“Can you give me a quick overview of the competitive landscape?”

Unless you have an in-depth and current competitive analysis on-hand, you might find yourself slightly panicked at this sudden request. A competitive analysis is typically an intensive process that’s only done periodically (ex. quarterly), but if you’re strapped for time, you can always pull together a quick, point-in-time snapshot of your competitive landscape from free sources across the internet.

To put together a competitive landscape report, you’ll want to gather data points on your competitors and then analyze across each of these three dimensions:

- Growth & Trajectory: Are they growing, and if so, how quickly?

- Marketing Reach: Who is controlling the conversation? Who is attracting the most attention

- Company Messaging & Positioning: How do your competitors talk about themselves? How has their story shifted over time?

Compiling Competitor Data

Before we dive into the data required for the landscape analysis, I’ll note that you can get many of these data points for free from various sources, including, but not limited to, LinkedIn company pages, Craft.co, Owler, Crunchbase, or your competitors’ website. Alternatively, you could request a free competitive landscape report from us if you’d rather us get this data (and more) for you. There is a lot of information on the internet about your competition. Rather than collecting it all at once, focus on these data points to get started analyzing your competitive landscape.

I recommend gathering this information in a spreadsheet so you can easily analyze the data later.

Firmographic Data

Firmographic data is basic information that can be used to categorize companies—geography, number of employees, industry, etc. We will use this basic information to segment the companies in our competitive landscape.

Collect the following firmographic data points:

- Industry

- Company size

- Founded Year

- Public or Private Company

- Stock Ticker (if Public)

- HQ Location

Growth/Financial Data

One of the questions a competitive landscape analysis should answer is: “which competitors are growing?” This will allow you to see where you fall in the market—are you a leader, a challenger, or lagging behind?

Here are the data points you’ll want to collect:

- Revenue: One of the most simple yet important data points that will tell you a competitors’ market position.

- Funding Raised: Knowing how much your competitor has raised gives you an idea of their growth trajectory and value.

- Open Job Opportunities: The number of open jobs is a solid indicator of a competitors’ growth trajectory and reveals areas in which they are making key investments.

- Market Cap: If your competitor is a publicly-traded company, their Market Cap will tell you the total dollar market value of their outstanding shares of stock.

Marketing Data

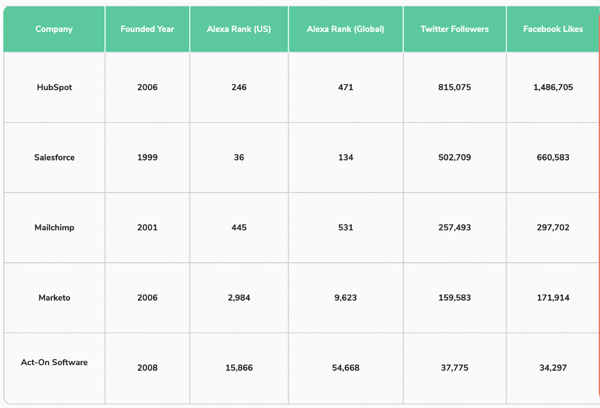

Beyond revenue and market cap, it’s essential to understand who in the market is controlling the conversation and attracting the most attention. For a quick snapshot of this, compile the following two data points:

- Alexa Rank: This will tell you who drives the most traffic to their website. Alexa Rank is a score of website popularity, so the lower the score, the more popular a website is—for example, Google has an Alexa Rank of #1.

- Social Engagement Metrics: Twitter followers, Facebook likes, LinkedIn followers, etc. Pick whatever platform is most relevant to your industry. Social engagement is another way of measuring how much attention your competitors are earning.

Messaging & Positioning Data

It’s essential to understand not only how your competitors are messaging themselves but also how that messaging has evolved over time. You’ll want to visit your competitor’s website (or request a free competitive landscape report) to see how your competitors’ messaging and positioning is changing.

- Marketing One-Liner: How your competitors sum themselves up in 1-2 sentences.

- Homepage changes: Recent changes made to their homepage

- Overall website changes: Recent changes made to other website pages (product pages, FAQ, career pages, About Us, etc.)

Analyzing Competitor Data

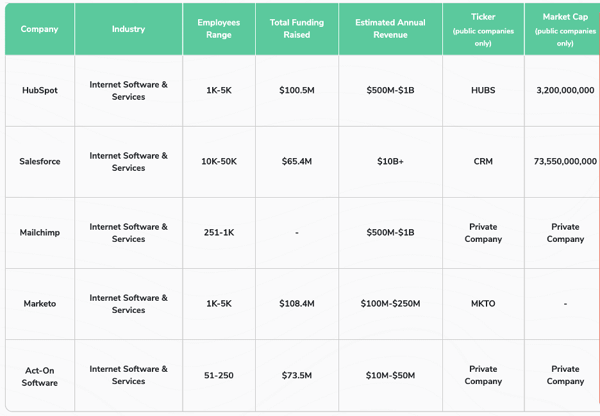

Now that you’ve compiled your data points, you’ll want to analyze the data across three dimensions and then summarize the competitive landscape by determining who is the market leader, who is controlling the conversation, and who is an emerging challenger.

Dimension #1: Growth & Trajectory

Using the growth and financial data you collected earlier, you can now analyze where you sit amongst your competitors when it comes to revenue and growth.

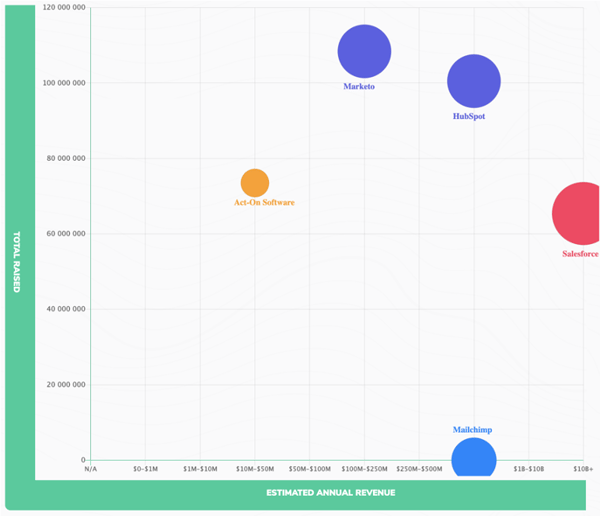

Here’s an example of how you might analyze the growth and trajectory of your competitors. In this example, we’re looking at Estimated Annual Revenue vs. Total Funding Raised, by company size (the size of the bubble indicates how many employees the company has).

Looking at the graph, you can glean a few insights about the competitive landscape of the Marketing Automation market:

- Mailchimp is likely the most profitable. With literally $0 in raised funding (it’s true—Mailchimp is entirely bootstrapped) but estimated revenue in the same range as HubSpot (who has raised $100m+ in funding), it could be argued that Mailchimp is the most profitable company in the market.

- Mailchimp is also likely the most efficient—they have fewer employees than the bigger players here, but revenue is second only to Salesforce.

- Salesforce is the biggest kid on the block with the largest company size and estimated annual revenue.

- Act-On is a significantly smaller but respectable player in the market.

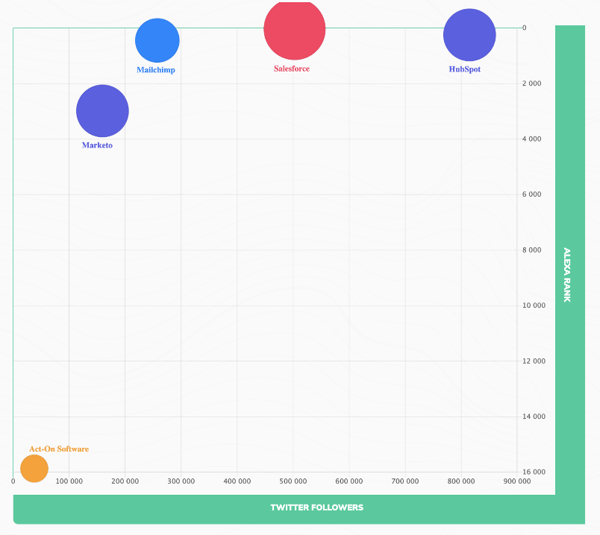

Dimension #2: Marketing Reach

It’s not all about the money. You also want to understand who has the greatest marketing reach, i.e., which companies are attracting the most attention from buyers and controlling the conversation.

Let’s take a look at the graph below. This graph compares Alexa Rank (website popularity) with the number of Twitter Followers, by company size.

Here are a few insights we can draw from the data:

- It’s no surprise that these companies are close in Alexa Rank—they are marketing companies after all. However, it does seem that HubSpot is controlling the conversation with a great Alexa Rank (slightly behind Salesforce) plus immense social reach.

- Act-On lags far behind, though understandable given the size of their company.

- Mailchimp once again shows that great marketing is essential to a bootstrapped startup—solid Alexa Rank at 445 while beating out the larger Marketo and trailing closely behind giants like HubSpot and Salesforce.

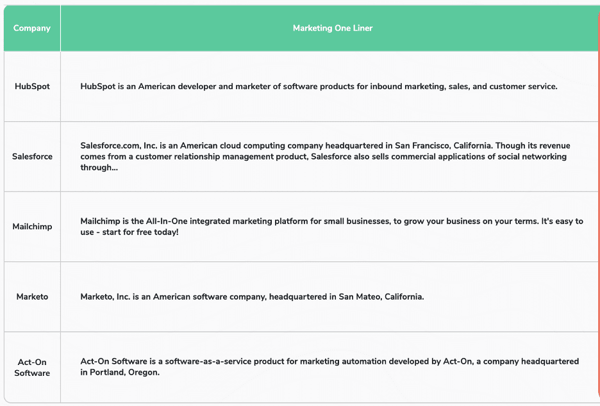

Dimension #3: Messaging and Positioning

It’s not all about the numbers—a qualitative look at your competitors’ messaging and how it has evolved over time gives you a glimpse into where they may be going strategically.

First, let’s look at marketing one-liners. A marketing one-liner is how a company summarizes themselves in 1-2 sentences.

Here are a couple of insights you can draw from the qualitative data:

- HubSpot differentiates themselves by going beyond just marketing—they describe themselves as a product for an entire organization across marketing, sales, and customer service.

- Mailchimp clearly states their target audience—small businesses. You can also tell that freemium is their core business model with the CTA of “start free today.”

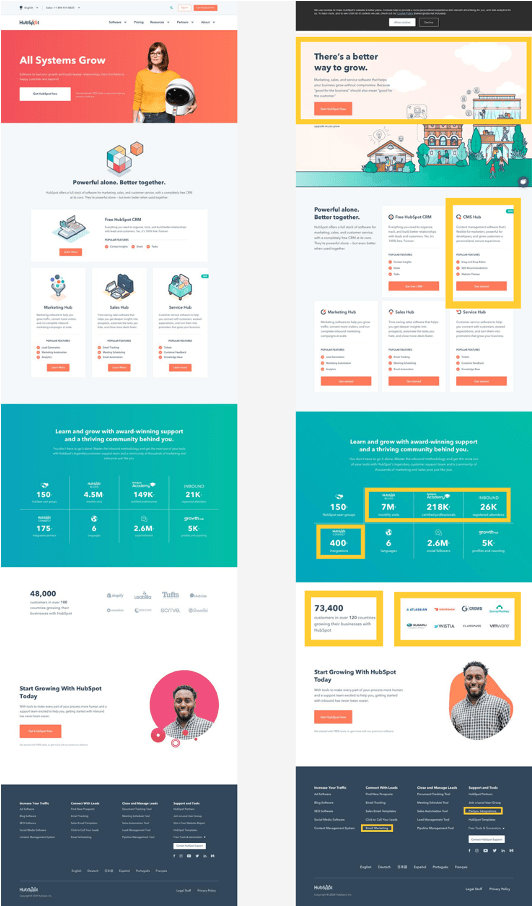

Now, let’s look at how messaging is evolving by looking at competitor website pages. This is a manual process if you don’t have competitive intelligence technology in place, and it will require you to regularly check your competitors’ website for changes.

In this example, let’s look at how HubSpot’s messaging has changed over time by digging into a major shift of their homepage. This image compares HubSpot’s homepage before and after a major redesign with key changes highlighted.

From these changes, you can discern the five key shifts in HubSpot’s strategy:

Shift #1: Messaging evolves from growth to customer-centric growth

The headline shifted from being purely about growth to customer-centric growth—meaning, growth that comes from serving your customers’ needs—not growth at their expense. The original headline also used more software-based language “systems” and “software” and shifted to language that focuses more on people.

Shift #2: Launches new CMS Hub

HubSpot launched a brand new CMS Hub, which they have added in their software offerings section.

Shift #3: HubSpot continues to invest in growing their traffic

From 4.5M visits a month to 7M in the course of a year or so—a 55% increase.

Shift #4: Massive investment in integration partnerships

A 217% increase in integrations in a year or so—a signal that they are focusing on opening up their ecosystem and bringing more integration partners to build on their solution.

Shift #5: Sizable increase in their customer base

Over this time period, HubSpot saw a 52% increase in the number of customers they have, with some swanky new logos to boot.

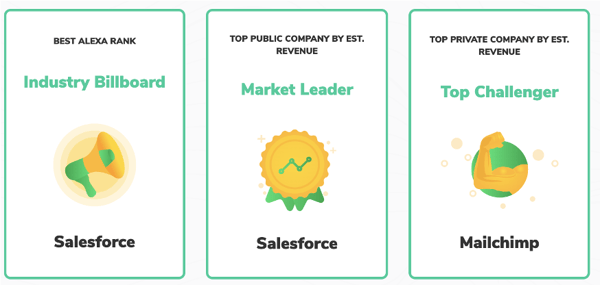

Summarizing the Competitive Landscape

You’ve analyzed the competitive landscape across three dimensions, and now it’s time to summarize the competitive landscape by determining who is the market leader, who is the industry billboard (e.g., who attracts the most attention), and who is an up-and-coming challenger.

You can determine what data points to use to make this decision. Likely your market leader will have the most revenue (or biggest market cap), and the industry billboard will have the best Alexa Rank or social reach. Use data points you find to be the most important for your specific needs.

For the specific example we’ve been using, our competitive landscape summary would look like this:

Related Blog Posts

Popular Posts

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

-

24 Questions to Consider for Your Next SWOT Analysis

24 Questions to Consider for Your Next SWOT Analysis

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World