Sales battlecards (also known as competitive battlecards, or simply as battlecards) give your sellers the facts, tactics, and materials they need to win competitive deals.

Before we go any further, a note for those of you who prefer to watch rather than read: Everything covered in this blog post is also covered in this video!

Produced by nearly two-thirds of competitive intelligence (CI) teams, battlecards are growing more popular by the day—and for good reason: A whopping 68% of sales opportunities are competitive.

Whether you’re trying to create your company’s first-ever battlecard from scratch or improve the battlecards that you’ve inherited from somebody else, you’ve come to the right place. By the time you’re done reading this blog post, you’ll have an answer to each of the following questions:

- What is a battlecard?

- How do you use battlecards?

- What do you put in a battlecard?

- What do battlecards look like?

- How do you make battlecards?

- How do you drive adoption of battlecards?

Let’s get started!

What is a battlecard?

A battlecard is a resource designed to help your sales team when they go head-to-head against a particular competitor. As an example, if you were hired by Slack to create battlecards for their sales team, you’d create one for Microsoft Teams, one for Mattermost, one for Rocket.Chat, and so on.

Traditionally, battlecards were static documents built by marketing, buried in a shared drive, and forgotten by reps. Today, the best teams treat battlecards as dynamic, AI-powered assets — automatically updated, integrated into rep workflows, and deeply connected to revenue. Platforms like Crayon make that possible.

How do you use battlecards?

Different sellers will use the same battlecard for different reasons. To a new hire, a battlecard is an educational tool—something they need to study in order to reinforce their training and get up to speed quickly. To a veteran, a battlecard is more of a content hub—a one-stop shop for the latest datasheets, slide decks, etc.

Because different sellers have different needs, some CI teams create multiple sales battlecards for each competitor. Returning to our Slack example, you may decide to create a Microsoft Teams battlecard for your BDRs (little detail, designed to make them better at cold calling) and another for your AEs (more detail, designed to make them better at running demos).

As we’ll discuss later in this post, you need to talk to your sales team before you create battlecards. Don’t assume that you know what they need. Everyone uses battlecards differently.

Competitive comparisons vs. battlecards

Competitive comparisons and battlecards are not the same thing—but they’re closely related.

A competitive comparison is something you create to help yourself better understand the similarities and differences between your product and a competitor’s product. In other words, it’s an analytical tool. In some cases, it can also be a deliverable—your product management team, for example, may find it valuable—but it is, first and foremost, an analytical tool.

A battlecard, on the other hand, is strictly a deliverable—something you give to others to help them understand (and communicate) your differentiators. If you’re going to create a competitive comparison, it’s best to do so before creating the corresponding battlecard.

What do you put in a battlecard?

Whatever your sellers need to help them beat that competitor—no more, no less.

Emphasis on no more. A competitive battlecard should be concise. Sellers have neither the time nor the patience to read paragraphs. Give them a battlecard with too much information and they’ll dismiss it as yet another resource that’s of no use to them.

To determine what to put in a battlecard, you have to talk to your sales leaders. Why do your sellers beat Competitor X? Why do they lose to Competitor X? Are any of your customers former users of this competitor’s product? If so, why did they make the switch?

Your sales leaders’ answers to these questions will point you in the direction of your veteran sellers, with whom you should speak as well. The stories of their wins and losses will reveal what you need to include in your battlecard.

Once you’ve spoken with everyone and gotten an understanding of how you stack up against Competitor X, some of the things you may put in your battlecard include:

- Why We Win: What are the top 3 things that make your product superior, and why do these matter to your customers? Bonus points if you can (1) validate each differentiator with an actual customer story and (2) share examples of your top-performing sellers bringing these differentiators to life.

- Competitor Strengths: What are the top 3 things that make your competitor’s product superior, and how should your sellers respond when these come up in conversation? Again, bonus points for sharing examples of your top performers in action. Double bonus points for writing short paragraphs that your sellers can copy and paste into their emails.

- Recent Wins: Some sellers prefer to learn by speaking directly with their peers. Point them in the right direction by keeping a list of who’s having success against Competitor X right now. Bonus points if you can segment this list by use case, industry, company size, or some other variable that’s relevant to your team.

- Recent Field Intel: Did one of your sellers recently hear that Competitor X is outsourcing their customer support? Changing their packaging? Sunsetting a feature? It’s important to quickly make pieces of intel like these—accompanied by the so what—available to the whole team, as they can dramatically improve your sellers’ chances of winning their open deals.

- Landmines and Quick Dismiss: Battlecard content should help your sellers feel confident when they face the competition. Landmines to plant are two to three high impact questions that highlight your competitor's gaps. In the same vein, having some quick dismiss rebuttals are perfect for when a competitor is name-dropped by the prospect.

If there’s one thing you take away from this section, it should be this: It’s not your job to be the all-knowing CI expert. When it comes to battlecards, the most impactful thing you can do is keep tabs on who’s having success against each competitor and enable everyone else to learn from them.

What do battlecards look like? Here are 2 examples

Using the types of content listed in the previous section, your battlecard might look like this …

… or it might look like this:

Concise, scannable, and full of customer stories and live examples—that’s a great battlecard.

A couple more things to keep in mind as you’re creating your battlecards:

- Be accurate. All it takes is one piece of bad intel to lose the trust of your sellers.

- Be consistent. Using the same format for each of your battlecards will help your sellers find the information they’re looking for as quickly and painlessly as possible.

- Be brief. Sellers don't have time to read the equivalent to War and Peace — ensure your battlecards can be read quickly. It's often about getting in, getting the necessary info, and getting out.

ABC: accuracy, brevity, consistency—the 3 pillars of good battlecards.

How do you make battlecards?

The battlecards you see above were made using Crayon, the competitive intelligence software platform trusted by Gong, Dropbox, and ZoomInfo. If you’d like to create battlecards like theirs, here are some tips to help you convince your boss to buy Crayon.

If you’re not quite there yet, you can make your battlecards using these free customizable templates.

How do you drive adoption of battlecards?

In a perfect world, you’d create battlecards that adhere to the best practices we’ve outlined thus far, and every single member of your sales team would immediately use them exactly as you’d intended. They’d call you a genius, a visionary, and the next time you saw them in person, they’d greet you with a flawless dance number choreographed to You Make My Dreams Come True by Hall & Oates.

Much to my chagrin, we don’t live in a Joseph Gordon-Levitt movie. If you want your battlecards to get used as much as they should get used, then there’s two things you need to do:

- Make it effortless to find them.

- Get a handful of top-performing sellers to exhibit role model behavior.

How to make it effortless to find your battlecards

If you want sellers to actually use battlecards, make them easy to find — ideally, in the tools they’re already in every day, like Slack, Teams and Saleforce.

One of the simplest ways to do this in Slack is to bookmark battlecard links at the top of your team channels (like #competitive-demo or #sales-chat). That way, anytime a rep needs quick intel in the middle of a conversation, it’s just one click away.

💡 Pro tip: Bookmark battlecards for different competitors, or different roles (like AE vs BDR), so everyone has fast access to the version that’s most relevant to them.

Using Microsoft Teams instead? You can take the same approach by embedding battlecard links directly in your Teams channels or tabs. That way, reps always have quick access to competitive intel — no matter which platform your team uses.

.png?width=2738&height=1606&name=Screenshot%20by%20Dropbox%20Capture%20(4).png)

Slack and Teams aren't the only place your sellers need quick access to competitive intel. Your CRM — whether it’s Salesforce, HubSpot, or another — is where reps live during live opps, so it’s critical to embed battlecards there too.

By integrating Crayon directly into your CRM, sellers can pull up the right battlecard the moment a competitor is added to an opportunity — no digging, no delays.

💡Pro tip: Make battlecards available in two spots:

-

At the opportunity level, so reps can get competitor-specific guidance in live deals.

-

On a central “Competitive” tab for general training, onboarding, and pre-call research.

This ensures both new and experienced reps always have the right intel, no matter where they are in the sales cycle.

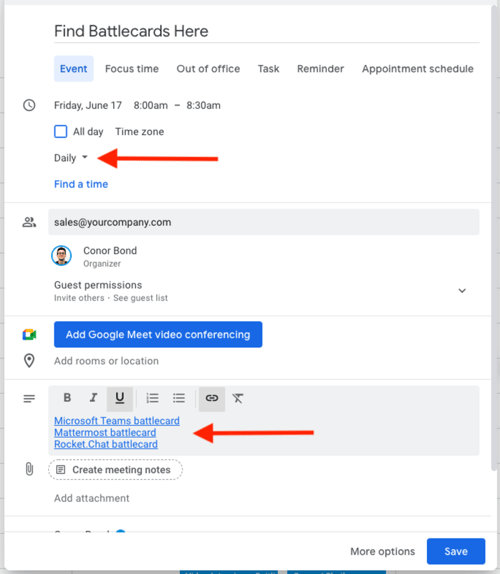

What about the day to day? No worries. I’m willing to bet your sellers have their calendars open all day long. So why not create a daily “meeting invitation” and put a link to each battlecard in the description?

Be creative! Wherever your sellers spend their time, that’s where your battlecards should live. The less energy they have to expend, the better your adoption metrics will be.

Spotlighting role model behavior

Effortlessness is only half the battle. To get your sellers fully on board with battlecards, they need to see, with their own eyes, that the people they admire—i.e., your top performers—are using them.

I’m not just making this up: According to McKinsey, role modeling is the #1 contributor to success when trying to get people to adopt a new behavior.

This is yet another reason to speak with your top performers before creating your battlecards. By asking for their input at the beginning of the process, you’ll make them feel invested, thus making them far more likely to agree to do “role model things.”

By “role model things,” I mean:

- Talking to the team about a recent win or loss and directing them to the corresponding battlecard to learn more

- Hosting office hours on the competitor about which they’re most knowledgeable and using the battlecard as reference material

- Directing their peers to the appropriate battlecard when they see a conversation in Slack or Teams regarding a competitor

Again, be creative! Your top-performing sellers are your partners in this initiative. As long as you get their buy-in from the jump, they should be willing to experiment until you find the right mix of tactics.

Drive your win rates to new heights

Want more battlecard best practices?

Once you've launched your battlecards, ensure your adoption rates skyrocket by downloading the Modern Battlecard Blueprint guide below. 👇

.png?width=500&name=Sales%20Enablement-What%20is%20SE_%20(2).png)