Most startups and growth-stage tech companies are understandably judicious in their outlay of capital. When you’re under the venture capital magnifying glass and trying to prove your product is commercially viable, investments in functions like sales and demand generation are seemingly safe bets. Both of those functions are easily tied to revenue production, unlike some other functions for which the ROI is hazier.

One of those hazy functions is product marketing. A target of chronic underinvestment, many tech company executives misunderstand the importance of product marketing. All too often, key product marketing functions are assigned to heads of product/sales/marketing, or are even performed by founders themselves. While those executives are often capable of performing a few of the more strategic functions performed by product marketers, several crucial outputs often fall through the cracks.

If you want to articulate your value proposition and prove commercial viability, there are three key functions best left to a product marketer.

Tactical Messaging and Positioning

Establishing your core market positioning, high-level messaging, and constructing a compelling narrative that conveys your product’s unique value proposition is a tall order. In the very earliest stages of a company’s lifespan, this is something ironed out by founding executives. As a tech company scales, however, there are consequences of keeping sole ownership of messaging with executives who are increasingly pulled in a myriad of directions. The first is the distillation of an overarching narrative position to the tactical deployments used by sales and marketing.

Thanks to the increasingly accessible nature of sales and marketing automation software, even modestly-sized go-to-market teams are capable of flooding your market with messages. As compelling as the higher-level narrative constructed by an executive might be, sales and marketing teams often have trouble distilling that overall message into the emails, content pieces, and website pages consumed by your prospective buyers. Product marketers are uniquely qualified to package strategic narratives into compelling content topics, effective pitch decks, and other key go-to-market deliverables that are derived from your higher-level story.

The second is the ability to shift your positioning as your market evolves. As industry trends, customer needs, and competitor strategies all evolve, so should your company’s value proposition, messaging, and positioning.

Customer & Market Research

As your company scales and your industry and buyer needs evolve, it becomes increasingly important to keep a tight pulse on the needs of your customers/buyers. This need is compounded by the different types of buyers you will encounter as your business scales. Your original value proposition may have resonated well with innovators and early adopters, but they are a finite audience. The late majority and laggards in your market are often motivated differently, rendering your original value proposition and messaging less useful as time goes on.

This is the point at which having some product marketing firepower becomes particularly important. Customer and market research is a time-consuming function. Volume-driven research projects, like NPS surveys, provide a strong foundation for additional exploration of key trends. In-depth interviews with customers and third-party research through firms like Forrester or Gartner provide much-needed context to corroborate and extrapolate on those broader trends. Win/loss interviews are also incredibly important, providing candid perspective from both happy buyers and those who elected to take their budget elsewhere. All of this research is also useless without action. Meaningful customer research should result in the refreshing of key deliverables (sales decks, core messaging frameworks, etc.), multiplying the effort required to derive meaningful value from your research.

Without a product marketer (or customer marketer), this laundry list of important customer research will either fall on an already-busy executive or someone in marketing/customer success ill-equipped to handle the breadth of the task. Or, more often than not, it never happens, leaving your value proposition vulnerable to erosion with every passing day. Plus, customer research is only one side of the coin in keeping pace with your market. To provide consistent, differentiated value, businesses need to be both customer-centric and competitor-conscious.

Competitive Intelligence

If your product truly addresses an important need in the market, it probably isn’t the only one to do so. Understanding how your competitors purport to solve the same customer needs/pain you aim to solve is crucial. Competitive research is an entirely different animal than customer research. The worst part? Research is only a fraction of a robust competitive intelligence (CI) process. Analysis and contextualization of research findings, plus synthesis into actionable deliverables like battlecards, is a serious undertaking. It’s also an incredibly important one, especially in the tech industry.

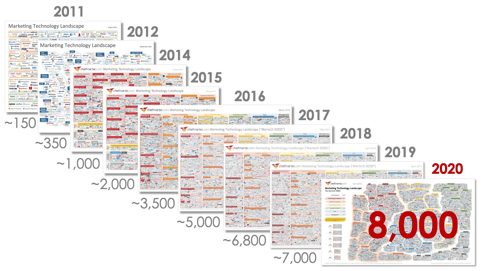

The marketing technology space alone has ballooned to ~8,000 companies, a serious upswing from the ~150 companies nine years ago. This trend is not unique to marketing technology. According to Crayon’s own market research, 90% of businesses report their industry has gotten more competitive in the last three years. It’s no surprise that 94% of those businesses are investing more in competitive intelligence than they were previously.

Competitive intelligence is unique in its application across every department of a tech startup. Competitor activity impacts sales team opportunities, product roadmap, marketing campaigns, and more, making product marketers uniquely qualified to drive forward the function (in the absence of a dedicated CI pro, that is). Even then, most product marketers, much like demand generation marketers needing HubSpot or Marketo, need software to automate several CI processes.

So why is it worth all that trouble? Aside from the aforementioned competitive knife fight that plagues most industries in tech, the ROI of a product marketer effectively arming your team with competitive insights is surprisingly high. Boosting sales team win rates by 50-60% is not an uncommon outcome, not to mention the value that’s harder to quantify - a more differentiated roadmap and value proposition, the ability to blindside competitors with marketing campaigns that hit their weak spots, and much more.

All of this is only possible with an investment in product marketing. It may be tempting to dump dollars into sales and marketing teams, allowing them to blanket your market with outreach. But without a fresh, differentiated value proposition that takes customer needs, competitor strengths, and the shifting nature of your market incorporated into that outreach, you may find the many virtues of your product fall on deaf ears.

Related Blog Posts

Popular Posts

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

Sales Battlecards 101: How to Help Your Sellers Leave the Competition In the Dust

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking