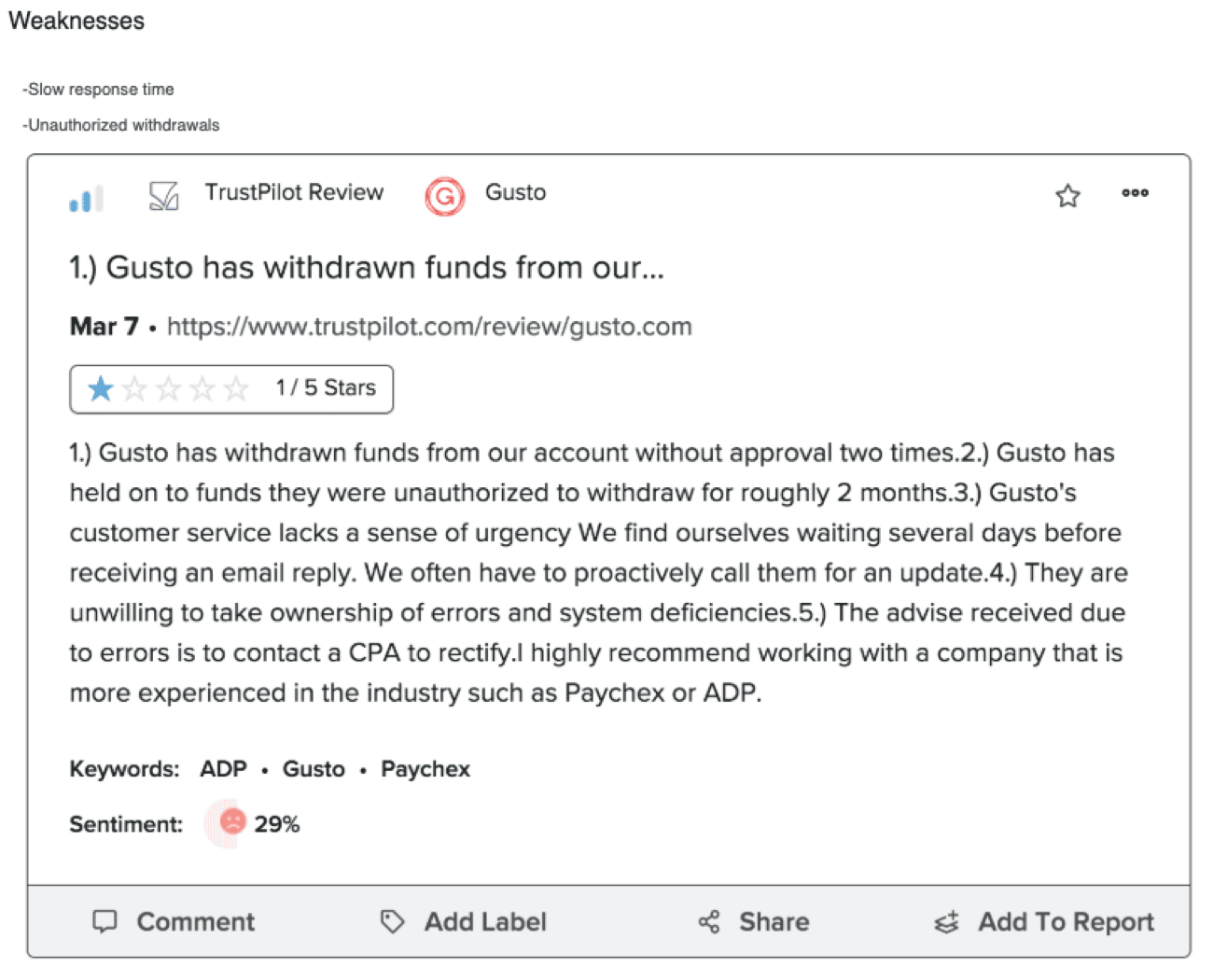

- Weaknesses: the competitor’s weaknesses as a company and as a product. Though a bit counter-intuitive, putting this ahead of Strengths focuses your team’s attention on weaknesses first.

- Strengths: the competitor’s strengths as a company and as a product. Unless you’re in very feature-focused deals, it makes sense to frame these in terms of your central value propositions more so than technical advantages.

- Key Differentiators: a list of what makes your products a better choice for companies, usually in juxtaposition with your competitor’s perceived strengths. This is often used as a summary of Strengths and Weaknesses.

- Messaging: a summary of how the competitor messages to the market. (Other titles: Messaging - their words; In their own words)

- Value Proposition: a description of how the competitor talks about their value to customers. The more that these can reflect your personas and be framed as a response to your value propositions, the better. (Other titles: Customer problems; Company strength - competitor weakness)

- Positioning: a description of how the competitor positions against you in deals.

- Pricing Strategy: a description of how the competitor structures pricing, packages, and proposals. You should focus on different pricing metrics (e.g., by the user instead of by deployment).

- Pricing and Packaging: a more detailed description of all of the pricing elements, as opposed to the summary information in a Pricing Strategy section.

- Contract Strategy: a summary of non-price related contracting considerations like length, legal terms, or other elements that might affect discussions with customers.

- Case Studies: the key customer stories that the competitor uses to prove their value. Targeted questions around weaknesses or unknowns in the case studies are great additional context for sales to see here.

Updates

A final area that will keep attention on your battlecards and competitive profiles are competitive updates. It’s great to put these at the top and ensure that you’re keeping up-to-date, as well as finding creative ways to let your teams know that they’re updated.

- Latest News: a generalized list of what announcements, news stories, and press releases that have appeared for the competitor.

- Important News: rather than the most recent, you might focus on the most relevant or impactful news about the competitor.

- Recent Key Takeaways: taking more of an analytical approach, you can capture the key interpretations of the latest competitive updates or trends.

- Latest Field Intel: a highlight area for the information that comes back to you from the field. Using this to advertise the strongest intel you’re getting for sales helps drive interest in getting more information, so take advantage of that competitive spirit.

- Executive Changes: while not something that you would necessarily use all the time, this update section can be very useful for sales to know when an executive change does happen.

With more options and more interest, you can create a lot of velocity for your competitive intelligence (CI) program. Take the above list as a starting point to create more traffic and communication to elevate the visibility of CI throughout your company.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking